Market Highlights: Cattle Prices Climb

Live cattle prices were up $2 to $3 from the previous week.

By: Andrew P. Griffith, University of Tennessee

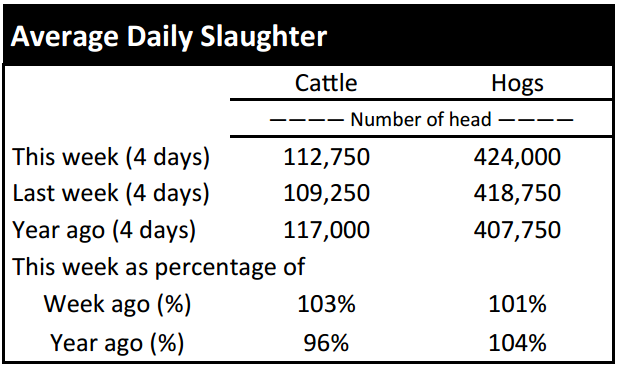

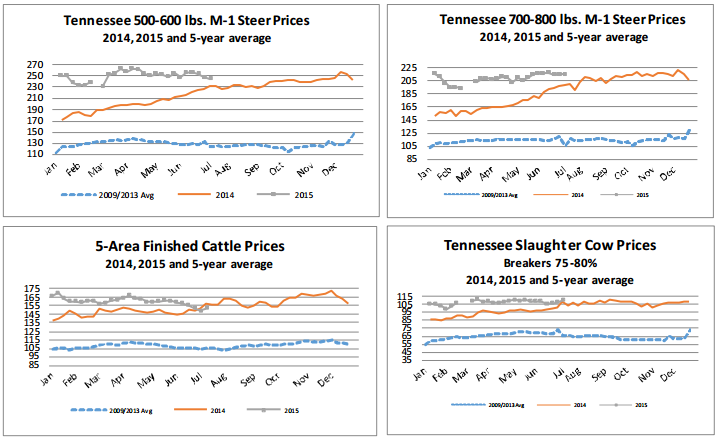

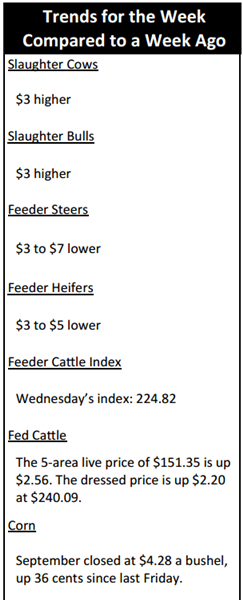

FED CATTLE: Fed cattle traded $2 to $3 higher on a live basis compared to a week ago. Live prices were mainly $150 to 152 while dressed trade was mainly $240. The 5-area weighted average prices thru Wednesday were $151.28 live, up $2.60 from last week and $239.45 dressed, up $1.44 from a week ago. A year ago prices were $157.40 live and $249.45 dressed.

In a bit of a surprise, the fed cattle market found support as packers were willing to pay a little more for fed cattle this week compared to last week. The expectation was for live cattle prices to be steady to slightly softer compared to last week considering the market is heading into the largest supplies of fed cattle.

Supply of live cattle tends to peak in July which depresses prices resulting in the summer price plunge. The price this week is more than $6 per hundredweight lower than the price the same week last year. The fed cattle market will be tested the next several weeks as cattle continue to roll off feed, but it appears packers may be willing to pay fairly steady money.

The market will likely establish a fairly narrow trading range before any significant changes in market conditions which will occur late summer and early fall.

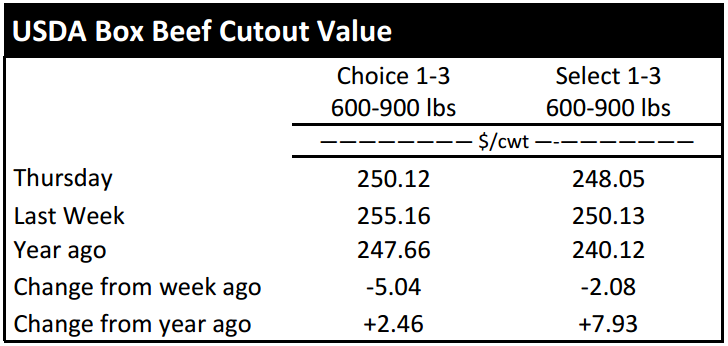

BEEF CUTOUT: At midday Thursday, the Choice cutout was $254.53 down $2.02 from Wednesday and down $4.26 from last Friday. The Select cutout was $248.42 down $0.84 from Wednesday and down $1.26 from last Friday. The Choice Select spread was $1.85 compared to $4.85 a week ago.

Independence Day has passed and the beef market is heading into the dismal dog days of summer. Packers did not experience the type of beef sales they were hoping for this summer holiday. Packers will not have any support from any grilling holidays for the next two months until Labor Day rolls around in early September.

It appears many grocers, restaurants and foodservice providers are purchasing beef hand to mouth out of expectation that beef prices will continue to decline the next several weeks. They appear to be keeping small quantities of beef in supply and willing buyers of poultry and pork products which are readily available in large quantities.

A depressed beef cutout price is very likely as seasonally strong fed cattle supply kicks in and beef supply increases. The price decline may not hurt packer margins too much if they can continue to secure cattle at relatively low prices as they have been able to do the past several weeks. The outlook is for the beef cutout price to soften the next several weeks before finding support in late summer.

OUTLOOK: Calf and feeder cattle markets struggled through the week and were wrapped in uncertainty. Steers were $3 to $7 lower while heifers were $3 to $5 lower compared to one week ago. The uncertainty was brought on by major price fluctuations in the futures market throughout the week. However, Thursday’s closing prices for most contracts were higher than last Friday’s closing price.

Losses at weekly auction markets were more evident the lighter the cattle were. It is common for lightweight calves to lose ground during the summer months as there are fewer willing buyers for high risk cattle during periods that experience extreme temperatures and weather conditions. Additionally, grass often runs thin this time of year and even though grass in most regions of the country is in the best shape it has been in a couple of decades, many stocker and backgrounders are not willing to take the risk that drought can bring.

Alternatively, the feeder cattle market generally begins heating up the second half of July. Feeders placed on feed around the beginning of August are generally harvested during the strong holiday markets at the end of the year. The summer feeder cattle market is still uncertain, but it is expected to maintain support and result in strong prices.

If a producer is feeling uncomfortable about the volatility in the market then it is advised that the producer participate in some sort of price risk management strategy. But, if volatility is not a concern then producers are advised to sit tight because prices are not expected to trend downward the next couple of months.

The slaughter cow and bull markets were up $3 this week compared to last week supporting the thoughts that grinding beef remains in strong demand. The market cattle producers should keep an eye on is the corn market. The December corn futures price has increased 75 cents a bushel in two weeks and the acreage report and crop conditions report is supportive of higher corn prices.

ASK ANDREW, TN THINK TANK: The question “How much does it cost to carry a cow?” has been presented to me many times by producers spanning the state. The answer to the question is “it depends.” No two producers have the same cost and cost structure. The cost to carry a cow in the breeding herd can range dramatically due to feed costs, pasture resources, and fixed expenses. Many of the differences across producers in the total cost of carrying a cow are due to fixed expenses. Many small producers end up having high fixed expense per cow because of the machinery complement while large producers have a very similar machinery complement but are able to spread that cost over more animals. Based on University of Tennessee budgets, variable costs of carrying a cow are about $690 a head while total costs is about $1,030 a head.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

THURSDAY’S FUTURES MARKET CLOSING PRICES: Thursday’s closing prices were as follows: Live/fed cattle –August $151.23 0.15; October $154.13 0.43; December $154.73 -0.03; Feeder cattle - August $217.45 -1.05; September $216.10 -0.95; October $214.75 -0.80; November $213.45 -0.78; July corn closed at $4.20 up $0.06 from Wednesday.