Market Highlights: Cattle on Ice

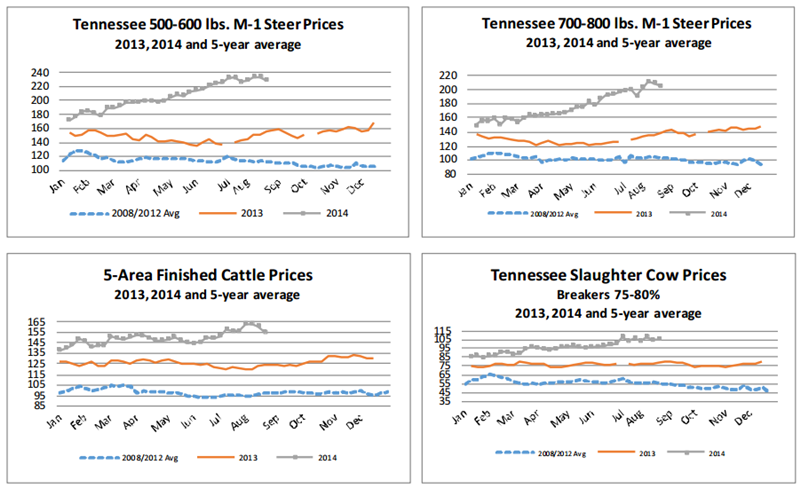

Cattle prices have been put on ice with markets falling off a bit.

By: Andrew P. Griffith, University of Tennessee

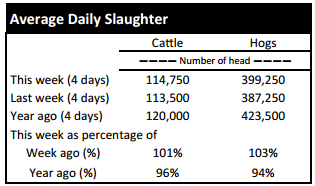

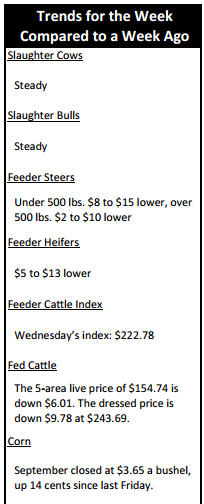

FED CATTLE: Fed cattle traded $5 to $6 lower on a live basis this week compared to last week. Prices on a live basis were mainly $154 to $156 while dressed trade occurred between $241 and $244. The 5-area weighted average prices thru Thursday were $154.74 live, down $6.01 from last week and $243.69 dressed, down $9.78 from a week ago. A year ago prices were $123.86 live and $196.86 dressed.

It appears fed cattle marketings are becoming less current as steer and heifer weights are about eight pounds heavier than the same week a year ago. The reduced harvest of cattle this summer is likely the prime suspect to why cattle marketing are less current. This leaves feedlot managers needing to move cattle in the near future.

Packing facilities have been watching slaughter rates closely to help support cutout prices. The reduced slaughter also left them paying higher prices for fed cattle, but has now put feedlots in a situation where they will have to move some product. Softness in the fed cattle market may persist the next few weeks, and prices could dip into the $140s.

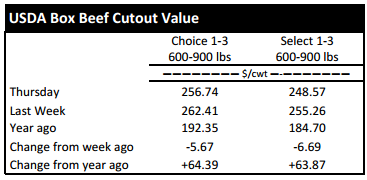

BEEF CUTOUT: At midday Friday, the Choice cutout was $256.04 down $0.70 from Thursday and down $5.29 from last Friday. The Select cutout was $250.21 down $1.64 from Thursday and down $3.48 from last Friday. The Choice Select spread was $5.83 compared to $7.64 a week ago. Both the Choice and Select cutouts have faltered the previous two weeks, but prices remain strong relative to previous years.

In recent weeks, wholesale prices for many beef products have been 30 to 50 percent higher than the same weeks a year ago. Cuts such as the chuck and round are two prime examples of beef products that have experienced a significant price increase. Similarly, 90 percent lean and 50 percent lean trimmings have experienced price spikes relative to a year ago.

The prices of these cuts and products are strongly supported by the demand for ground beef. A larger percentage of chucks and rounds are being ground this year relative to a year ago which supports the price of the two cuts.

It is evident consumers prefer the taste of beef over competing meats, because they continue to step up to the beef counter.

Cutout prices have the potential to dip lower the next several weeks. One supporting factor will be Labor Day beef purchases as retailers will try to move product during the last grilling holiday of the season.

TENNESSEE AUCTIONS: On Tennessee auctions this week compared to a week ago steers and bulls under 500 pounds were $8 to $15 lower while those over 500 pounds were $2 to $10 lower. Heifers were $5 to $13 lower. Slaughter cows and bulls were steady. Average receipts per sale were 659 head on 10 sales compared to 691 head on 11 sales last week and 850 head on 10 sales last year.

OUTLOOK: Calf and feeder cattle prices were put on ice this week as all classes stumbled. Signs of the market faltering were evident late last week with the announcement from Russia with regards to imposing import bans on agricultural products from the United States and other countries.

That news caused a knee-jerk reaction from futures traders who sold off contracts resulting in multiple days of the market moving down the $3 limit for most contracts. It is difficult to say if the decline in cash prices is completely due to Russia’s announcement or if another factor is at play.

Price is determined by supply and demand, and it just so happens to be that supply of cattle and beef is relatively low while demand is relatively strong in the current market. With that being said, prices are expected to remain strong relative to previous years, but the expectation of price movement after this jolt in the market is less certain. It is likely multiple factors have led to the price decline witnessed this week for feeder cattle. However, it would not be surprising to see prices recover a little in coming weeks.

Some softness may appear in the calf and feeder cattle market in coming months as more spring born calves come to market this fall. However, prices are not expected to soften as much as in previous years because of the limited supply of cattle.

The elevated prices will continue to support the increase in financial risk margin operators are facing. Stocker producers, feedlot managers, and slaughter and beef packing facilities have been fortunate thus far in that record purchase prices have been followed by record sale prices. The trend will eventually come to an end and the financial risk currently being faced will be more evident as margins decline.

Financial risk is composed of both price and production risk. Many margin operators manage production risk to some degree. However, it may be advantageous for margin operators to consider managing part of their financial risk by managing price risk.

TECHNICALLY SPEAKING: Based on Thursday’s closing prices, August live cattle closed at $150.00. Support is at $148.73, then $146.83. Resistance is at $150.63, then $152.53. The RSI is 42.34. October live cattle closed at $147.35. Support is at $146.19, then $144.24. Resistance is at $148.14, then $150.09. The RSI is 34.41. December live cattle closed at $149.65. Support is at $148.75, then $148.40. Resistance is at $149.80 then $150.65. The RSI is 36.72. August feeders closed at $215.13. Support is at $214.12, then $212.29. Resistance is at $214.36, then $216.71. The RSI is 48.83. November feeders closed at $211.78. Support is at $211.15, then $209.85. Resistance is at $212.60 then $213.05. The RSI is 43.51. January feeders closed at $206.18. Support is at $206.15, then $204.68. Resistance is at $206.45 then $208.35. The RSI is 42.81. Friday’s closing prices were as follows: Live/fed cattle –August $150.60 +0.60; October $147.75 +0.40; December $150.90 +1.25; Feeder cattle - August $217.23 +2.10; October $214.30 +1.93; November $213.65 +1.88; January $208.05 +1.88; September corn closed at $3.66 up $0.04 from Thursday.