Market Highlights: Beef and Cattle Prices Soften

Cattle and beef trade both softer.

By: Andrew P. Griffith, University of Tennessee

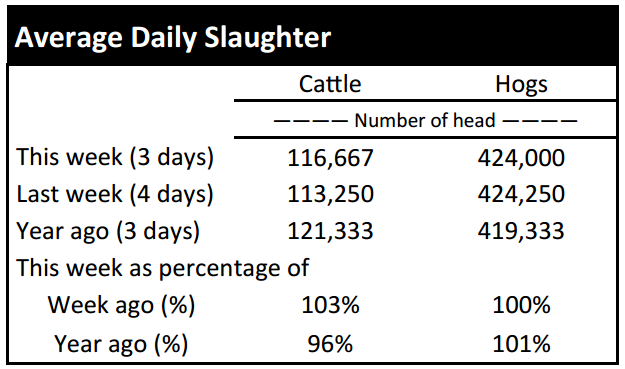

FED CATTLE: Fed cattle trade was not well established at press. However, the market seemed to have a slightly weaker undertone.

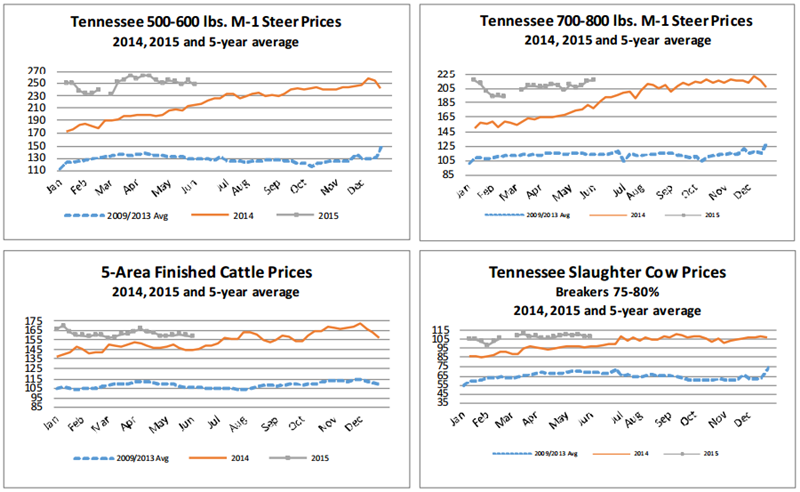

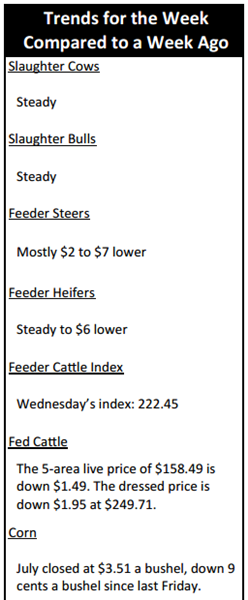

A few cattle had been traded in the $158 to $160 range on a live basis. The 5-area weighted average prices thru Thursday were $158.49 live, down $1.49 from last week and $249.71 dressed, down $1.95 from a week ago. A year ago prices were $144.16 live and $230.76 dressed.

Feedlot managers are confident fed cattle supplies are short enough to warrant a steady to firmer market, but packers have no intention of paying up for cattle when beef prices are softening. Many of the packers are short bought at this time, but they may be willing to wait this one out as they can begin calling on cattle contracted for June next week.

Futures prices are not helping feedlot managers’ cases either as they show signs of softening. The summer generally tends to be a time when fed cattle prices lose some traction and start back pedaling. There is nothing in the market that appears to be able to overcome this seasonal tendency in the current market. Fed cattle prices are expected to slowly decline the next couple of months before finding solid support.

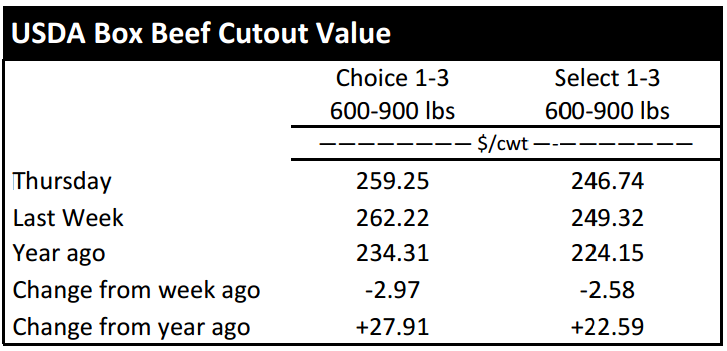

BEEF CUTOUT: At midday Friday, the Choice cutout was $255.11 down $4.14 from Thursday and down $5.69 from last Friday. The Select cutout was $243.57 down $3.17 from Thursday and down $4.43 from last Friday. The Choice Select spread was $11.54 compared to $12.80 a week ago.

Now that Memorial Day has passed and many retailers have restocked the shelves, beef cutout prices have softened. The market is heading into June which is generally the strongest beef demand month of the year. There is currently no expectation for June to result in soft demand relative to previous years.

Consumers are expected to continue purchasing and consuming beef both at home and at restaurants. Speaking of restaurants, the National Restaurant Association recently released its Restaurant Performance Index for April.

The index is a monthly composite index intended to track the health of and outlook for the U.S. restaurant industry. The index came in at 102.7 which is 0.5 percent higher than the previous month. April 2015 marked the 26th consecutive month where the RPI exceeded 100 which indicates expansion in the industry.

Consumer demand for beef is not showing any sign of slowing down which will probably bode well for restaurants, food service providers and beef industry participants.

OUTLOOK: Auction markets across the state continue to experience fairly strong auction receipts as summer quickly approaches. Part of the driver behind sustaining strong cattle receipts week to week is the strong prices that continue to be offered for calves. This is not the case for all feeder cattle however. Many stocker and backgrounding operations are experiencing the benefits of keeping those animals on grass to add a little more weight before marketing.

The Southern Plains is a great example of an area where producers continue to add weight using available forage. Decent to good forage conditions have been nonexistent in the Southern Plains region for several years which required producers there to reevaluate management decisions.

Now that forage conditions are greatly improved due to significant rainfall and in some cases rainfall that resulted in flooding, producers are taking advantage of forage resources and continuing to add weight. As producers defer the sale of these cattle into the later summer months, it is becoming increasingly difficult for feedlot managers to source feeder cattle to fill pen space. Backgrounding operations may be on to something here as the August feeder cattle future price continues to be volatile.

The August contract traded just shy of $225 per hundredweight on Thursday which is nearly a $6 upside swing since last Friday. The August contract daily settlement price since the first of the year has traded from $226 per hundredweight the first week of January to just under $197 in mid to late February which is a $29 range which equates to about $218 per head for a 750 pound steer. In mid to late April, the August contract closed as low as $206.45 and has improved by about $18 per hundredweight since that time.

The current run in the market provides backgrounders the opportunity to use price risk management strategies to secure a relatively strong price and protect against any severe debacle in the feeder cattle market the next two months. This same analysis holds true for contracts through the end of the year. Contract months ranging into 2016 are less advantageous from a seller’s standpoint but could be beneficial from a buyer’s view.

ASK ANDREW, TN THINK TANK: I would like to take this time to thank “Farmer from Northwest Tennessee” for his/her letter and letting me know that part of the state has been wet all spring. I appreciate the insight from this farmer and the willingness to share the information with me since I had shared how dry many parts of the state had been prior to the past 10 days. This letter has spurred me to institute a section where folks can ask me questions or share what is happening in their neck of the woods as it relates to agriculture. Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle –June $152.33 -1.18; August $151.28 -1.48; October $152.93 -1.55; Feeder cattle - August $222.95 -2.00; September $221.68 -1.58; October $220.35 -1.23; November $219.38 -0.90; July corn closed at $3.52 down $0.02 from Thursday.