Market Highlights: Beef Prices Slide More

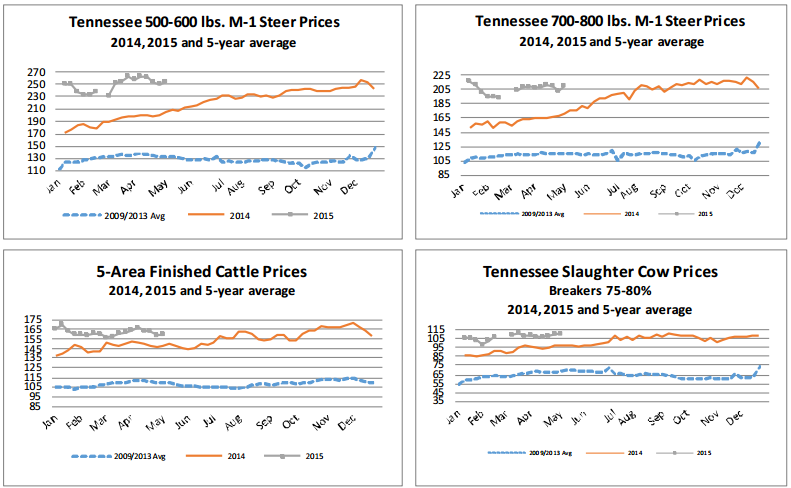

Cattle prices are up, but beef prices are down.

By: Andrew P. Griffith, University of Tennessee

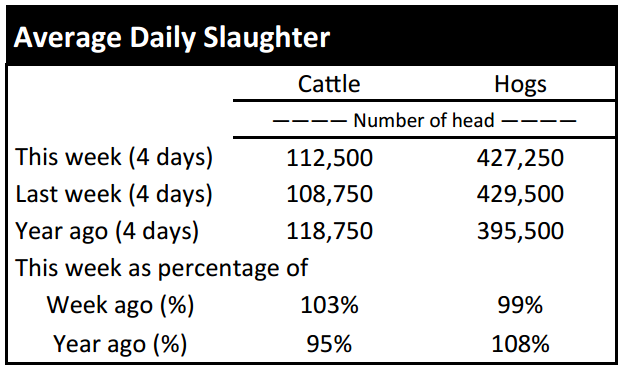

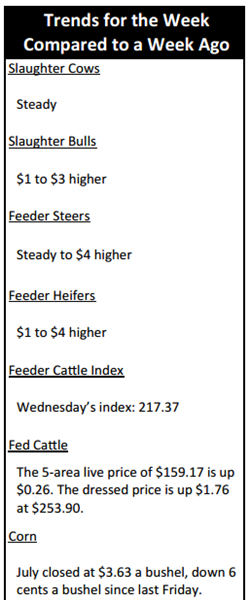

FED CATTLE: Fed cattle traded steady to $2 higher on a live basis compared to a week ago. Prices on a live basis were $158 to $160 while dressed prices were between $253 and $255. The 5-area weighted average prices thru Thursday were $159.17 live, up $0.26 from last week and $253.90 dressed, up $1.76 from a week ago. A year ago prices were $147.79 live and $236.38 dressed.

Packers and feeders were reluctant to compromise as they played a game of tug of war. Feedlot managers have closeouts that are bleeding red ink while cutout prices are faltering and squeezing packer margins. The June live cattle contract is now the nearby futures contract, but the June contract is trading at $10 plus discount to cash prices in both the South and North.

Complete convergence of the cash and futures is not likely to occur at all while significant partial convergence is not expected to occur until June arrives. The cash price is likely to weaken into the summer, but the live cattle contract is also likely to find some support and push towards the cash price by the first of June.

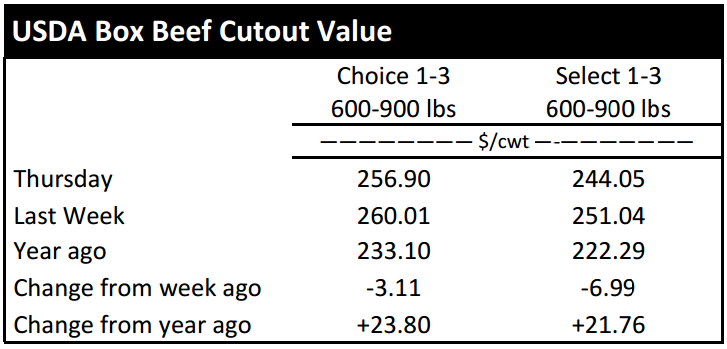

BEEF CUTOUT: At midday Friday, the Choice cutout was $254.50 down $2.40 from Thursday and down $4.28 from last Friday. The Select cutout was $242.38 down $1.67 from Thursday and down $6.90 from last Friday. The Choice Select spread was $12.11 compared to $9.49 a week ago.

The unofficial start of summer does not kick off until Memorial Day weekend but, grilling season has already started for many consumers. This is evident through the Choice Select spread which has widened by about $9 since the first week of April.

Restaurants and food service folks have been shifting their purchases from Select grade cuts to Choice grade product more suitable for grilling. The desire to purchase Choice grade beef relative to Select grade beef is expected to continue throughout the grilling season.

The Choice Select spread is expected to continue widening the next several weeks before experiencing some resistance. Steak cuts such as the ribeye and loin along with ground product will drive the beef market through the summer.

The one big question is if consumers will defect from beef due to high retail prices. There has been little indication that consumers will look past the beef counter. A second question is how the highly pathogenic avian influenza outbreak in the chicken flock will impact beef prices. It could go either way at this point.

TENNESSEE AUCTIONS: On Tennessee auctions this week compared to a week ago steers and bulls were steady to $4 higher. Heifers were $1 to $4 higher. Slaughter cows were steady while bulls were $1 to $3 higher. Average receipts per sale were 718 head on 10 sales compared to 640 head on 10 sales last week and 550 head on 12 sales last year.

OUTLOOK: Last week’s cattle on feed report was a little bearish in terms of the number of cattle on feed as numbers were even with a year ago but higher than what many analysts had expected. There is not necessarily a lot to say about the report, but the report does confirm what many in the industry suspected with regards to growing calves outside the feedlot.

Placements of cattle on feed was down for cattle weighing less than 800 pounds, but cattle placed on feed weighing 800 pounds and up increased 16.1 percent from one year ago.

Many producers continue to hold cattle longer on pasture as the market price of yearling feeder cattle supports the notion to continue adding weight. Thus, cow-calf, stocker and backgrounding operations are holding cattle to heavier weights.

Similarly, feedlot operators are holding cattle to heavier weights because the market continues to pay for the additional weight. This may or may not be an issue going forward, but the large number of heavier cattle on feed could put pressure on live cattle prices as the market approaches some of the largest slaughter weeks in the month of June.

One aspect of the market that supports prices is that the dressed weight of cattle is generally declining at the same time slaughter is peaking. However, slaughter weights are holding their own which will put more beef product on the market which will pressure beef prices and then cattle prices.

The market price is expected to continue rewarding putting weight on calves and feeder cattle the next several months, but producers should consider adding value to those animals by providing a complete health program as well as preparing those animals to enter the feedlot.

The idea of adding value to calves is often overlooked by small producers, but it is not overlooked by order buyers and feedlot managers. Making a change to the operation always comes with some degree of resistance, but the time to attempt making a change is when times are good because it provides a greater margin for error. Such changes can and will mean the difference in profits and losses when prices falter and costs escalate.

TECHNICALLY SPEAKING: Based on Thursday’s closing prices, June live cattle closed at $149.70. Support is at $148.12, then $144.94. Resistance is at $151.29 then $154.47. The RSI is 50.18. August live cattle closed at $148.10. Support is at $146.85, then $144.85. Resistance is at $149.25, then $149.73. The RSI is 51.70. October live cattle closed at $149.68. Support is at $149.58, then $146.80. Resistance is at $149.78, then $150.60. The RSI is 50.94. May feeders closed at $212.98. Support is at $211.01, then $207.48. Resistance is at $214.53 then $218.06. The RSI is 53.26. August feeders closed at $214.70. Support is at $213.90, then $213.88. Resistance is at $214.80 then $215.68. The RSI is 53.64. September feeders closed at $213.93. Support is at $213.78, then $213.03. Resistance is at $213.98 then $214.70. The RSI is 54.05. Friday’s closing prices were as follows: Live/fed cattle –June $149.18 -0.53; August $147.83 -0.28; October $149.60 -0.08; Feeder cattle - May $213.63 0.65; August $215.08 0.38; September $214.70 0.78. October $213.78 0.53; May corn closed at $3.60 down $0.03 from Thursday.