Market Highlights: Slight Downturn

Both the fed cattle and beef cutout markets have taken a slight downturn, but things should turn around and head back towards record highs.

By: Andrew P. Griffith, University of Tennessee

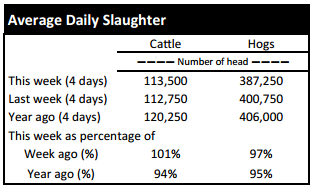

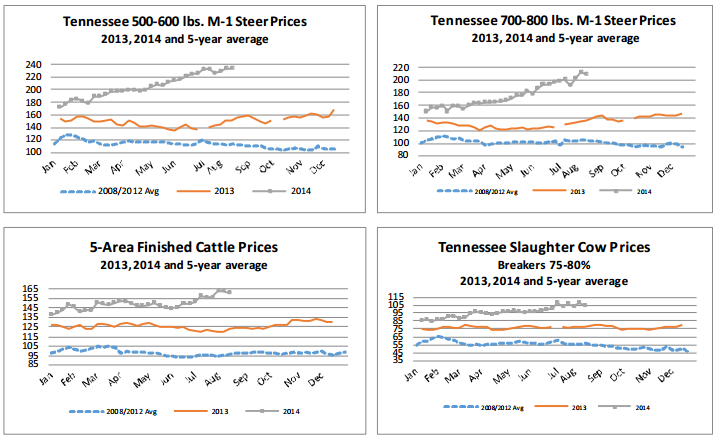

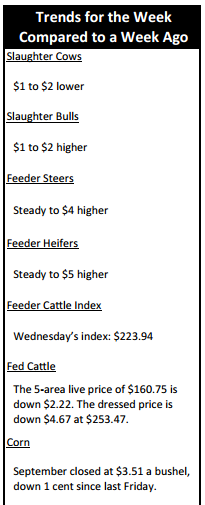

FED CATTLE: Fed cattle traded $2 to $3 lower on a live basis this week compared to last week. Prices on a live basis were mainly $160 to $161 while dressed trade occurred between $250 and $253. The 5-area weighted average prices thru Thursday were $160.75 live, down $2.22 from last week and $253.47 dressed, down $4.67 from a week ago. A year ago prices were $122.37 live and $193.00 dressed.

Fed cattle prices have been strong all year, and they have excelled during the summer grilling season. The strength in the market has resulted in strong profit margins for cattle being marketed. Feedlots have been able to demand higher prices all summer because marketings have remained current, and packers, though reluctant, have been willing to pay higher prices because the beef cutout price has provided ample revenue. However, prices are starting to feel their first real pressure of the summer.

A downturn in the fed cattle market could place feedlot managers in a bind on cattle placed the past four months. If the market turns too sharply then strong profit margins could turn thin or red in a hurry.

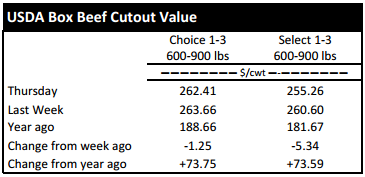

BEEF CUTOUT: At midday Friday, the Choice cutout was $261.33 down $1.08 from Thursday and down $2.44 from last Friday. The Select cutout was $253.69 down $1.57 from Thursday and down $5.02 from last Friday. The Choice Select spread was $7.64 compared to $5.06 a week ago.

This is only the second week since the first week of June that the Choice beef cutout price has moved lower. The exact reason for the decline is not known at this time. It could be softening demand, or it could be because of the negative news to meat proteins coming out of Russia. Regardless, Choice and Select beef have had a strong counter-seasonal price run.

The softening of prices the market traditionally succumbs to during the summer has yet to come to fruition. There remains one more summer grilling holiday the first week of September. Some retailers will already be securing product to feature Labor Day weekend. It is not clear at this time if they will feature beef, pork or poultry.

Many retailers have found it difficult to feature beef at such high prices, but consumers continue to step up to the beef counter. It is likely the beef market will find some resistance the next couple of months as each meat protein market adjust to changes in movement due to Russia. One positive note is that consumers continue to have a strong appetite for ground product.

TENNESSEE AUCTIONS: On Tennessee auctions this week compared to a week ago steers and bulls were steady to $4 higher. Heifers were steady to $5 higher. Slaughter cows were $1 to $2 lower while bulls were $1 to $2 higher. Average receipts per sale were 690 head on 11 sales compared to 658 head on 12 sales last week and 776 head on 8 sales last year.

OUTLOOK: Calf and feeder cattle prices across the country continued to have a good run this week as most weight classes were able to press forward. Prices for feeder cattle have continued to be supported by strong finished cattle prices which have been supported by the export market. However, signs of weakness may be lurking around the corner.

Previous commentary in this market update has alluded to the thought that prices would likely only be negatively affected by a food safety scare, livestock disease outbreak, or some other macro-economic factor that is outside the cattle industries control. The latter happened this week when Russian officials announced an import ban on all food products from the United States as well as a number of import bans on the EU, Canada, and Australia.

It may appear to some purveyors as if this ban will have major implications on the beef industry in the U.S., or it may appear to others as having little negative impact since exports of beef to Russia have been practically non-existent since the end of 2012. The impact depends on how the movement meat protein changes due to the imposed ban.

Though the ban does not directly impact beef exports, it could have the ability to indirectly impact the market to a great extent. Participants in the beef, pork and poultry industries will be watching this situation closely as the flow of meat trade could be greatly impacted. World happenings can and will greatly influence the cash price received by Tennessee livestock producers. It may take a while for the full impact of this Russian ban to be felt, but it has already showed up in futures contract prices and will likely show up this week in local cash prices.

TECHNICALLY SPEAKING: Based on Thursday’s closing prices, August live cattle closed at $155.55. Support is at $154.45, then $151.15. Resistance is at $157.75, then $161.05. The RSI is 54.53. October live cattle closed at $153.00. Support is at $151.84, then $148.42. Resistance is at $155.27, then $158.69. The RSI is 44.50. December live cattle closed at $153.25. Support is at $152.50, then $152.05. Resistance is at $155.25 then $155.90. The RSI is 42.47. August feeders closed at $218.32. Support is at $217.11, then $213.46. Resistance is at $220.76, then $224.41. The RSI is 57.16. November feeders closed at $215.60. Support is at $215.00, then $213.35. Resistance is at $218.15 then $218.53. The RSI is 51.32. January feeders closed at $210.33. Support is at $207.70, then $206.75. Resistance is at $213.33 then $213.75. The RSI is 51.26. Friday’s closing prices were as follows: Live/fed cattle –August $152.55 -3.00; October $150.00 -3.00; December $150.25 -3.00; Feeder cattle - August $215.33 -3.00; October $213.98 -3.00; November $212.60 -3.00; January $207.33 -3.00; September corn closed at $3.52 down $0.08 from Thursday.