Market Highlights: Beef and Cattle Prices Drop

Beef and fed cattle prices drop from last week.

By: Andrew P. Griffith, University of Tennessee

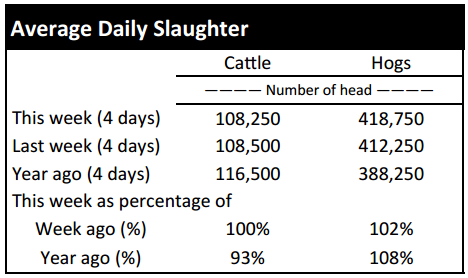

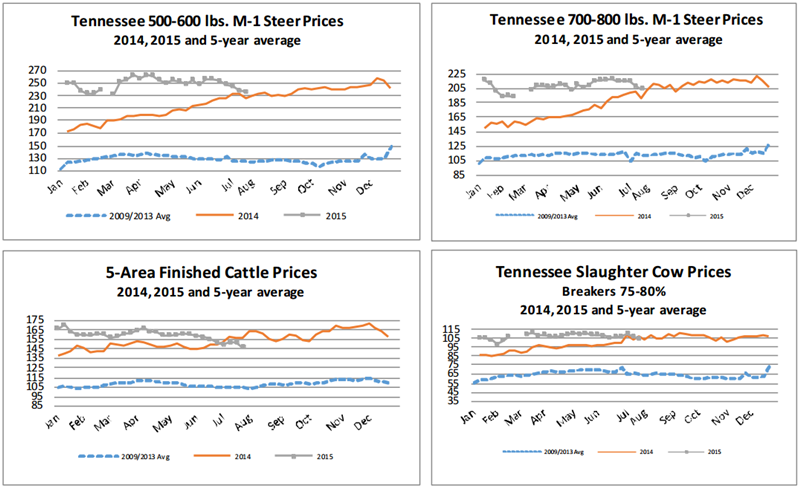

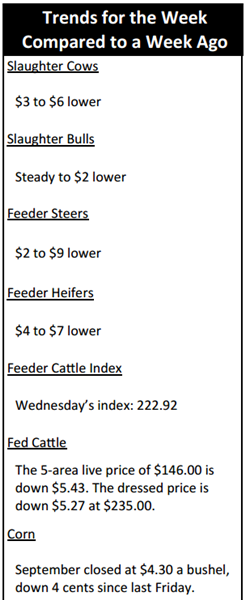

FED CATTLE: Fed cattle traded $2 lower on a live basis compared to a week ago. Live prices were mainly $146 to $148 while dressed trade was mainly $235 to $236. The 5-area weighted average prices thru Thursday were $146.00 live, down $5.43 from last week and $235.00 dressed, down $5.27 from a week ago. A year ago prices were $156.02 live and $246.57 dressed.

Fed cattle prices limped through the week as cash prices continued their downward skid. However, there was a glimmer of hope as fed cattle futures stabilized late in the week. It is doubtful the increase in futures prices will result in a stronger fed cattle market next week, but stronger deferred contracts bode well for feedlot managers trying to manage risk.

This is the fourth consecutive week that prices have been below same week prices one year ago. It is likely this trend will continue considering fed cattle prices made a tremendous run out of the summer and through the end of the year in 2014 and peaked just above $171. Fed cattle prices will continue to be pressured as long as wholesale beef prices struggle.

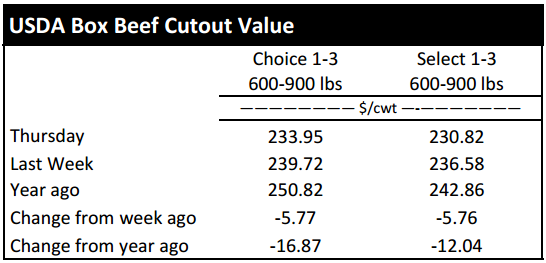

BEEF CUTOUT: At midday Friday, the Choice cutout was $233.31 down $0.64 from Thursday and down $5.72 from last Friday. The Select cutout was $236.04 down $1.14 from Thursday and down $6.36 from last Friday. The Choice Select spread was $3.63 compared to $2.99 a week ago.

The Choice cutout is down nearly $30 from its spring peak in the middle of May. The $30 decline represents an 11.4 percent drop in the price over the past two months. The magnitude of the drop seems rather ferocious to the beef market, but it is actually a very seasonal decline at this point. Considering previous years, the Choice beef price declined 6.7 percent in 2014, 11.9 percent in 2013, and 10.6 percent in both 2012 and 2011.

Thus, what seems to be a tremendous fallout in wholesale beef prices due to the nominal value of the cutout is in actuality a very seasonal price decline to this point in the game. There is nothing that says the Choice and Select cutouts will not continue to decline but at this point concerns over the price decline should remain minimal.

The cutout value is generally supported by steak cuts during the summer grilling season, but the loin primal and the rib primal have faltered and will likely to continue struggling considering retail beef prices and the retail beef price relative to competing meats.

OUTLOOK: The cattle complex is struggling to find a foot hold as the beef market continues to spiral out of control and the fed cattle market, feeder cattle market and the slaughter cow market continue stumbling around.

The cash feeder cattle markets were softer this week and are following feeder cattle futures. It might be advantageous to briefly discuss what has been happening in feeder cattle futures the past several months. Most of the active contracts have a similar pattern but the October futures contract will be used for this example.

The October 2015 contract traded as high as $234.50 on November 18th 2014. The market hit a down trend the first week of December and the market closed as low as $212.10 on December 17th before recovering to close at $224.30 on January 5th. However, the market then reversed back to its downtrend and reached its contract low of $195.28 on February 24th.

Again, the market turned north and closed at $216.93 on March 23rd. By April 20th, the October contract had inched down to $204.98. But, the market regained its composure and the October contract escalated to $222.78 on June 10th. The summer lull of the cattle complex then hit the feeder cattle market which caused the October feeder cattle contract to dip back to a close of $207.75 on July 13. As of July 17th, the October contract was trading in the $212 to $213 region.

The October contract could easily go either direction, as could any of the other contract months. However, the October contract appears to have descent support at the $205 level but also has resistance just above the $217 price level which demonstrates a range for the expected maturing value when the contract closes.

That was all said to demonstrate how quickly prices can turn upside down or right side up. Nothing says this market will stay in the range suggested, but producers with dollars on the table are encouraged to determine an acceptable profit margin and at a minimum set a floor on that margin if not lock it in. Feeder cattle prices will inevitably begin a downward trend over the next few years.

ASK ANDREW, TN THINK TANK: Earlier this week, Jon W. asked me to define the beef cutout and fed cattle price and describe their correlation so readers could better understand how they fit into the feeder cattle market. The boxed beef cutout represents the estimated value of a beef carcass based on prices paid for individual beef items derived from the carcass. In other words, the beef cutout value is a composite value of all the products or items that come from a carcass and those items are weighted by how much of that one item is in the total carcass and the price of each product or item. The cutout value does not include hide and offal products. Fed cattle are steers and heifers generally confined in group pens and fed a high energy diet until slaughter at which time they generally weigh between 1200 and 1400 pounds. Thus, feedlot managers market fed cattle to packing facilities who then turn around and sell wholesale beef products. The packer selling beef can use the composite cutout value to determine its breakeven price when purchasing fed cattle while the feedlot uses the fed cattle price in its determination of how much it can pay for feeder cattle. Feedlots and packing facilities are both margin operators which results in a constant tug of war between the two parties.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle –August $146.83 0.33; October $149.35 -0.08; December $151.55 0.15; Feeder cattle - August $214.95 0.48; September $213.50 1.03; October $211.73 1.45; November $209.98 1.33; September corn closed at $4.20 down $0.10 from Thursday.