Market Highlights: Beef Imports Rise

By: Andrew P. Griffith, University of Tennessee

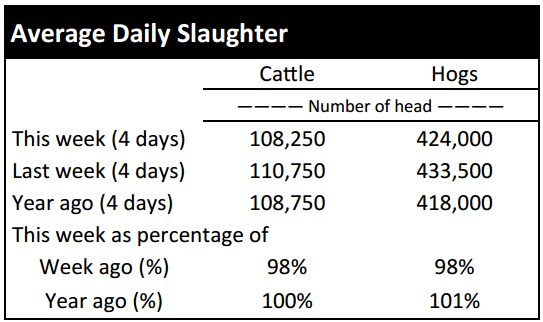

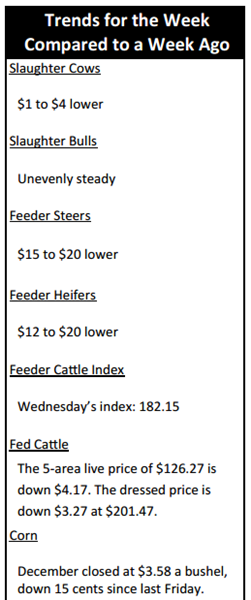

FED CATTLE: Fed cattle trade was not well established at press. The cattle sold had prices on a live basis near $126 to $127 while dressed prices were $198. The 5-area weighted average prices thru Thursday were $126.27 live, down $4.17 from last week and $201.47 dressed, down $3.27 from a week ago. A year ago prices were $167.53 live and $262.00 dressed.

Live cattle experienced another dismal week as the bottom continues to fall out. Packers are hesitant to pay asking prices because the futures market continues to soften while wholesale beef prices remain in a downward spiral. It appears the largest of the cattle are behind the market now as the dressed steer price has declined 10 pounds over the past two weeks.

It is going to take some consumer help in purchasing beef to support finished cattle prices through the holiday season and the doldrums of winter. It is hard to imagine the cattle price continuing to decline, but it was also difficult to imagine them continuing to increase one year ago. The market will soon have its answer.

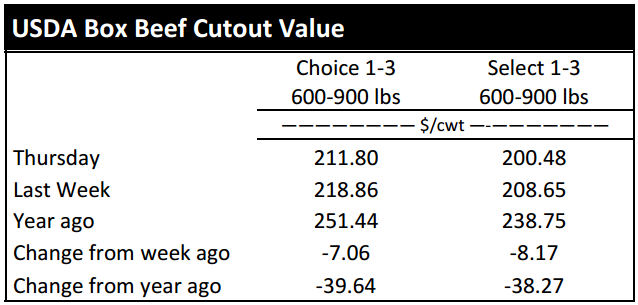

BEEF CUTOUT: At midday Friday, the Choice cutout was $209.37 down $2.43 from Thursday and down $6.55 from last Friday. The Select cutout was $200.94 up $0.46 from Thursday and down $6.44 from last Friday. The Choice Select spread was $8.43 compared to $8.54 a week ago.

Similar to all other aspects of the beef industry, the beef cutout price is actually really strong, but it looks weak relative to the highs set in 2014 and earlier in 2015. The beef cutout price is being forced to compete heavily with the import market. Beef and veal imports through the first nine months of the year are 29.5 percent greater than the same nine month period in 2014.

Beef imports have been attractive because of high domestic beef prices and the strong value of the dollar. Imports may slow now that Australia has reached its quota. Anything over the quota will result in a tariff being applied which results in a higher priced product.

Alternatively, as was mentioned a week ago, beef and veal exports are 13.3 percent lower than 2014 through the first nine months of the year. The international market is taking a toll on the U.S. beef industry, because the U.S. is generally able to move beef products globally. Beef prices are also negatively impacted by poultry exports falling off due to cases of highly pathogenic avian influenza earlier in the year which closed several markets.

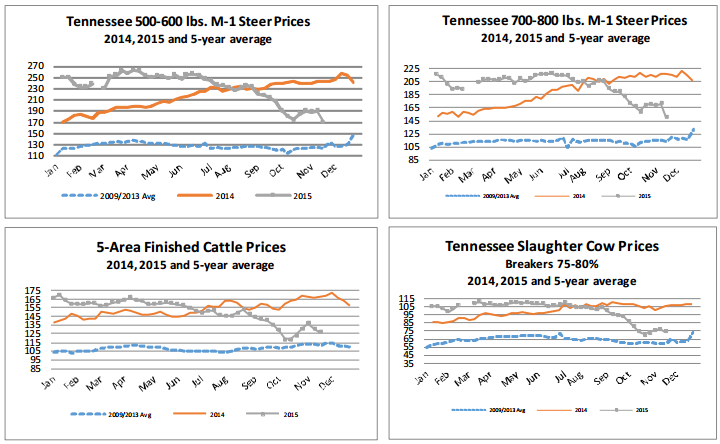

OUTLOOK: Volatility is the word of the day, the week, and the past couple of months. Based on Tennessee auction market prices for the week ending November 13th, steer and heifer prices declined $12 to $20 per hundredweight compared to one week ago.

The decline was to be expected considering the November feeder cattle futures price has declined more than $16 the past week and a half with several days of limit lower moves. Feeder cattle futures have bounced back from their November 10th low but there is little information supporting any abrupt price recovery.

The deferred spring contracts continue to be discounted $10 to $13 compared to the November contract which would indicate the cash market is in for further declines. However, there is still a possibility that traders are undervaluing feeder cattle in the deferred contracts.

If traders are undervaluing cattle in the future months then it is likely prices for those contracts will jump as those contracts roll into the nearby contract position. The problematic part of that situation is when it comes to trying to hedge the sale of cattle.

The basis values are extremely strong right now and the opportunity for hedging a sell may not be advantageous for deferred months if the futures market price moves to a more normal basis which would be considered weak relative to today. Therefore, producers could end up increasing their price risk rather than decreasing the risk. It is still likely the market has feeder cattle undervalued on a cash basis and a futures basis, but this fall is just an equal and opposite reaction of the fall of 2014 when cattle were overvalued.

Producers are encouraged to watch both the cash market and the futures market closely the next several weeks to have a little better feel of how the market volatility is playing out. The market volatility is likely to persist into late winter until more is known on cattle inventory, beef production, and the all-encompassing export market.

Consumers are showing signs of beef price fatigue, but some consumers continue to pay for high quality cuts. A factor that may support prices in 2016 is a slowdown in imports of lean beef.

ASK ANDREW, TN THINK TANK: At a meeting this week at Virginia Tech University, a question was raised concerning the Trans-Pacific Partnership which is a 12 country trade agreement that accounts for about 40 percent of the global GDP. The trade agreement is anticipated to reduce more than 18,000 tariffs, some of which are agriculturally related. It is difficult to answer the question which had to do with what would the impact be on the beef industry. At first glance, the trade agreement looks favorable to beef, but there will be domestic ripple effects from other industries in this country that the agreement may be less favorable too. The agreement has not been ratified by each country and therefore has not taken effect.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle – December $130.18 -2.98; February $132.25 -2.98; April $132.15 -2.80; Feeder cattle - November $174.73 -0.65; January $164.10 -2.80; March $160.30 -3.75; April $161.93 -3.88; December corn closed at $3.58 down $0.04 from Thursday.