Cattle Market Signals: High Costs, Projected Profits and Beef Demand

Editor's Note: This article is the third in a series that comprise Drovers 2023 State of the Beef Industry. The full report will appear as a 16-page special section in the September 2023 issue. Additional articles from the series will be published in this space in the following days.

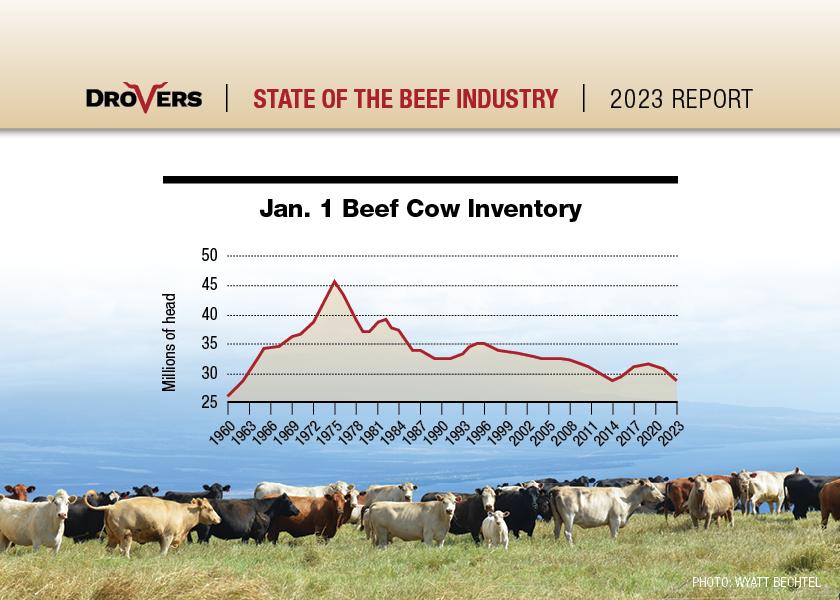

Weather has been the dominating story for the beef industry in recent years. That’s resulted in sharp inventory declines for all classes of cattle as 2023 began. The item that gets the most attention (appropriately so) being the Jan. 1 beef cow inventory. Beef producers began the year holding just 28.9 million beef cows, the lowest starting inventory since 1962.

Moreover, given slaughter rates through the first half of the year, it’s likely cow producers will take another cut out of those numbers going into 2024. Beef cow slaughter through June represents ~6% of the Jan. 1 starting inventory; that’s just a half-percent below last year’s pace.

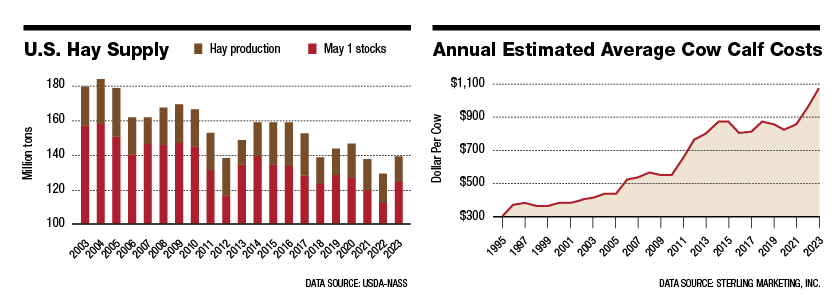

Reluctance to rebuild the cowherd is due to any number of factors. Most notably, forages (hay and pasture) are in short supply. For instance, this year’s hay inventory carryover into the current crop year (starting May 1) stands at just 14.5 million tons (and only 2.5% above the previous low established in 2013).

Higher Costs Ahead

Meanwhile, drought continues. It’ll likely require several years of recovery before producers feel confident enough to begin restocking. Simultaneously, high input costs and higher interest rates contribute to incentive to keep selling cows and/or reluctance to retain heifers.

Markets Strengthen

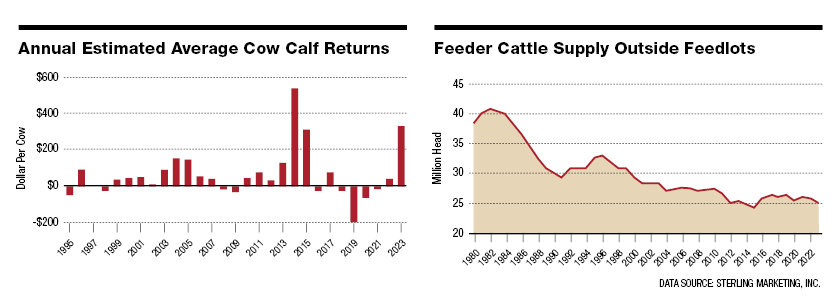

On the flip side of higher expenses are better markets. LMIC forecasts cow-calf producers will be profitable (on average) in 2023 with returns projected in excess of $300 per head. Since 2010, returns have been negative only four out of 14 years with an average annual return of ~$87 per head.

Strength in the feeder market should continue to be underpinned by supply challenges in the calf supply. USDA pegged the Jan. 1 feeder cattle supply outside of feedyards at 25.27 million head. That’s the lowest since 2015 and roughly in line with 2014. Despite rising feeding costs (corn, fuel, interest, labor), tightening supply and a favorable string of feedyard closeouts will continue to bolster the feeder market for the foreseeable future.

Beef Demand

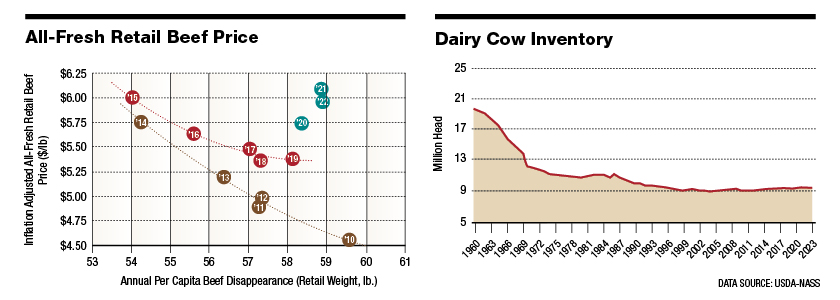

From a consumer standpoint, beef demand continues to be solid. Last year’s beef production saw a record (28.22 billion pounds.)

And yet, even in the midst of bigger supply and an economy burdened by ongoing inflation, consumers purchased beef at record retail prices averaging nearly $7.60 per pound. The year-over-year comparisons are especially favorable. Beef consumers are purchasing more product and paying higher prices, all an indication of strengthening demand.

Dairy Contributions

Last, the dairy sector is increasingly an important contributor to, and participant of, the beef industry. Beef cross calves are progressively becoming an essential component of beef production, and dairy producers are cognizant of subsequent opportunities on the beef side. While the dairy business continues to consolidate, dairy cow numbers remain surprisingly resilient. The 2023 starting inventory was 9.40 million cows, right in line with the 10-year average (9.35 million head). As such, the dairy herd represents a sizable, reliable and consistent supply of feeder cattle going forward; that’s vastly different from dairy-sourced calves that were previously thought to simply be a discounted, after-thought in the marketplace.

Read More on the State of the Beef Industry