Secy. Vilsack, ‘I think at the end of the day I should pay tax’

In April, the Biden Administration released the American Families Plan (AFP), which included their intention to make stepped-up basis, or accumulated gains in asset value subject to capital gains taxation when the asset owner dies, a law.

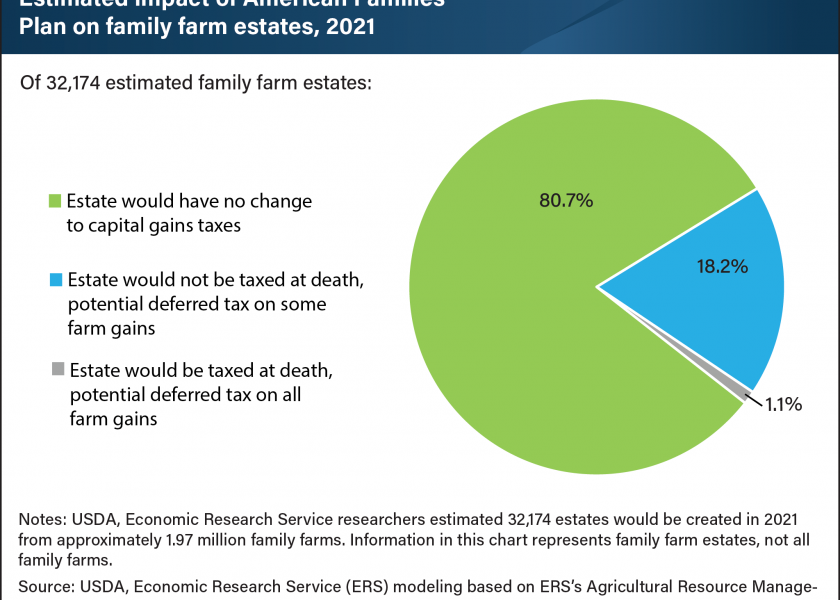

The USDA Economic Research Service (ERS) recently released data to showcase those who would be affected if the stepped-up basis were approved in the AFP.

USDA Secretary Tom Vilsack told AgriTalk’s Chip Flory agricultural America’s analysis of the stepped-up basis is mostly inaccurate, creating a lack of support in the stepped-up basis concept.

“In their calculations, they’ve forgotten about the exemption levels of $1 million per person, $2 million per couple, and if there’s a homestead, $2.5 million per couple,” says Vilsack. “When you apply that, combined with the exemption for owner and operator, you get 98% of farmers—almost 99% of farmers—are not covered by this.”

The 1.1% impacted by stepped-up basis, according to Vilsack, are those who own land and don’t have any heirs who are interested in farming the land. It’s those who have the land as an investment that appreciates over time.

Vilsack used his own financial situation as an example.

“When I die, is it fair for my own kids to get a huge tax break, or is it better for my kids to pay their fair share and in doing so, allow families across the United States to have access to a child credit? It makes it easier for working families, middle class families, including farm families, to be able to support their children,” says Vilsack. “Is it better to have the opportunity to have more affordable college for millions of kids? Or is it better for Tom Vilsack and his kids to have a huge tax break? At the end of the day, that’s what this is all about.”

Secretary Vilsack says the “us vs. them” political division has hindered politicians from completing items of business, which has also fueled American’s lack of trust in politicians. Enabling this stepped-up basis will help dissolve this distrust, according to Vilsack.

“I think at the end of the day I should pay tax. I don't think a family farm or farmer who owns and operates a farm, and his kids want to own and operate the farm, I don't think they should pay the tax,” says Vilsack. “That's the reason we pressed hard when this was put forward to make sure there was an exemption, and there is for 98.9% of farms.”

To hear more of Flory’s interview with Vilsack, listen here.