Market Highlights: Cattle Price Pressure Not a Bad Thing

By: Andrew P. Griffith, University of Tennessee

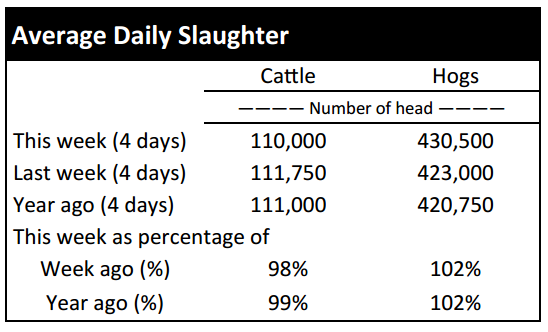

FED CATTLE: Fed cattle trade was not well established at press. Asking prices were around $127 in the South and $200 in the North. Bid prices were severely lower. The 5-area weighted average prices thru Thursday were $118.03 live, down $5.84 from last week and $189.98 dressed, down $4.52 from a week ago. A year ago prices were $159.77 live and $255.04 dressed.

The June live cattle contract, which is the leading contract, gained $6.65 this week which has resulted in it closing a large portion of the gap between cash prices and futures prices. As was mentioned one week ago, the cash and futures prices will eventually have to converge and this week was a positive movement for cattle feeders as the futures price moved towards the stronger cash price. Deferred contract months followed suit but not with the same fervor as the nearby contract.

The stronger futures market had cattle feeders holding out for higher prices as the momentum seems to have swung their way. Cattle feeders’ ability to push prices higher will be highly dependent on beef cutout prices the next several weeks.

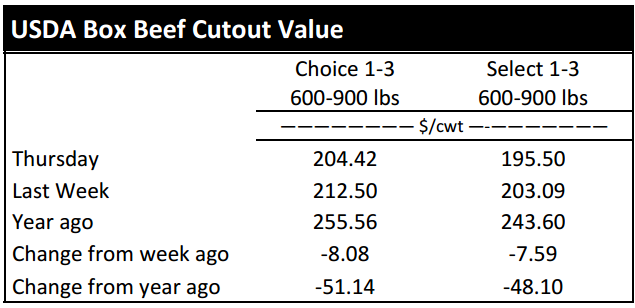

BEEF CUTOUT: At midday Friday, the Choice cutout was $203.66 down $0.76 from Thursday and down $8.39 from last Friday. The Select cutout was $194.91 down $0.59 from Thursday and down $8.26 from last Friday. The Choice Select spread was $8.75 compared to $8.88 a week ago. In three weeks’ time, the Choice and Select cutouts have lost more than $21 each.

The price decline could be considered a natural phenomenon. The price decline was most certainly self-induced by the industry as packers attempted to manage production in late winter and early spring, and are now pulling cattle out of pens at a fairly rapid pace. The pulling forward of cattle has resulted in an increased available supply of beef which has pressured beef prices lower during a time when the market is generally experiencing price support as retailers and restaurants gear up for the grilling season.

The recent price pressure is not necessarily a bad thing as it may benefit packers and feedlots alike down the road. The pulling forward of cattle may stress the market today, but it could potentially provide support to the market during the summer and early fall months when beef prices seasonally begin to wane. Today’s market actually appears fairly strong despite the softening of cutout prices. The decisions made today will impact the results of tomorrow, and today’s decisions may be beneficial.

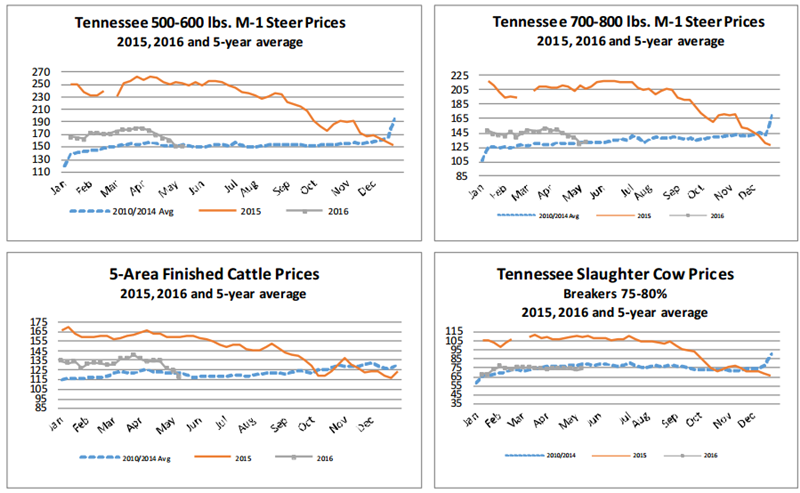

OUTLOOK: The futures market reversed its course this week as the brakes were put on the declining market and market participants have stepped on the accelerator to push feeder cattle prices higher. Most contracts have witnessed price increases of $7 or greater since last Friday’s closing price. Though futures have turned on their heels and headed in the opposite direction. Cash prices for feeder cattle have not been as quickly to respond.

On Tennessee auctions this week, calves and feeder cattle weighing 500 pounds and more were called steady to $2 higher compared to a week ago which is a welcome sign for most producers, but it still lacks the price strength that most would like to see prior to marketing.

Alternatively, calves weighing less than 500 pounds were as much as $3 lower compared to the previous week. Seasonally speaking however, the calf and feeder cattle markets appear to be on point with the seasonal trends. If seasonality takes complete control then lightweight calf prices will continue to slowly decline through late spring, summer, and into the fall while feeder cattle prices will slowly gain value through spring and summer before facing serious opposition in the fall.

The fundamentals of the market support some price support as feedlots have accelerated marketings and seem to be pulling cattle forward to take advantage of the strong basis. The increased marketing rate has resulted in feedlots being much more current in the marketings which suggest they will be looking for cattle to restock the pens. Producers looking to market calves in the next several months should keep an eye on the price direction to improve marketing decisions.

On a little different subject, the slaughter cow market tends to peak in the Months of May and June. Producers with cows that failed to calve this spring or fall calving herds that identified open cows may benefit from marketing those cows in the near term. Most of those cows should be in fairly good condition and carrying good weight considering they have been on grass for several weeks. The marketing of calves is not the only source of income for cow-calf producers and sometimes it is beneficial to strike when the iron is hot.

ASK ANDREW, TN THINK TANK: In a meeting this week, a question regarding long-term planning was asked. What is the definition of long-term and how far out should producers be planning to remain successful or build success in the beef cattle business? The answer may be different for different segments of the industry such as commercial cow-calf, stocker/backgrounder, seed stock, and feedlot. Stocker producers probably have the most flexibility in production and thus their definition of long-term planning may be shorter than most. However, it is encouraged that producers have a three to five year plan from a production and economic standpoint to improve the probability of success. The key to planning is having a well-defined objective. The plan may need to be changed slightly from year to year to achieve the objective, but a well-defined objective will keep a person on track to his or her definition of success.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle –June $120.73 1.10; August $117.90 0.48; October $117.38 0.45; Feeder cattle - May $147.38 -0.58; August $147.18 0.15; September $146.05 0.38; October $144.35 0.55; May corn closed at $3.76 up $0.04 from Thursday.