Speer: Keep The Main Thing The Main Thing

At the risk of beating a dead horse, this is the fourth (and final) column regarding the thinking, “The market is broken.” It’s gained traction during the past three years, beginning with the fire at Tyson’s Holcomb plant, and then all through Covid. But despite being commonly repeated, it’s just not true.

The first three columns addressed the “broken market” mantra from several different perspectives. However, the last column also touched briefly on the business. It’s the most important part of all this discussion and merits some additional perspective.

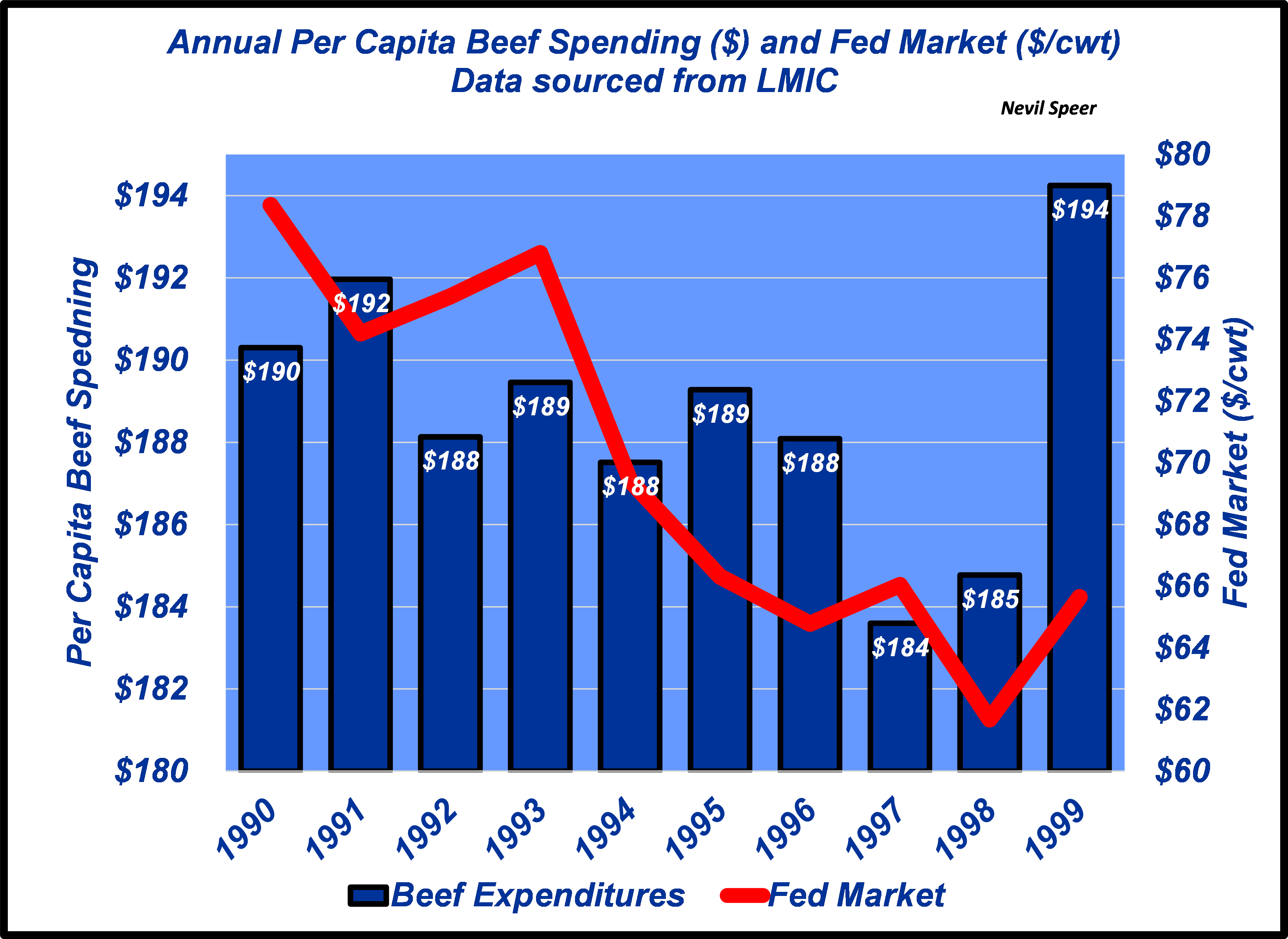

The “broken market” idea conveniently fails to remember just how rocky it was in the 80s and 90s. For example, the first graph highlights the annual fed market and consumer spending during that time. Note a couple of things. First, consumer spending didn’t budge from 1990-to-1999. Consumers were increasingly purchasing pork and poultry instead. Second, that resulted in the fed market being supply driven (true commodity market) – and subsequently retreating nearly $17 between 1990 and 1998.

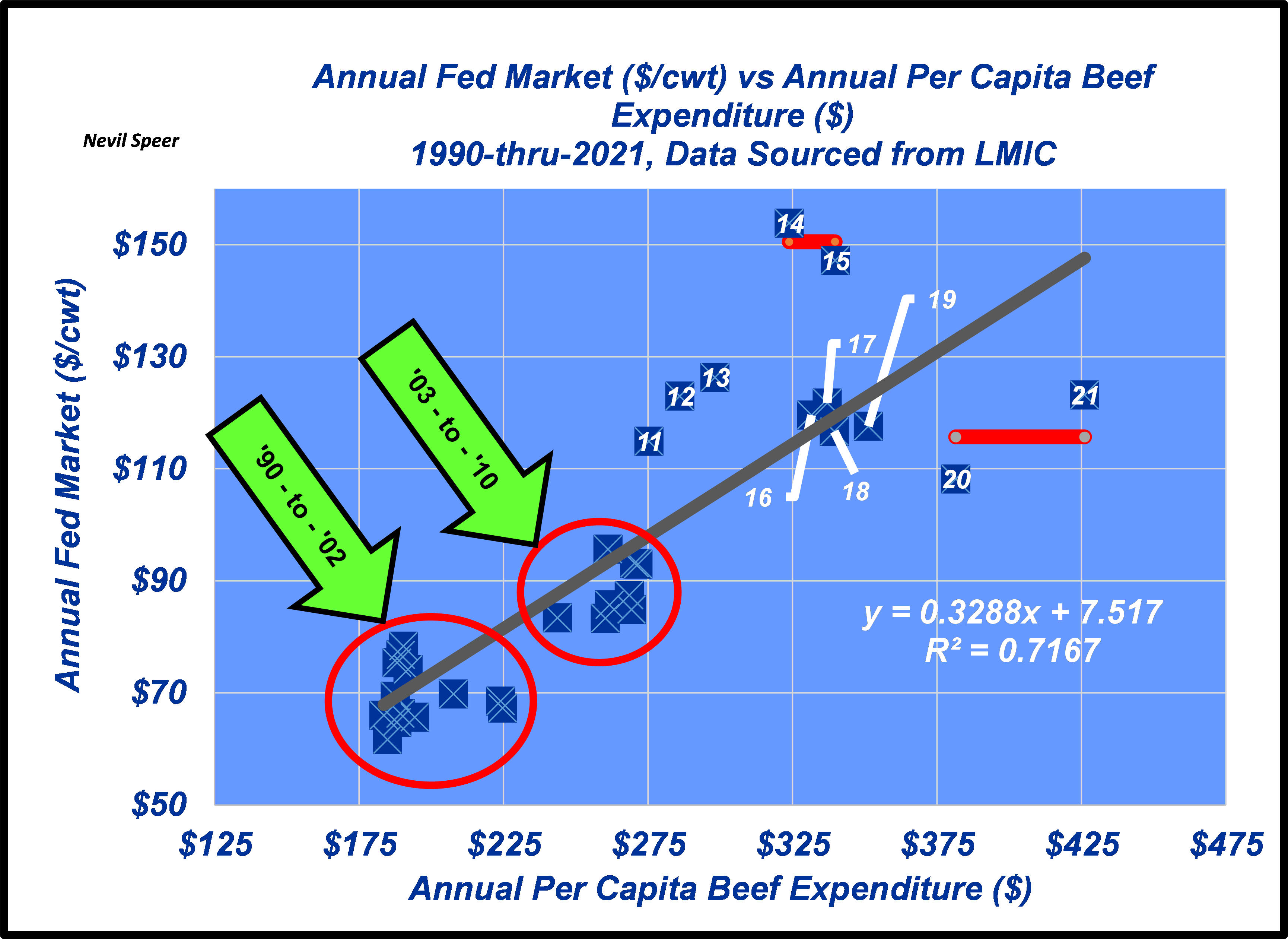

Now, let’s zoom out and look at those metrics from a different perspective. The second graph details annual fed market versus spending between 1990-and-2021. Here again, key items to point out. One, note the trend – more spending equals better prices. Two, the correlation between the two is nearly .85! As a result, nearly 72% of the variation in fed prices year-to-year can be explained by differences in consumer spending – it’s the overwhelming driver of better prices over time!

Does beef demand matter? Dr. John Marsh, Montana State University, summarized it like this in his paper from 2003:

"Retail beef demand declined by nearly 66% from 1976 to 1999. Results indicate autonomous shifts in retail demand significantly impacted farm-level demands and production…the 1976-99 reduction in beef demand decreased real slaughter call prices and production by 32.1% and 11.2%, respectively. Real feeder cattle prices and production decreased by 8.0% and 22.6%, respectively."

Now fast forward to several weeks ago; Dr. Stephen Koontz, Colorado State University, made these observations about the current strength of the market and demand: “…if beef prices are strong and supplies are reasonably abundant then the only thing that it can be is the strength in demand. It’s the consumer – both domestic and international – and the downstream market. This strong consumer demand is being revealed in retail prices and strengthening the wholesale and farm level prices.

The “broken market” people always look to ’14/’15 as a panacea – all was well with the world. And then they turn around and tell you about ‘20/’21 and everything that’s wrong with the business. However, when it comes to market dynamics (and deviation from the expected) both time periods really represent the same thing – supply disruptions. One could argue that in ‘14/’15 the market overshot to the upside…but even so, that would NOT have happened if the foundation of demand hadn’t been solidified. Simultaneously, ‘20/’21 could have been way worse; throw the mother-of-all-black-swan-events at the industry and solid beef demand is appropriately interpreted as a market put.

This all about separating signal from noise. Negotiated cash trade, packer margins and country-of-origin labeling – that’s all noise. Final demand is THE signal – full stop! To that end, curious how the factions who claim the market is “broken” have it backwards. They advocate around all the noise while simultaneously wanting to do away with the Beef Checkoff.

The cornerstone of success, for any industry, depends on final consumer demand. All dollars that flow into the business are ultimately derived from consumers. So, broken market? Not so much – so long as the beef industry keeps the main thing the main thing.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.