Market Highlights: Cow Herd Expansion Slowing

By: Andrew P. Griffith, University of Tennessee

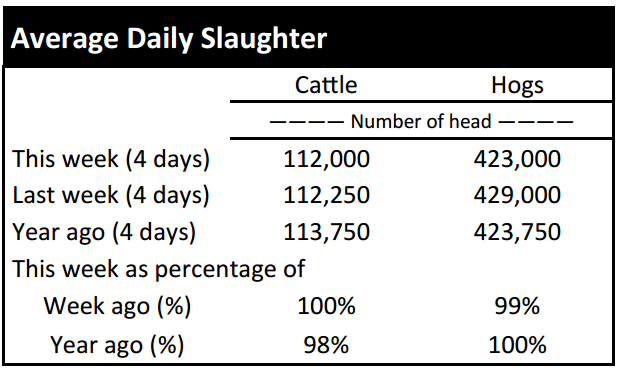

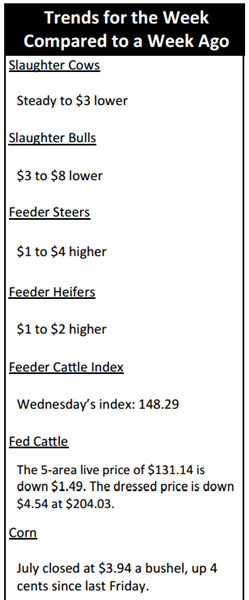

FED CATTLE: Fed cattle traded $2 lower on live basis compared to a week ago. Live prices were mainly $130 to $132 while dressed prices ranged from $204 to $206. The 5-area weighted average prices thru Thursday were $131.14 live, down $1.49 from last week and $204.03 dressed, down $4.54 from a week ago. A year ago prices were $159.98 live and $251.66 dressed.

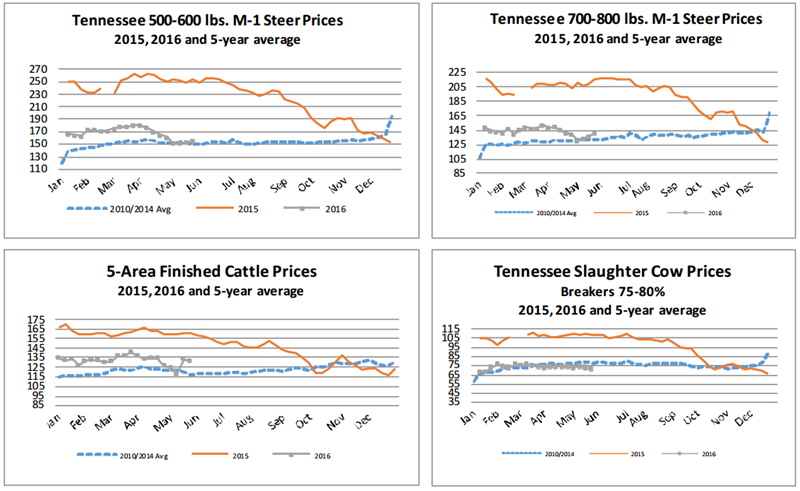

Live cattle futures traded steady the first half of the week before losing ground late in the week. The stagnant prices and then softer prices led to lower cash prices this week.

The basis, which is the cash price minus the futures price, remains strong. The strong basis provides feedlot managers incentive to market cattle in the near term relative to later time periods. If the basis weakens then that would be adding insult to injury for cattle feeders who are trying desperately to recover losses that have mounted the past eight or nine months.

The outlook does not look positive for stronger finished cattle prices the next several months. Again, beef demand will be the key driver.

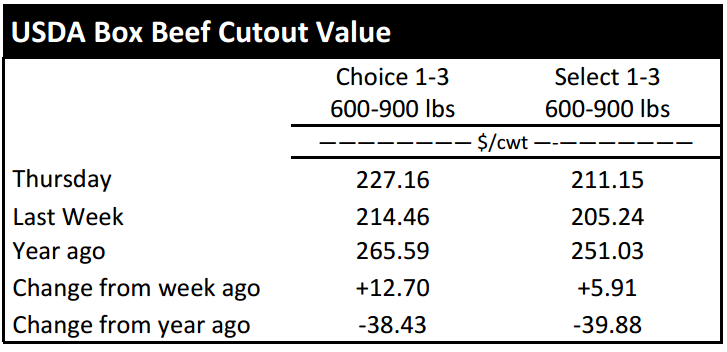

BEEF CUTOUT: At midday Friday, the Choice cutout was $225.10 down $2.06 from Thursday and up $7.16 from last Friday. The Select cutout was $208.85 down $2.30 from Thursday and up $3.03 from last Friday. The Choice Select spread was $16.25 compared to $12.12 a week ago.

After a strong week last week for both the Choice and Select beef cutouts, more of the same was witnessed this week. The Choice cutout was the big mover as retailers and restaurants made last minute purchases to stock the meat counter for the kickoff of grilling season.

There is no doubt consumers are already throwing cuts of beef on the grill, but with only a little more than a week to go until Memorial Day, consumers will be out in full force looking for a deal on the right cut of meat. The surge this week has resulted in a widening of the Choice Select spread which is expected considering higher quality middle meats tend to be the preferred cuts.

Depending on consumer follow through and the fact that retail beef prices are still fairly high, there is a good chance that the beef cutout stagnates next week and then loses significant ground through June and July. The Choice Select spread should maintain a fairly wide spread as most consumers focus on Choice quality grade middle meats during the summer holidays.

OUTLOOK: Feeder cattle futures prices were choppy this week, but they did put a halt, even if only a short one, to last week’s sluggish prices. Local markets responded with higher calf and feeder cattle markets as most classes were $1 to $4 higher than the previous week. These small gains may mean very little to most producers, but the slowdown in price decline may bode well for feeder cattle prices as the market moves into the summer months.

The May cattle on feed report was released today, but the numbers to watch are placements the next several months. In general, April is not a strong month for placements in the feedlot, but they count nonetheless. However, it will be of benefit to producers to keep an eye on cattle placements in the feedlot the next several months as it will provide important information concerning feeder cattle prices in the future. More importantly though, the number of cattle placed will provide an idea of beef supply the next several months.

Heifer placements will provide insight into heifer retention and thus the pace of breeding herd expansion. It seems certain that herd expansion has slowed to a snail’s pace compared to one year ago, but from a historical standard, expansion is likely still moving at a fairly rapid clip.

On another subject, slaughter cow prices continue failing to impress. Seasonally speaking, slaughter cow prices are generally strongest in the months of May and June. However, prices have been rather stagnant through the early parts of spring and have actually softened this week.

It may not be time to give up on slaughter cow prices just yet as there remains plenty of time for them to make a run. However, it is difficult to explain the beef markets that drive slaughter cow prices right now. Slaughter cow prices are driven by 90 percent lean ground beef and 50 percent lean ground beef prices, but explaining those markets right now would be like trying to explain fire to a fish.

The May cattle on feed report for feedlots with a 1000 head or more capacity indicated cattle and calves on feed as of May 1, 2016 totaled 10.78 million head, up 1.3% from a year ago, with the pre-report estimate average expecting an increase of 0.1%. April placements in feedlots totaled 1.66 million head, up 7.5% from a year ago with the pre-report estimate average expecting placements down 1.6%. April marketing’s totaled 1.66 million head up 1.2% from 2015 with the pre-report estimate average up 1.6%. Placements on feed by weight: under 600 pounds up 4.4%, 600 to 699 pounds down 6.3%, and 700 pounds and over up 11.8%.

ASK ANDREW, TN THINK TANK: A question was raised concerning the price difference or lack of price difference between value added calves (i.e. calves receiving vaccinations, being weaned, or both) and calves receiving little to no management before time of sale. The concern was that value added calves were receiving the same price as those calves with less management. There have been situations where prices were similar when comparing the alternative management practices. However, value added cattle generally receive a higher price because they are lower risk cattle to the purchaser. If a producer is utilizing value added management then it is beneficial to participate in a sale that focuses on value added cattle. If the weekly auction market is being used then producers should advise sale management and ask them to announce this information prior to the animals being sold.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle –June $121.05 -0.50; August $117.45 -0.88; October $117.10 -0.73; Feeder cattle - May $148.63 0.35; August $147.93 -0.18; September $146.03 -0.13; October $144.08 -0.10; July corn closed at $3.95 up $0.05 from Thursday.