Market Highlights: Summer Beef Slump

The summer months have resulted in softer prices for wholesale beef, finished cattle, feeder cattle, calves and slaughter cows.

By: Andrew P. Griffith, University of Tennessee

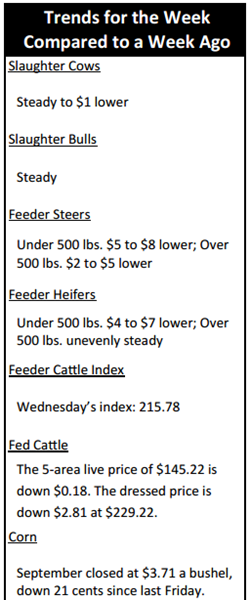

FED CATTLE: Fed cattle traded steady on a live basis compared to a week ago. Live prices were mainly $144 to $146 while dressed trade was mainly $231 to $233. The 5-area weighted average prices thru Thursday were $145.22 live, down $0.18 from last week and $229.22 dressed, down $2.81 from a week ago. A year ago prices were $162.97 live and $258.14 dressed.

The big question is if the summer lows are now in or if the market is just taking a breather before dipping lower. Some of the technical analysis indicates even lower fed cattle prices, but fundamental analysis would lean toward a steady trade to slow firming in the market over the next few weeks.

Regardless if the market strengthens, softens, or stays the same; prices are not expected to make any drastic moves over the next several weeks as August is not known for its beef movement. Live cattle prices will likely have to sit in anticipation that Labor Day spurs beef movement towards the second half of August. There is not going to be the same upside potential that was experienced one year ago.

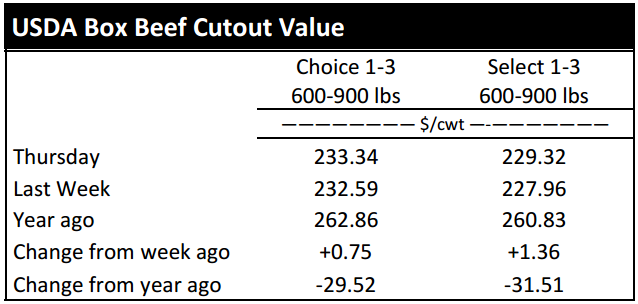

BEEF CUTOUT: At midday Friday, the Choice cutout was $233.27 down $0.07 from Thursday and up $2.27 from last Friday. The Select cutout was $229.69 up $0.37 from Thursday and up $1.09 from last Friday. The Choice Select spread was $3.58 compared to $2.40 a week ago.

This is the first week since the end of June that wholesale boxed beef prices did not decline from the previous week. The Choice cutout is $21 lower over the five week period while the Select cutout is $20 lower. Retailers remain hesitant to feature beef strongly due to the high retail beef price.

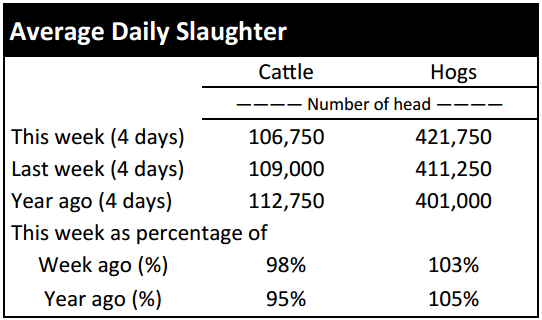

It appears packers are again slowing chain speed to reduce the quantity of beef available for purchase and thus pushing wholesale beef prices higher. Federally inspected slaughter last week fell below 540,000 head and appears to be falling further this week. It is not likely slaughter rates will be as drastically reduced as they were mid-February to mid-April when weekly slaughter rates ranged from 503,000 to 539,000, but they will likely be reduced enough to manipulate beef prices.

The National Restaurant Association’s Restaurant Performance Index was released today and stood at 102.0, down 0.4 percent from May. The index still represents growth in the restaurant business, but the index has declined two consecutive months and is at its lowest point in nine months.

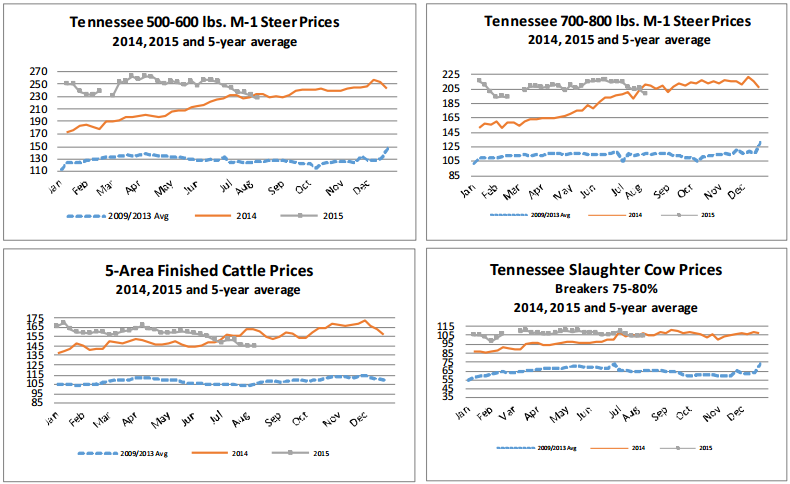

OUTLOOK: After two years where seasonal trends disappeared for all practical purposes, the seasonality of the beef complex appears to be rounding back into form. The summer months have resulted in softer prices for wholesale beef, finished cattle, feeder cattle, calves and slaughter cows. The sheer magnitude with which prices have declined seems large and it is.

Additionally, the percentage change in prices is slightly higher than the historical range of cattle and beef price declines from spring highs through the end of July. For instance, 500 to 550 pound steers have lost more than $42 per hundredweight since its spring peak in mid-April which is a decline of $210 to $231 per head.

This decline in prices represents a 15.4 percent decline in prices while most years the decline is somewhere between 7 and 10 percent through the end of July on Tennessee auctions. Similarly, slaughter cow prices have begun to soften.

The seasonal trend for slaughter cows is for prices to soften through the fall when cattlemen are weaning calves and culling cows.

The fall weaning time period presents an ideal time for producers to market cows that are poor producers, because the calves have been weaned and most cattlemen do not want to feed the cow through the winter. From a production standpoint, marketing these cows in the fall makes a lot of sense. However, it does not always make sense from an economic and profitability standpoint. But, it does not appear we will have as large a decline in slaughter cow prices as is normally seen in the market.

The Mid-Year July 1 Cattle Inventory report was released last Friday. All cattle and calves increased 2.2 percent and totaled 98.4 million head compared to one year ago. Beef cow inventory was 30.5 million head which is 2.5 percent higher than one year ago. Beef cow replacement numbers increased 6.5 percent from 2014 and totaled 4.9 million head.

ASK ANDREW, TN THINK TANK: A few weeks ago, the cattle crush was discussed in the weekly comments, but it was not explained. The “cattle crush” is also known as the cattle feeding spread. The term “crush” is taken from the soybean processing term for buying soybeans, crushing them and then selling the resulting soymeal and soy oil. Thus, the soybean process takes one input and then results in two marketable products. The cattle crush provides market participants the opportunity to simulate the financial aspects of product transformations when considering price risk management opportunities. The cattle crush works by taking corn and feeder cattle (two inputs) and then marketing finished cattle (one output). Thus, the cattle crush involves buying feeder cattle and corn futures and selling live cattle futures. There is not a perfect science to the cattle crush, but the consideration of 50,000 pound feeder cattle, 5,000 bushel corn, and 40,000 pound live cattle contracts must be considered. Thus, consider 200 head of feeder cattle weighing 750 pounds which would be a total of 150,000 pounds or 3 feeder cattle contracts. If the 200 head are carried to 1,200 pounds then 6 live cattle contracts would be needed because there would be a total of 240,000 pounds of finished cattle. It can be assumed that growing the animals 450 pounds will require 50 bushels of corn per head which would be 10,000 bushels or 2 corn contracts. Thus, it would take 3 feeder cattle contracts, 2 corn contracts and 6 live cattle contracts to complete the cattle crush.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle –August $146.45 1.23; October $146.55 0.10; December $148.05 -0.08; Feeder cattle - August $211.48 0.25; September $208.50 -0.10; October $206.40 -0.20; November $204.80 -0.33; September corn closed at $3.71 down $0.02 from Thursday.