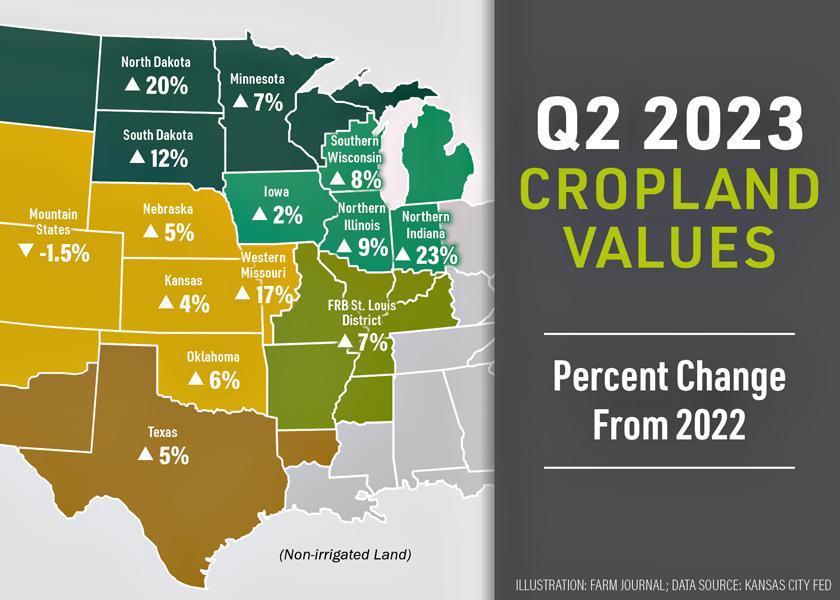

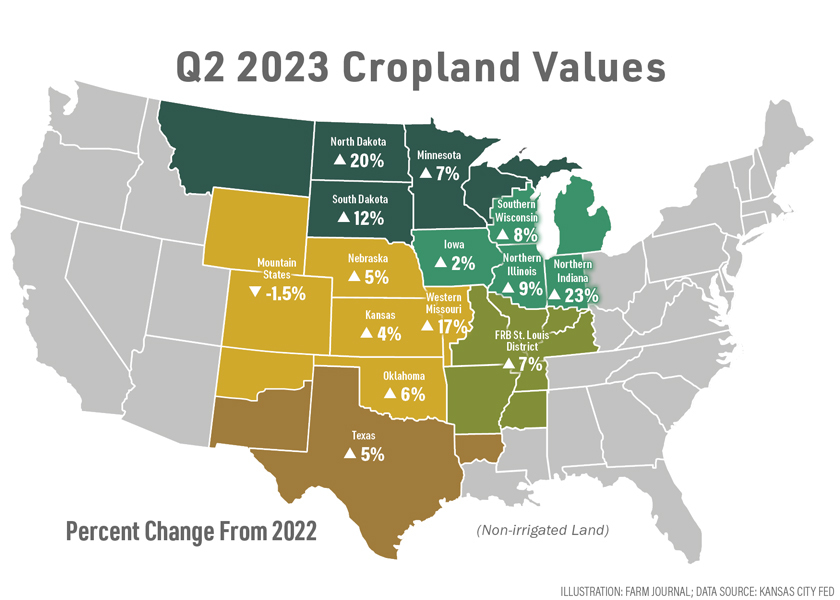

How Have Cropland Values Changed from 2022?

In its August 2023 report, the Kansas City Fed found farmland values eased from a year ago but remained steady at an average increase of 7%. Despite rising input costs and interest rates, farmland continues to be a wise investment opportunity, according to Bruce Sherrick, professor at the University of Illinois.

“People sometimes refer to farmland as an investment in gold, plus a coupon,” Sherrick says. “You get a fairly low annual cash flow, fairly high long-term rates of return and tax advantages to the asset classes.”

While the choice to buy and sell land makes sense, it is more difficult to understand what it is worth in this market. Land values range drastically for many reasons, including state-by-state land inflation, as is referenced in the Fed’s August report.

Paul Sadig of Farmers National Company says there are two driving factors in today’s farmland market:

1. Interest rates

The Kansas City Fed’s reported average fixed interest rate on a farm loan was above 8%, which is a 30-basis-point increase from last quarter. This rate change tells a bigger story, according to Sadig.

“Interest rates didn’t play an instant role in land prices, but we are seeing it now. In fact, loan activity has increased, which tells us those operators have significantly less cash in pocket for capital purchases, like land, and they’re willing to swallow the interest,” Sadig says.

2. Opportunity

Traditionally, farm operators compete against investors for farmland, according to Sadig. He says 80% of Farmer’s National real estate transactions are purchased by farm operators, and that number hasn’t fluctuated since 2022. However, this dynamic could change as land availability continues to evolve.

“We are certainly seeing fewer properties offered for sale across the country. When a piece of land becomes available, there are more active buyers looking for it. It’s a big factor in the land value equation right now,” Sadig says.

For people interested in either side of the land coin—buy or sell—Sadig suggests they go into business deals with these points in mind.

Looking to buy farmland?

When a land opportunity becomes available, the thought of the purchase can bring feelings of excitement and anxiety. Before pulling the trigger, Sadig says it’s important to look at the deal from all angles.

“The last thing you want to do is pay top-dollar for highly productive land, then find out it has drainage or erosion issues. However, on the other side of the buyer equation, those land issues would be bargaining chips. Either way, buyers need to take a thorough look at the land in question,” Sadig says.

On the other side of the coin, there may be more bargaining chips in the current sellers’ market.

Looking to sell farmland?

With farmland prices reaching $30,000 per acre in some areas, farm families are sitting around the dinner table, sharing conversations about whether now is the time to sell their land. He recommends these land sale discussions revolve around tax consequences.

“Ownership structures make a difference in how a land transaction will close on tax. Families need to decide whether they’re willing to pay capital gains tax, and we may have to counsel them to place that property in an ownership structure they’re more comfortable with to avoid tax ramifications,” Sadig says.

A look ahead

As we move into harvest in 2023 and look to 2024, Sadig says he’s keeping watch on the “I” states, and suggests others do the same.

“The ‘I’ states are interesting because they’re always the hottest—with the most competition and activity—but they’re also the ones to first realize a change,” Sadig says. “Any change in land markets will come first from these states, and that’s what we’re watching for in spring 2024.”