Market Highlights: Cattle Prices on the Up and Up

By: Andrew P. Griffith, University of Tennessee

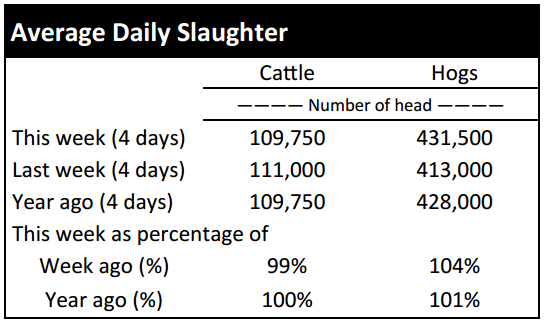

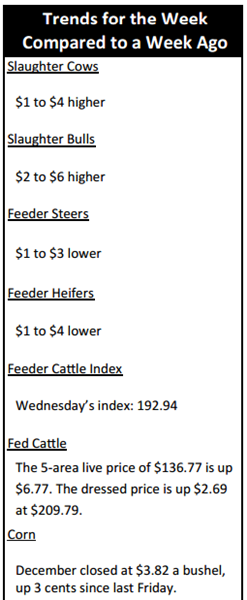

FED CATTLE: Fed cattle traded $1 to $2 higher than a week ago. Prices in the South were mainly $136 to $139 while prices in the North were $208 to $210. The 5-area weighted average prices thru Thursday were $136.77 live, up $6.77 from last week and $209.79 dressed, up $2.69 from a week ago. A year ago prices were $167.42 live and $263.30 dressed.

Fed cattle prices advanced again this week despite heavier carcasses continuing to come to market. The average dressed weight of steers the week ending October 17 was 930 pounds which set a new carcass weight record. The current carcass weight of steers is 32 pounds heavier than a year ago.

It is likely carcass weights have continued to advance and will continue to advance the next several weeks as is the seasonal tendency. This has some analysts questioning if the heavy carcasses were cleaned up in September since weights continue to advance, and thus question if prices are in for another decline. It is unlikely all the heavy cattle were marketed in such a short window, but the seasonal weight increase is probably the main driver right now.

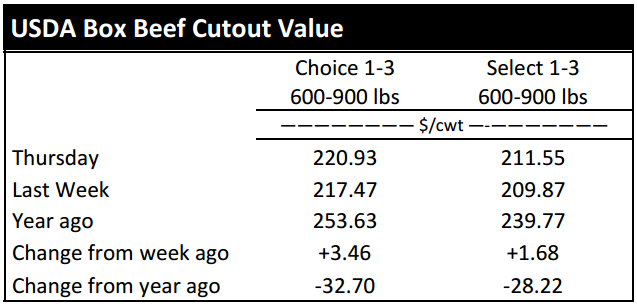

BEEF CUTOUT: At midday Friday, the Choice cutout was $219.20 down $1.73 from Thursday and up $2.16 from last Friday. The Select cutout was $211.88 up $0.33 from Thursday and up $0.99 from last Friday. The Choice Select spread was $7.32 compared to $6.15 a week ago.

Beef cutout prices are holding their own through the traditional months of soft demand. Most industry experts feel certain record setting prices are behind the market, but a looming question is how high of a price can be sustained. The answer to the question lies in domestic beef demand and export demand. Exports have been fairly lackadaisical the biggest part of the year which has been largely caused by high beef prices and a strengthening dollar.

Uncertainties lie everywhere, but it is most likely that retail beef prices will remain elevated though they will be softening through 2016.It is also likely imports from Australia will slow if drought conditions improve which will provide producers the opportunity to repopulate pastures. Another factor that seems fairly certain is that competing meat prices will remain relatively low. What is less certain is the ability or desire of countries to purchase high quality and high valued meat products. These factors and more will continue to weigh on the beef market.

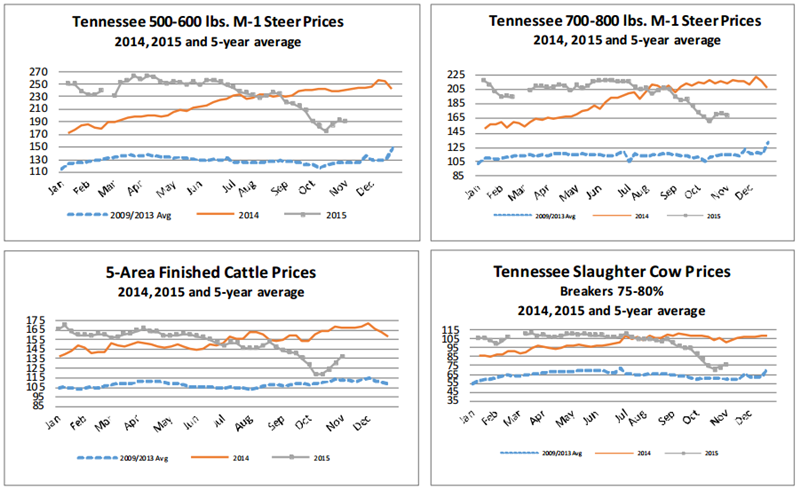

OUTLOOK: Calf and feeder cattle prices were softer this week on Tennessee auctions with little change in fundamentals. Marketings in Tennessee slowed compared to a week ago but that was likely due to the steady rainfall experienced across most parts of the state. Marketings are expected to pick back up next week when the weather is more favorable for gathering and sorting cattle.

Calf prices will continue to be pressured the next several weeks as spring born calves are pulled off pasture and weaned on the truck. It appears many producers marketed calves earlier than normal while others are delaying the sale of calves. October is generally the peak marketing month for calves in Tennessee. It is likely the price decline in September and early October was the factor that resulted in delayed marketings, but it now appears as if producers are waiting for the price to miraculously rebound like it has the past two years in the fall of the year.

It is not likely calf prices will find much footing until the first of the year. Thus, producers can market calves on the seasonally weak calf market the next month or so, or they can wean and precondition those calves until after the first of the year. Preconditioning calves will provide producers the opportunity to add weight to calves and potentially capitalize on a strengthening market while also producing lower risk cattle.

On the buying side, many stocker producers are hesitant to purchase calves during October due to the large daily temperature swings which oftentimes results in increased calf morbidity and mortality. However, November may provide a favorable purchasing opportunity as calf prices decline a little further. For those using grass to grow calves, October provided favorable conditions for grass to continue producing which will result in a relatively low cost of gain.

Relatively low purchase prices and low cost of gain should provide stocker and backgrounding operations decent margins, but it will be difficult to use futures and options to hedge the sell. It would appear deferred feeder cattle futures are undervalued and would make one think it could be difficult to turn a profit.

ASK ANDREW, TN THINK TANK: I was recently asked what my thoughts were on commingling cattle with a neighbor’s cattle in order to market truckload lot sizes of feeder cattle. I think this can be an advantageous marketing strategy, but there are a few things to remember and consider. The key is to market as uniform a load of cattle as possible. Uniformity includes but is not limited to breed, color, weight, sex, health program, frame, flesh, muscling, and other growth characteristics. It is also beneficial to commingle the groups of cattle several weeks prior to marketing and shipping. This type of marketing plan has the potential to increase the sell price and total revenue.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle – December $141.70 -1.10; February $143.38 -0.95; April $142.05 -1.10; Feeder cattle - November $190.75 -1.18; January $182.70 -1.55; March $178.93 -1.90; April $179.65 -1.75; December corn closed at $3.82 up $0.02 from Thursday.