Market Highlights: Upside of Down Cattle Market

There is still upside in a down cattle market.

By: Andrew P. Griffith, University of Tennessee

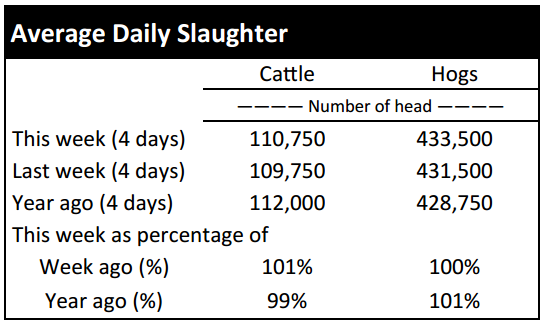

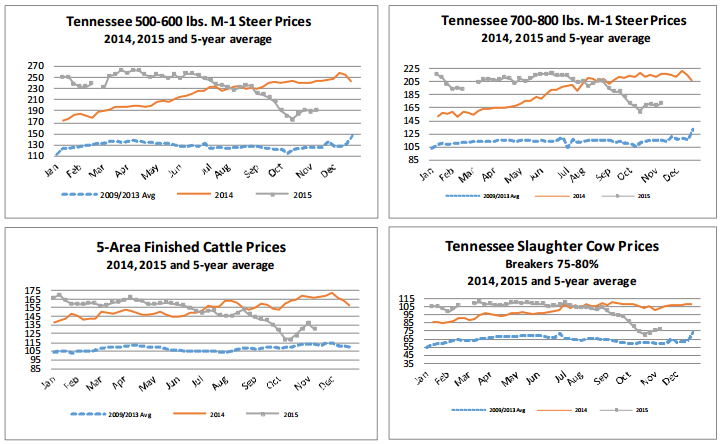

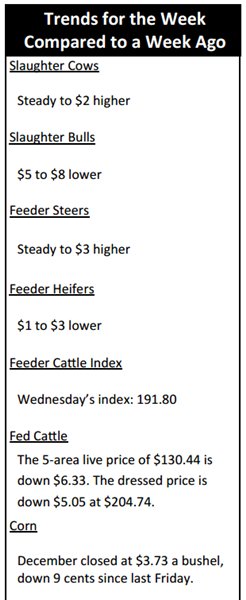

FED CATTLE: Fed cattle traded $6 lower than a week ago. Prices on a live basis were mainly $130 to $132 while dressed prices were mainly $203 to $206. The 5-area weighted average prices thru Thursday were $130.44 live, down $6.33 from last week and $204.74 dressed, down $5.04 from a week ago. A year ago prices were $166.87 live and $261.13 dressed.

The live cattle futures price for the December contract has declined about $7 per hundredweight the first week of November. The decline in the futures price has been mirrored in the cash market. The price decline this week is simply adding insult to injury in the cattle feeding business. Losses continue to mount for cattle feeders as what were once high priced feeder cattle continue to be harvested at extremely low fed cattle prices.

The upside to the cattle price decline is that cattle feeders are buying yearlings at much lower prices than four to six months ago. The ability to buy lower priced cattle does not necessarily result in profitable cattle, but it means there is a lower investment and a price increase has a higher probability of profits.

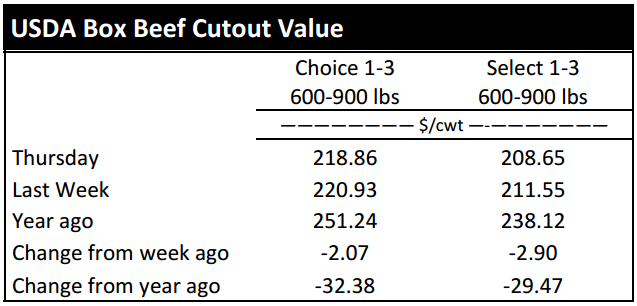

BEEF CUTOUT: At midday Friday, the Choice cutout was $215.92 down $2.94 from Thursday and down $3.28 from last Friday. The Select cutout was $211.88 down $1.27 from Thursday and down $4.50 from last Friday. The Choice Select spread was $8.54 compared to $7.32 a week ago.

Packer margins are not considered to be too bad at this point. Choice boxed beef prices have declined about $30 per hundredweight since the middle of August which sounds fairly extreme. However, the live steer price has declined more than $15 per hundredweight on a live basis. Thus, the input price has been declining just as quickly as the output price.

There are sure to be concerns among packers as boxed beef prices decline, but the bigger concern to packers may be the volume decline in the export market. Beef and veal exports in 2015 have been below 2014 levels all year. Through the first nine months of the year, beef and veal exports are 13.3 percent lower than the same nine month period in 2014.

Additionally, September beef and veal exports alone are nearly 25 percent lower than exports in September 2014. One bright side in the beef market is that middle meat prices have actually remained fairly strong. The holiday market may be the determining factor for packer margins the next couple months and where boxed beef prices go.

OUTLOOK: Feeder cattle futures contract prices declined more than $9 per hundredweight on most contracts from the close on Tuesday through the close price on Thursday. The decline was pretty much halted on Friday as most contract months experienced only marginal losses. The late week losses on the futures market was sure to negatively influence Tennessee auction market prices, but the week as a whole was not too bad.

Steer prices were steady to $3 higher compared to a week ago while heifer prices were $1 to $3 softer compared to last week. It appears Tennessee cattlemen hauled several cattle to town this week as marketings on reported auctions were 42 percent greater than the previous week.

The increased marketings provided many stocker and backgrounding operations the opportunity to secure a few high quality animals. However, many stocker producers will continue to search for quality calves the next several weeks as most are a little bit behind on securing winter inventory. Thus, demand for calves should remain strong the next few weeks.

Similarly, it is likely calf marketings will remain elevated as long as weather conditions are suitable for getting calves out of the field. As inventory is secured by stocker producers, it is usually advised to consider managing price risk in some manner. However, futures and options do not appear to be offering very favorable marketing opportunities in the spring of 2016.

There are several analysts who feel the market still has several more dollars of downside risk from now until spring which would insist that pricing opportunities appear favorable at this time. Currently, the futures market is expecting a $12 per hundredweight price break between now and March which would be another $90 per head break after the $300 to $400 per head break experienced in late summer and early fall. Technical analysis would indicate further declines to some extent, but it is hard to imagine markets continuing on a free fall with beef market fundamentals.

ASK ANDREW, TN THINK TANK: A question from a Pickett County producer this week was in relation to what size cow is the most profitable and at what age should cows be culled. The answer is it depends. The most profitable cow size depends on the resources available and the market for which production is taking place. Generally speaking, a moderate size cow weighing between 1,100 and 1,300 pounds is the most profitable for most producers. As far as cow age is concerned, a cow must return more revenue in a year than it cost to carry the cow. Thus, the cow should be culled when profit is less than zero or when another cow can produce more profit than the cow being considered for culling.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle – December $134.80 0.40; February $137.13 0.23; April $136.48 0.00; Feeder cattle - November $181.63 0.00; January $172.25 -0.43; March $169.23 -0.83; April $170.58 -0.48; December corn closed at $3.73 down $0.02 from Thursday.