Market Highlights: Beefed Up Prices

Beef and cattle prices continue to rise.

By: Andrew P. Griffith, University of Tennessee

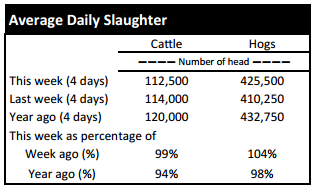

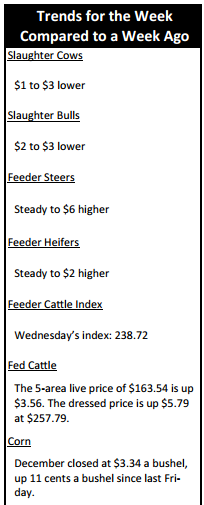

FED CATTLE: Fed cattle traded $2 higher on a live basis compared to a week ago. Prices were mainly $162 to $164 in the South while prices in the North ranged from $256 to $260. The 5-area weighted average prices thru Thursday were $163.54 live, up $3.56 from last week and $257.79 dressed, up $5.79 from a week ago.

A year ago prices were not reported due to the government shutdown. Live cattle futures started this week as strong as or stronger than they ended last week, but they hit a soft spot on Thursday and prices continued on a downward trajectory on Friday. However, cash prices did not seem to be phased as fed cattle prices found support from the run-up in futures earlier in the week.

Cattle feeders are sure to be satisfied by the price support as they stare down the barrel of a loaded gun that could quickly turn into negative margins if the market were to be negatively affected by outside factors. Based on the past four months, it appears live cattle futures climbed to the top of a waterslide at Dollywood Splash Country and are preparing for a plunge. However, the market has continually found a way to defy all odds and press forward so maybe Dolly has no reason to worry about any splash.

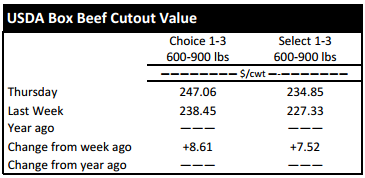

BEEF CUTOUT: At midday Friday, the Choice cutout was $247.70 up $0.64 from Thursday and up $8.67 from last Friday. The Select cutout was $235.12 up $0.27 from Thursday and up $8.32 from last Friday. The Choice Select spread was $12.59 compared to $12.24 a week ago.

Packers continue to face volatility in the fed cattle market as well as in the boxed beef market. Price increases in the beef cutout this week have helped to insure positive margins as major gains were witnessed in both the Choice and Select cutouts, but the potential for even stronger margins were hampered by the increase in fed cattle prices.

Beef demand remains strong both domestically and internationally, but export demand could be stymied in the future if the U.S. dollar continues to strengthen relative to other currencies which also could result in an increase in beef imports.

Packers continue to wait for their opportunity to gain leverage on cattle feeders which will come in due time, but feedlot managers have been able to maintain leverage due to low supply and strong demand. As cattle continue to be fed to heavier weights and as cattle back up in the feedlot then packers will be able to secure cattle at “more favorable” prices which may result in cattle feeders losing some money.

TENNESSEE AUCTIONS: On Tennessee auctions this week compared to a week ago steers and bulls were steady to $6 higher. Heifers were steady to $2 higher. Slaughter cows were $1 to $3 lower while bulls were $2 to $3 lower. Average receipts per sale were 907 head on 12 sales compared to 882 head on 11 sales last week and 830 head on 10 sales last year.

OUTLOOK: Cattle marketings are starting to pick up for the fall time period with most of the feeder cattle being marketed between 350 and 650 pounds. There is nothing unusual about this marketing pattern, but the question for cow-calf producers is if they could benefit from growing those calves to heavier weights.

Similarly, stocker producers are evaluating the weight classes that offer the best margin opportunities. Thus, it may be appropriate to consider it from a cost of gain versus value of gain standpoint. The cost of gain in the feedlot reported by Kansas State in the August issue of “Focus on Feedlots” was $0.93 per pound for steers and $0.98 per pound for heifers which is expected to decline in coming months.

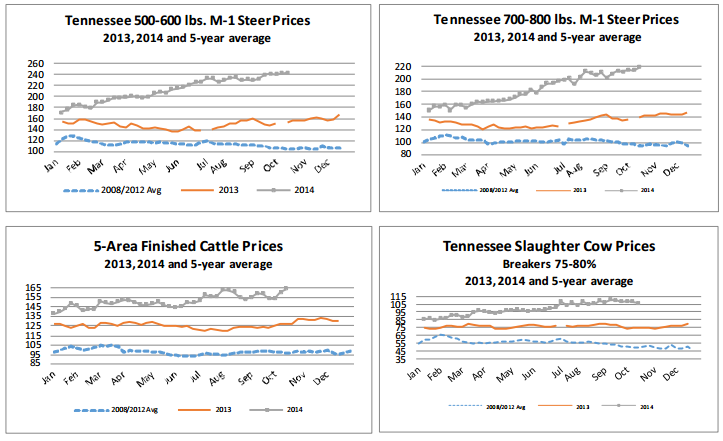

Producers utilizing forage should be able to achieve a lower cost of gain than the feedlot, but the question now is how the value of gain stacks up against the cost of gain. Using weekly auction market average prices for the current week, a 579 pound steer was valued at $1,372 per head ($236.99/cwt) while a 721 pound steer was valued at $1,593 per head ($220.93/cwt). Thus, growing steers from 579 pounds to 721 pounds would result in a value of gain of $1.55 per pound {($1,593 - $1,372) ÷ (721 – 579)}.

When analyzing the value of gain for different weight classes of steers weighing between 421 and 721 pounds, the value of gain ranged from $1.14 to $1.64 per pound with most value of gains above $1.30 per pound when marketed through the weekly auction market. However, the value of gain is markedly higher if the feeder cattle were marketed in load lots.

A load of 750 pound steers brought $1,740 per head this week ($232/cwt) while two loads averaging 837 pounds brought $1,879 per head ($224.51). The value of gain from 530 pounds to 750 pounds was $1.92 per pound while the value of gain from 530 to 837 pounds was $1.83 per pound. Similarly, the value of gain from 627 pounds to 750 pounds was $2.35 per pound while the value of gain from 627 to 837 pounds was $2.04 per pound.

It is understood that cattle prices for feeder cattle could fall between purchase and sale time. However, price risk management tools such as livestock risk protection, forward contracting, or futures and options could be used to secure a profitable price and value of gain.

TECHNICALLY SPEAKING: Based on Thursday’s closing prices, October live cattle closed at $164.00. Support is at $162.14, then $157.47. Resistance is at $166.82, then $171.49. The RSI is 66.28. December live cattle closed at $165.88. Support is at $164.08, then $159.53. Resistance is at $168.63 then $173.18. The RSI is 64.60. February live cattle closed at $166.40. Support is at $166.10, then $165.55. Resistance is at $167.60, then $168.83. The RSI is 67.18. November feeders closed at $241.52. Support is at $239.05, then $233.22. Resistance is at $244.87 then $250.70. The RSI is 78.24. January feeders closed at $235.30. Support is at $234.75, then $234.08. Resistance is at $235.70 then $236.33. The RSI is 79.95. March feeders closed at $234.28. Support is at $233.50, then $232.50. Resistance is at $235.20, then $237.40. The RSI is 81.62. Friday’s closing prices were as follows: Live/fed cattle – October $164.90 0.90; December $165.30 -0.58; February $165.00 -1.40; Feeder cattle - October $240.50 -1.15; November $239.20 -2.33; January $233.10 -2.20; March $231.30 -2.98; December corn closed at $3.34 down $0.11 from Thursday.