Signs Say to Look Up

Time to cull cows, wean calves and decide what to do with them. While things are starting to look up, the question is when good times will roll again.

Cattle producers have been cutting production—measured by the number of cows making babies—for 25 years now. And still, no profits.

Has the law of supply and demand been repealed? Of course not. But beef has problems on both sides of the law.

As the U.S. cow herd dropped about 25% from nearly 40 million cows in 1984 to close to 30 million cows in 2009, beef production has risen by about the same amount.

Cattle are bigger and, thanks to modern production techniques, a mama cow is more likely to conceive and wean a calf that will end up in the meat mix. The industry's cuts have not been drastic enough to put a damper on beef supply.

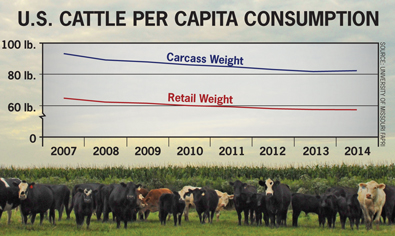

And demand? Between the glut of competing meats, slow exports and consumers' reluctance to spend money in this tight economy, that's down, too.

The result is that the price of fed cattle, the industry's primary pay day, has been sloshing along in the $80 cwt. range, causing everybody in the chain to settle for nonsustainable margins or take big losses.

When will it change? Chris Crawford, EHedger livestock specialist, says the beef industry is being held back by large supplies of pork and poultry, as well as weak export growth and the general economy. But competing meat producers are wallowing in red ink and cutting production. That, plus green shoots in the general economy, give him hope for "later in the year and going forward.”

But nobody thinks the picture is going to get rosy anytime soon. The Food and Agricultural Policy Research Institute (FAPRI) at the University of Missouri (MU) projects beef cow herds will continue to slowly decline until 2014.

That's not certain, of course. As Ronald L. Plain, D. Howard Doane Professor of Agricultural Economics and MU Extension economist, notes, there are a lot of variables to setting cattle prices.

The domestic economy is one of the biggest. High unemployment numbers have a negative impact on beef demand, Plain says. Even people who are working are less inclined to spend money. That means less beef demand and less demand for higher-priced cuts.

This explains the narrower spread between Choice and Select beef, he says, as well as the narrower gap between ground beef prices and high-value cuts like ribeye. Such cuts are an important part of the total value of a beef animal, so weak demand has an outsized impact.

How great an impact is hard to tell. As Plain and others suggest, retail beef prices are too incomplete to provide a measuring stick.

Gregg Doud, National Cattlemen's Beef Association lead economist, says that during these hard times, more beef moves through "specials” or product features. But official USDA figures are based on labeled prices, which means economists are left to measure retail prices based on the equivalent of window sticker prices on cars.

That is hardly perfect, Plain says. The Consumer Price Index reflects only what meat is priced at—not what it's sold for. However, Doud says, the average selling price of beef as measured by private concerns is below USDA's reported prices.

So there is more backwards pressure from retailers than most cattle people realize—and it has contributed to a situation in which packers' profits have run low in recent months and cattle feeders have poured good money after bad for 15 straight months, according to Don Close of the Texas Cattle Feeders Association.

Slower outside markets. Beef exports have grown this year, but not nearly as much as hoped. The weak international economy gets most of the blame, with growth in the Asian markets disappointing everybody. As the economy heals, that should get better.

FAPRI is counting on a weaker dollar to bring exports around in the midterm future, an expectation also shared by the business community. A stronger dollar pushes foreign prices up and puts U.S. beef at a further disadvantage.

But the economy isn't the only problem on the trade front. Japan, Korea and China—potentially huge markets for U.S. beef—all have trade barriers in place, and some beef professionals doubt the Obama administration's commitment to getting them lifted.

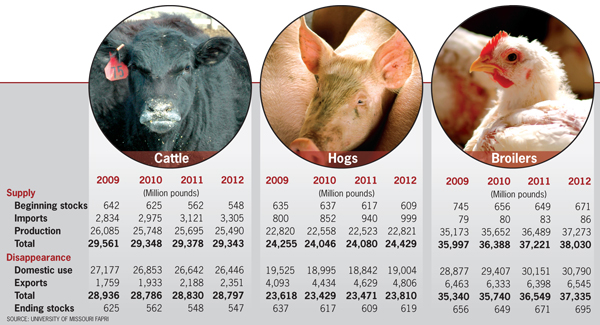

Pork and poultry. Even if the economy turns around, beef still has to worry about meat case competition. Pork is enduring a financial nightmare and slashing herd numbers in reaction. Short-term, that puts a lot of cheap pork on the market; long-term, lower supplies are ahead.

While there is no chance of consumers contracting "swine flu” from eating pork, many foreign consumers believe it might. Pork exports through June were down 18% from a year ago despite lower prices.

Chicken integrators are not having such a fine time, either. Per capita consumption of poultry is projected to fall for the third straight year in 2009 as they struggle to find production levels that will return profits.

Keep your optimism. But not all recent news is bad. Leather and byproduct prices have actually increased this year—adding $9 per cwt. to the value of a fed animal in August, up from $6 per cwt. in December.

It's easy to see there's some hope in the future. All it will take is for the worldwide economy to recover and chicken and swine producers to get their numbers in order. FAPRI's complete outlook at www.fapri.iastate.edu/outlook/2009 isn't exactly all good news, but it does predict recovery.

"The question,” Plain says, "is when.” BT

To contact Steve Cornett, e-mail scornett@farmjournal.com.