Cargill Profit Jumps 66% on Cattle Herd Growth, Beef Demand

Cargill Inc., the U.S. agricultural commodities giant, posted a 66 percent jump in fiscal first-quarter profit as it benefited from higher cattle volumes at its slaughterhouses and improved demand for beef.

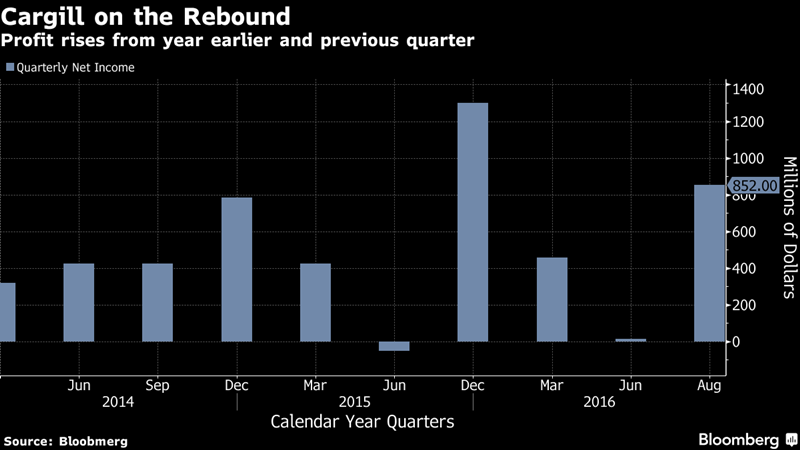

Net income climbed to $852 million in the quarter ended Aug. 31 from $512 million a year earlier, Minneapolis-based Cargill said Tuesday in a statement. Sales fell slightly to $27.1 billion from $27.5 billion.

The largest closely held company in the U.S. said its animal nutrition and protein segment had “sharply” higher earnings, making it the biggest contributor to the quarter’s overall adjusted profit. The improvement at the unit was led by the beef operations.

North American cattle ranchers started expanding their herds back in 2014, following a multi-year drought that reduced the number of animals. Beef prices rose amid smaller supplies, and consumption fell, but the market subsequently turned around. Now, those additional animals are fully grown and are arriving at slaughter plants, including those owned by Cargill. That means much lower prices on higher U.S. beef production. Output will gain 5.2 percent in 2016, while U.S. per-capita consumption will rise this year and next after falling in 2015, the Department of Agriculture said last month.

Tighter Focus

The quarter represents a rebound for Cargill, which in the preceding three months eked out a net income of just $15 million following wrong-way bets in the soybean market. Those mark-to-market losses on soybeans were reversed in the latest quarter, Cargill reported Tuesday. It also said earnings at its origination and processing segment -- the business that buys, sells and stores crops -- rose “moderately,” partly because of better soybean-processing margins. The global poultry, U.S.-based turkey and processed-eggs businesses also had higher profits.

Over the last two years, Cargill has tightened its focus through $2.4 billion in asset sales including its U.S. pork business. It’s also undertaken acquisitions such as the purchase of Archer-Daniels-Midland Co.’s chocolate business. Furthermore, the 151-year-old company has altered its leadership structure and reined in its financial units.

As part of that broader transformation, Cargill is selling two cattle yards in Texas to Amarillo-based Friona Industries. Cargill said it intends to put capital currently used to buy and feed cattle into other parts of its protein business.

“We posted a strong start to the new fiscal year,” Chief Executive Officer David MacLennan said in the statement. “We’ve been charting a new path to higher performance, and it’s rewarding to see the many changes we’ve made resulting in gains across much of the company.”