U.S. Cropland Cash Rents Hit All-Time High

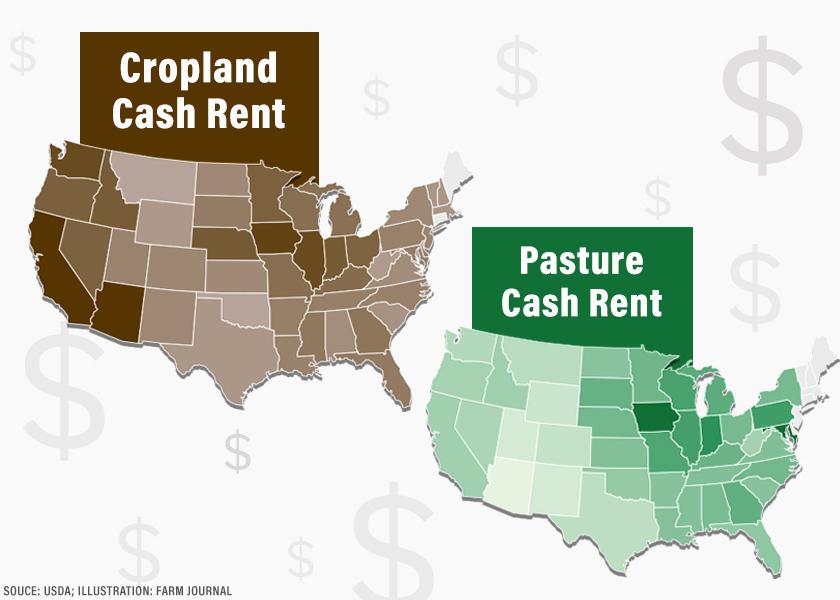

For 2022, the national average for cash rents on cropland is $148 per acre. That’s up $7 from last year and eclipsed the previous high of 2015’s $144 per acre, according to USDA National Agricultural Statistics Service.

The highest cropland per-acre cash rents include:

- Arizona: $336

- California: $331

- Hawaii: $271

- Iowa: $256

- Illinois: $243

- Washington: $217

- Indiana: $212

- Nebraska: $211

- Idaho: $194

- Minnesota: $185

Several states saw double-digit increases in cropland cash rents versus 2021. Those include:

- West Virginia: up 12%

- New York: up 12%

- Vermont: up 11%

- New Jersey: up 11%

- Utah: up 11%

- South Carolina: up 10%

- Iowa: up 10%

- Hawaii: up 10%

For pastureland, the national average is $14 per acre. That’s up $1 from 2021.

Negotiation Tips for Cash Rents

Are you in the process of negotiating cash rent levels for 2023? If thinking about negotiating cash rental rates makes you sweat — you’re not alone. This annual task can be unnerving, especially if you are asking for a rental reduction. The current cloudy profitability and policy picture adds even more pressure this year.

How can you confidently communicate your side of the discussion and secure a rental rate that will hopefully put you in the black?

Spend time preparing for these vital meetings and use negotiation best practices. You can’t take the easy way out, says Mark Faust, president of Echelon Management.

“Negotiations are the most valuable per-hour work you ever do in your life,” he says.

He suggests these key negotiation strategies:

1. Do your homework.

The best way to increase your personal confidence in negotiations is to be prepared. Block out time to prepare and think through each conversation.

“Most of the time we only think about ourselves in negotiations,” Faust says.

Instead, think through the agreement from your landlord’s perspective. What are the soft and hard costs if you change your lease terms or don’t come to an agreement? What questions will your landlord have? What are their goals and objectives for their land?

Through this process, you can create a list of options for each landlord, such as a change in the rental rate, a different lease type, less or more field maintenance, etc.

2. Plan on multiple meetings with each landlord.

“There’s a false belief that a negotiation must be completed before you leave,” Faust says. “It’s better to slow it down and space out the conversation to make sure it’s a win-win for both parties.”

For example, the first meeting with your landlord should be for you to present an overview of the previous year and your expectations for the upcoming year. Paint your profitability picture.

“Show a business case for how they are mitigating unprofitability and market volatility,” Faust says.

After that initial meeting, schedule another time to actually decide on the rental rate. “In two or three conversations, you can refine and zero in on what you want to agree to, without rushing it,” Faust says.

Also, never negotiate alone, Faust advises. Maximize your family or team’s talent to increase your odds of success.

3. Present multiple options—not “yes” or “no.”

Most people come into negotiations with undefined goals. Instead of a specific target, they just want to “move the needle” on a price. That’s not adequate, Faust says.

“Through your preparation, you can create your ideal agreement,” he says. “Write it down, so you can work backward from it.”

Share the multiple options you crafted in your preparation with your landlord.

“Negotiations are not a zero-sum game,” Faust says. “It’s not about splitting the pie, it’s about expanding the pie.”

Read more negotiation tips to employ with your landlord.

Seal the Lease Deal: Financial Focus, Transparency Help to Expand Rented Acres