Market Highlights: Beef Price Drop

Beef and cattle prices dropped this past week, but it's still a profitable time to be in the beef industry.

By: Andrew P. Griffith, University of Tennessee

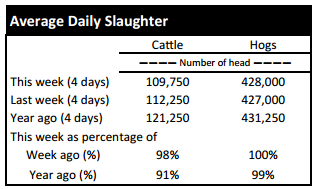

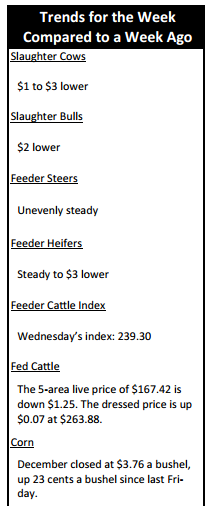

FED CATTLE: Fed cattle traded $2 lower on a live basis compared to a week ago. Prices were mainly $168 on a live basis while dressed trade ranged from $263 to $265. The 5-area weighted average prices thru Thursday were $167.42 live, down $1.25 from last week and $263.88 dressed, up $0.07 from a week ago. A year ago prices were $132.19 live and $209.07 dressed.

Fed cattle prices found no path to press forward past last week’s record setting price. Live cattle futures faltered late in the week as did boxed beef prices which meant most packers slammed on the breaks when it came to the thought of paying higher prices for live cattle.

There will be continued resistance from packers to pay higher prices for fed cattle which could easily turn positive feeding margins into negative margins. Much of the pressure will come from lower pork and poultry prices as production in both sectors has started gaining traction.

The market is set up for someone to lose money and packers are taking the brunt of the hit, but the tide could easily turn to feedlot managers in the near future.

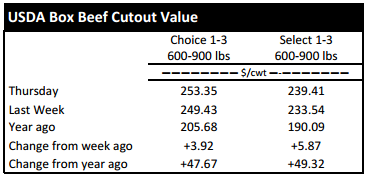

BEEF CUTOUT: At midday Friday, the Choice cutout was $251.77 down $1.58 from Thursday and up $4.73 from last Friday. The Select cutout was $239.17 down $0.24 from Thursday and up $6.73 from last Friday. The Choice Select spread was $12.60 compared to $14.60 a week ago.

Packers may have received a reprieve this week as small gains were witnessed in boxed beef prices while at the same time fed cattle prices softened. However, price changes were not able to flip packer margins as red ink continues to cover the page.

The primal cuts driving the current cutout price may be a surprise to many, but the export market is strong for the chuck, brisket and short plate. Many Asian countries place a higher value on these cuts than the domestic market. Thus, packers continue to export these products at higher prices than can be achieved domestically.

Ground product continues to see success in the domestic market as fresh 90 percent lean boneless beef continues to trade near $3 per pound at the wholesale level. Weekly fresh 90 percent lean boneless beef prices have been more than 40 percent higher than the same week a year ago since the second week of July. This will continue to support commercial slaughter cow prices, but it may be difficult to pry cows out of producer’s hands with strong feeder cattle prices.

TENNESSEE AUCTIONS: On Tennessee auctions this week compared to a week ago steers and bulls were unevenly steady. Heifers were steady to $3 lower. Slaughter cows were $1 to $3 lower while bulls were $2 lower. Average receipts per sale were 820 head on 12 sales compared to 992 head on 12 sales last week and 960 head on 10 sales last year.

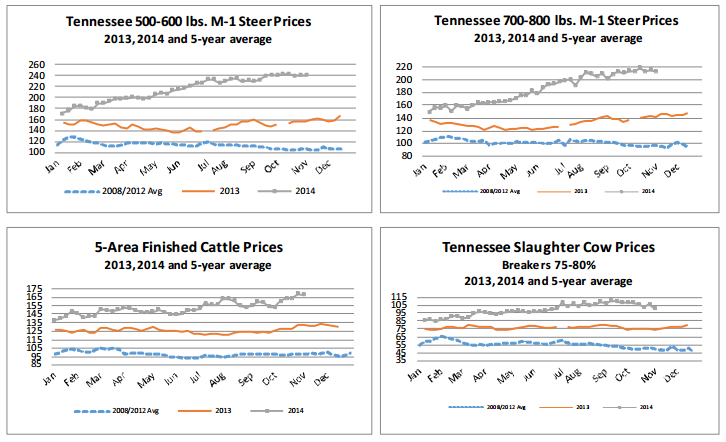

OUTLOOK: A tremendous amount of volatility has been present in feeder cattle markets the past five or six months. Such volatility makes many producers uneasy because they directly relate volatility to risk. However, volatility is not risk and risk is not volatility. Volatility is how quickly the market is increasing and decreasing while risk is more associated with the long-term direction of the market. Thus, even though volatility seems to be ever present in the feeder cattle market, negative price risk is rather minimal at this time.

Cattle prices have climbed more than 70 percent the past fifteen months and there is little to no indication of prices falling in the near future. Therefore, returns to the investment in cattle production are expected to remain strong the next couple of years.

The one concern many producers have with volatility is selling cattle at a low point during a volatile market. However, cash price volatility has been much lower than volatility in the futures market. Volatility in the futures market can be detrimental to the hedging process as prices can quickly increase or decrease.

High market volatility also increases the cost of purchasing put and call options which makes them less attractive when trying to set a price floor or price ceiling. Market fundamentals have begun putting pressure on both calf and slaughter cow prices. The fall run of bawling calves is in full swing as is cow culling which tends to depress prices. However, cow culling is nowhere near year ago levels.

Beef cow slaughter through the middle of October is 17.5 percent lower than the same time period last year with many of the most recent weeks being down more than 20 percent compared to the same week a year ago. Additionally, heifer slaughter through the middle of October is 8.4 percent lower compared to the same time period a year ago while steer slaughter has only declined 2.7 percent. Reduced heifer and beef cow slaughter indicate producers are attempting to expand the herd and get one more calf out of those older cows. Heifer retention will support feeder cattle prices in the near term which is positive in terms of risk, but it does not mean much for volatility as many of us are aware.

TECHNICALLY SPEAKING: Based on Thursday’s closing prices, December live cattle closed at $167.32. Support is at $166.28, then $164.38. Resistance is at $168.18 then $170.08. The RSI is 57.29. February live cattle closed at $167.48. Support is at $167.15, then $166.40. Resistance is at $168.40, then $169.20. The RSI is 58.40. April live cattle closed at $166.18. Support is at $165.55, then $165.40. Resistance is at $166.50, then $166.55. The RSI is 58.84. November feeders closed at $234.23. Support is at $232.83, then $230.23. Resistance is at $235.43 then $238.03. The RSI is 51.41. January feeders closed at $228.48. Support is at $227.95, then $227.25. Resistance is at $228.60 then $229.03. The RSI is 51.46. March feeders closed at $226.10. Support is at $225.65, then $225.00. Resistance is at $226.13, then $227.50. The RSI is 49.87. Friday’s closing prices were as follows: Live/fed cattle –December $166.05 -1.28; February $166.10 -1.38; April $165.60 -0.58; Feeder cattle - November $234.15 -0.08; January $228.48 -0.00; March $225.75 -0.35; April $226.00 -0.13; December corn closed at $3.77 up $0.03 from Thursday.