Getting Consumers to Shop Retail’s Deli-Prepared

As is the case with other industries, COVID-19 has had a significant impact on retail grocery. While in most cases stores are reporting record sales, deli department sales were down 10% in March and April of 2020 compared to 2019.1 Deli meat and cheese were not the culprits for this decline, but the deli-prepared foods section was. In a typical year, deli-prepared foods would account for the most sales in the deli department. As a result, focusing on deli-prepared is critical to retailers who are looking to revive the overall deli department.

National Cattlemen’s Beef Association (NCBA), on behalf of the Beef Checkoff, sought to understand more about consumers preferences when it comes to deli-prepared foods to aid retail partners. By conducting an online quantitative survey of 1,193 consumers, NCBA, on behalf of the Beef Checkoff, was able to identify opportunities and challenges to getting consumers to shop the deli-prepared section of their grocery store. Further, since many food items in this section pertain to beef and other proteins, the research also looked at specific protein items that consumers were interested in buying from the deli-prepared section.

Currently, 35% of consumers report that they have increased or just started purchasing from the deli-prepared section compared to 6 months ago—or right after the initial outbreak of COVID-19.2 This shows that though consumers had declined their purchasing in the spring, there are some returning to this department, and likely more who will. Among those who are currently shopping this department, 42% are doing so on a weekly basis.2 Further, it shouldn’t be a surprise that most are buying items for lunch or dinner, though some, such as women and middle-aged consumers, are also inclined to purchase items for sides and appetizers in addition to typical meals. This combined with the expectations that more consumers will go back to shopping this department provide ample opportunity in this space.

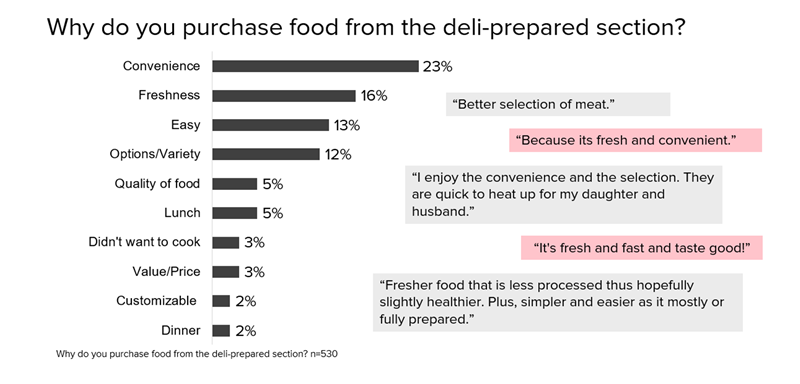

In general, consumers are clear about why they shop the deli-prepared department. The reason mentioned most is convenience—specifically as it pertains to how quick items here are to serve. Others also often mention the freshness of the food, how it’s easier than cooking, and that they can find specific foods and a variety of options in this section. Some also view this section as a cheaper or easier means for food than eating out.

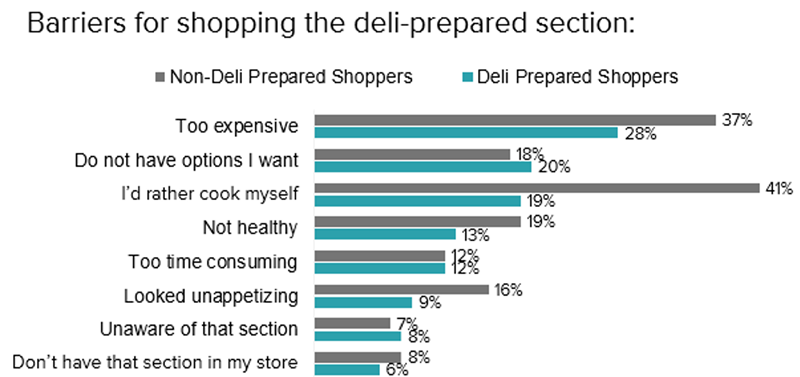

Reasons why consumers don’t shop this section include the price and the desire to cook themselves. In particular, wanting to cook themselves is even more of a barrier for consumers who aren’t currently shopping for deli-prepared foods. So, what would get those not currently buying from this section to do so? Triggers include lower prices, items that fulfilled a short notice need, and items that in general just looked good. Potentially, offering deals or discounts on items that consumers frequently need on short notice or are more prone to impulse purchase could convert them into deli-prepared shoppers.

Though each retailer is unique in their deli-prepared offerings, top of mind items that consumers claim would encourage them to purchase from this section include meats, cheese, salad, and sandwiches. Consumers are also interested in fried items, finger foods, pastas, and soups. Specifically, 45% of consumers would like to see even more beef options in the deli-prepared section.2 However, having a variety of protein options is still important, especially among younger consumers. Shoppers are also looking for a variety of cuisine options as well, such as American, Italian, and Mexican when they shop the deli-prepared section. Incorporating beef into options utilizing these cuisines could entice even more consumers.

More specifically when it comes to different protein options, consumers are currently buying and are more open to buying beef meatballs and beef sausage than meatballs or sausages made with other proteins2. The interest in proteins and specific beef items shows that beef options could help draw even more consumers to shop for deli-prepared foods. However, overcoming the initial barriers to shopping the deli-prepared section are most important to address before offering up delicious beef options.

1. IRI, Total US, MULO, Monthly Sales Growth 2020

2. NCBA, Deli-Prepared Survey, November 2020