Pork Exports Soar, While Beef Exports Slow to Start 2023

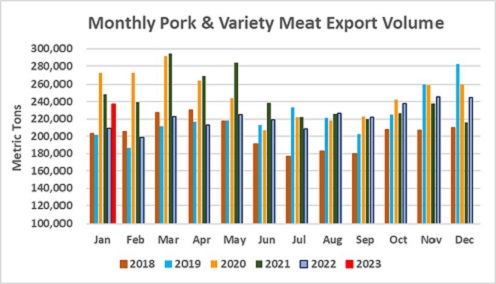

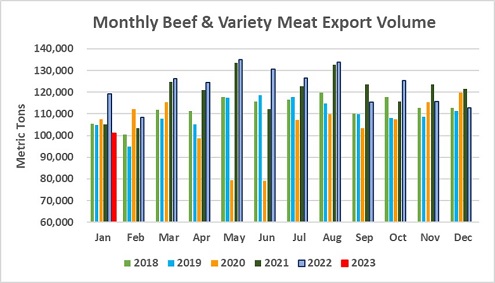

U.S. pork exports finished 2022 strong and continued momentum into January, says data released by USDA and compiled by the U.S. Meat Export Federation (USMEF). Meanwhile, U.S. beef exports broke records in 2022, yet a slowdown occurred late in the year and has continued into 2023, with shipments well below the large totals from a year ago.

Pork Exports

Pork exports for January totaled 236,767 metric tons (mt), up 13% year-over-year, while export value increased 16% to $643.4 million, USMEF says. Exports to Mexico led the way, finishing 2022 on a remarkable run. To start 2023, volume totals for the month of January were up 11% (96,800 mt), while value soared 40% higher to $191.2 million. Despite increasing competition in Mexico, due to the suspension of import duties for all eligible suppliers through 2023, demand for U.S. pork continues to surge.

Exports to China/Hong Kong, Japan, Canada, the Dominican Republic, Colombia, Honduras and the ASEAN region also trended higher year-over-year.

While the Dominican Republic suspended import duties for all suppliers for a portion of 2022, the expired decree leaves the U.S. as the only major supplier with duty-free access at this time when the country continues to be impacted by African swine fever (ASF).

As pork production in China has recovered from its ASF outbreak, the country now looks to revive its economy after lifting COVID-related restrictions.

January pork export results in volume and value (compared to 2022) include:

• China/Hong Kong—46,315 mt (up 31%); $121.8 million (up 25%)

• Japan—28,476 mt (up 8%); $115.7 million (down 2%)

• Canada—17,972 mt (up 19%); $67.4 million (up 7%)

• Dominican Republic—8,185 mt (up 28%); $23.8 million (up 67%)

• Honduras—4,430 mt (up 39%); $11.1 million (up 64%)

• ASEAN—3,668 mt (up 46%); $12.1 million (up 58%)

January pork exports equated to $57.81 per head slaughtered, up 8% from last year.

“While Mexico is certainly the pacesetter for U.S. pork exports, it’s encouraging to see such broad-based growth,” says Dan Halstrom, USMEF president and CEO, in a release. “Market diversification is always a point of emphasis for the U.S. industry, and it’s more important than ever to find new opportunities for U.S. pork in both established and emerging markets.”

Beef Exports

Beef exports have not experienced the same positive momentum as pork in January as shipments decline to several major destinations, including South Korea, Japan, China/Hong Kong, Mexico, the Dominican Republic, the Philippines, Taiwan and Africa. Volume in January fell 15% year-over-year to 100,942 mt, valued at $702.3 million (down 32%).

The sharpest decline occurred across Asian destinations, specifically South Korea, Japan and China/Hong Kong. The lift of COVID-restrictions in China/Hong Kong late last year were not enough to boost consumer demand for beef, as a significant wave of COVID cases came at the same time that imported cold chain product testing and disinfection was eliminated.

Increased competition could soon be reality in Mexico as Mexican officials finalized import requirement for some imports from Brazil—the first time the country has opened to Brazilian beef.

January beef export results in volume and value (compared to 2022) include:

• South Korea—18,896 mt (down 36%); $151.5 million (down 52%)

• Japan—22,456 mt (down 2%); $144.9 million (down 20%)

• China/Hong Kong—14,980 mt (down 24%); $125.3 million

• Mexico—17,479 mt (up 20%); $94.7 million (up 19%)

• Dominican Republic and Bahamas—2,339 mt (up 26%); $19.6 million (up 15%)

• Philippines—1,020 mt (up 73%); $6 million (up 17%)

• Taiwan—4,578 mt (down 34%); 44.3 million (down 47%)

• Africa—2,624 mt (up 284%); $3 million (up 148%)

January beef exports equated to $331.27 per head of fed slaughter, down 34% year-over-year.

USMEF notes beef inventories swelled in some key markets at the end of 2022, leading to the decline in exports to start 2023.

“While beef exports are off to a slow start in 2023, we remain optimistic that post-COVID foodservice demand will strengthen in additional markets as the year progresses,” Halstrom says.