Market Highlights: Holiday Beef Slump Looms

By: Andrew P. Griffith, University of Tennessee

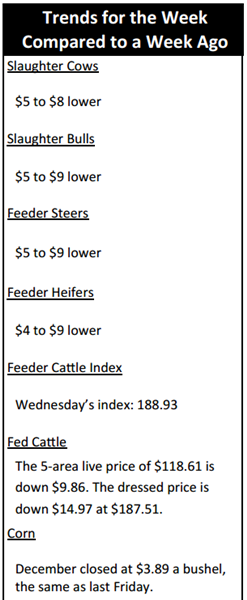

FED CATTLE: Fed cattle traded $9 to $10 lower on a live basis compared to a week ago. Prices in the South were mainly $118 to $120 while prices in the North were mainly $186 to $189. The 5-area weighted average prices thru Thursday were $118.61 live, down $9.86 from last week and $187.51 dressed, down $14.97 from a week ago. A year ago prices were $159.98 live and $252.00 dressed.

Cattle feeders continue to purge the lots of heavy cattle. The losses on these heavy cattle continue to grow as the market continues to tumble, but feedlot managers have no option other than to move the extremely large animals and try to replace them with lower priced feeder cattle. Red ink will likely persist in the feedlot for the next couple of months, but a reprieve may be coming as some of the lower priced feeder cattle work through the system.

Cattle feeders are reeling from losses, but they continue to benefit from relatively inexpensive feed and the cost of placing cattle in the feedlot has declined significantly the past couple of months. Cattle feeders should be able to continue purchasing replacement cattle at reduced rates relative to this summer.

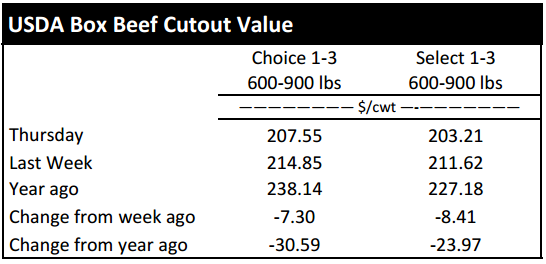

BEEF CUTOUT: At midday Friday, the Choice cutout was $206.75 down $0.80 from Thursday and down $6.70 from last Friday. The Select cutout was $203.38 up $0.17 from Thursday and down $7.30 from last Friday. The Choice Select spread was $3.37 compared to $2.77 a week ago.

Packers are feeling the grind as boxed beef prices continue to be pressured by increased cattle slaughter and beef production. The Choice cutout has slid more than $20 in two weeks while the Select cutout has declined more than $16 over the same time period. Packers have been able to purchase cattle at relatively low prices the past several weeks which has resulted in increased slaughter rates relative to earlier in the year.

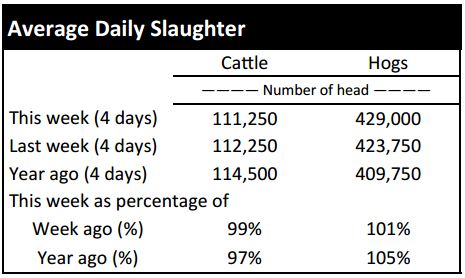

Federally inspected cattle slaughter has exceeded 570,000 head the past few weeks and is expected to do so again this week. The increased slaughter has increased beef production which is forcing the cutout price lower. Beef production under federal inspection ending last week was about 2.5 percent higher than the same week one year ago.

Retailers are not heavily promoting beef at this time and will likely put more of their efforts into turkey and ham the next several weeks. Retailers will likely start pushing beef items a little harder after the purchasing for Thanksgiving has been completed.

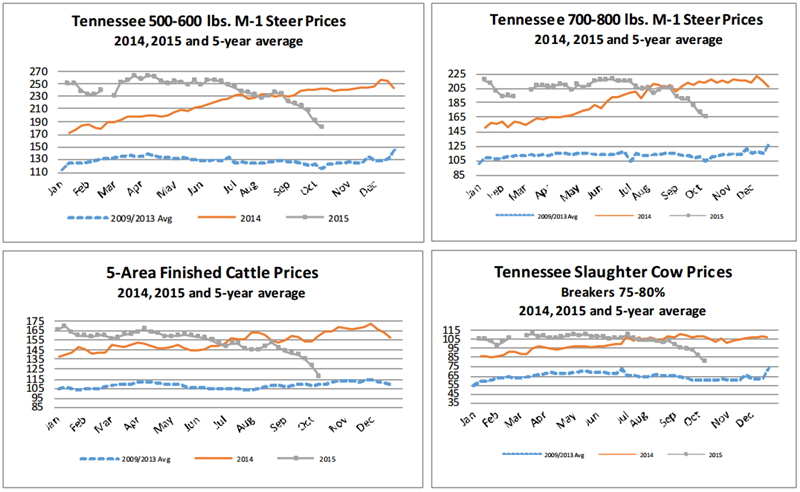

OUTLOOK: Calf prices had another rough go of it this week as producers are setting wheels under cattle at a fairly quick pace. It appears the declining market has frightened producers resulting in the offloading of cattle from the countryside.

The feeder cattle market is reeling from the front loaded fed cattle market where feedlots are trying to offload extremely heavy finished cattle. But, there remain several heavy feeder cattle still on grass which does not seem as attractive to feedlot operators who have plenty of heavy cattle. The heavy feeder cattle will have to work through the system before feeder cattle prices rebound.

Calf prices will not rebound until the feeder cattle market is witnessing clearing action. On top of that, the normal fall run of calves is upon us which further depresses calf prices. Based on weekly weighted auction averages for the state of Tennessee, 550 pound steers have lost $298 per head since the middle of August while 750 pound steers have declined $299 per head over the same time period.

The story on heifers is not much different with 550 and 750 pound heifers down $278 and $266 per head respectively in the past seven weeks. Producers should not expect much relief from this price decline through the month of October or even November. Prices may find some support in December, but it is more likely that strong support will not come until after the first of the year. Producers with heavy feeder cattle will probably not benefit from holding cattle much longer.

Alternatively, some producers may benefit from weaning calves and backgrounding them for a few months. This also means there is likely a good purchasing opportunity for stocker producers in today’s market. The expectation is for feeder cattle prices to find support in 120 days or so which could provide a beneficial marketing opportunity.

Slaughter cows have not been immune to the price decline either as they have lost about $300 per head in the past couple of months. Slaughter cow prices, similar to calf prices, will likely continue to deteriorate through October and most of November as producers market cows after calf weaning.

ASK ANDREW, TN THINK TANK: I would first like to correct an error in last week’s comments where I said the average dressed weight for a steer was 963 pounds when in fact the average dressed weight was 919 pounds for the week ending September 12th. I have received several calls and emails related to feeder cattle futures contracts the past couple of weeks, and the primary question has been whether to hold the position or to exit the position. In the short term, feeder cattle futures are not expected to make any strong movement. However, the deferred contracts starting in 2016 are likely to make a turn and gain a few dollars by the time the calendar flips. Producers should keep a close watch on the situation the next few months as the markets move.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle –October $123.05 1.65; December $131.50 1.50; February $133.70 0.90; Feeder cattle - October $179.83 2.43; November $175.00 2.88; January $169.90 3.00; March $168.80 2.98; December corn closed at $3.89 up $0.04 from Thursday.