Hindsight 2020: Retail and Foodservice Trends Through the Pandemic

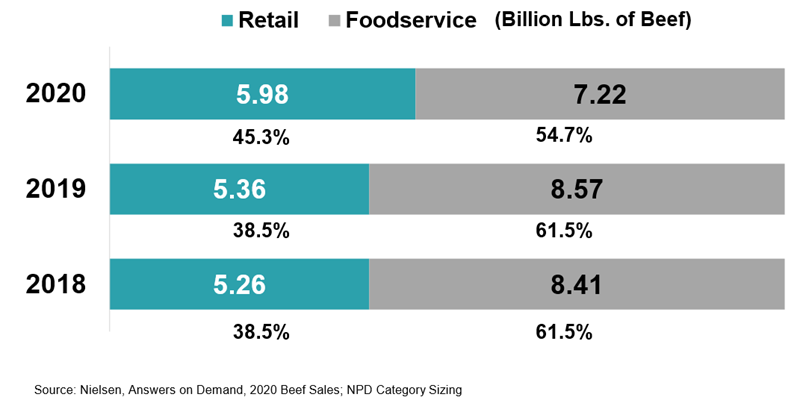

A year into one of the largest disruptions of the global and U.S. economies, some industries and market sectors are continuing to feel the severe impacts of COVID-19. One of the largest industries in the U.S. to continue struggling due to the impact of COVID-19, the foodservice industry, comprises the majority of consumer beef demand in the United States on an annual basis. About 60% of annual beef demand is consumed at restaurants, schools, entertainment venues, and other non-retail locations1; this past year, grocery stores experienced a demand shock from increased shopper activity and temporary supply deficits. While the increased demand and the impacts of COVID-19 temporarily led to supply constraints during the summer, the retail industry rebounded well for the remaining months of 2020.

A major change in consumer behavior that affected the retail industry was the “stocking-up” behavior experienced at the beginning of the pandemic. Shoppers rushed to their grocery stores to buy surplus groceries, especially meat products. Even as late as September of last year, 50% of consumers surveyed reported to be “stocking-up” at a greater rate than normal.[i] With this behavior, and with the foodservice industry restricted or shutdown, 83% of consumer meals were being cooked and consumed at home.2 Ground beef was one of the main products to be stored in refrigerators and freezers, with over 50% of consumers reporting to have surplus ground beef products.2

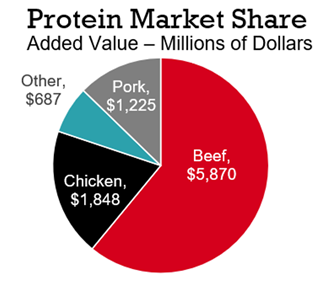

Due to the various impacts of COVID-19 leading to increased demand, the retail meat department had a tremendous year: all fresh meat sales increased by 19%, from $49.5 billion in 2019 to $59.1 billion this past year, adding $9.6 billion in added value.3 Beef sold $31.9 billion dollars in 2020, adding $5.9 billion in additional value while increasing volume sales by 606 million pounds to bring total sales to 5.98 billion pounds.3 This added value translates to a 61% share of the total increased value of the meat department.3 Ground beef was responsible for 34% of beef’s increased value, or an additional $2.02 billion in sales.3 Other proteins experienced volume and value growth just not to the level of beef; chicken added $1.8 billion in additional annual value on 501 million pounds of extra volume sales, while pork elevated its annual volume sales by 245 million pounds, adding $1.2 billion in total revenue for 2020.3 The elevated sales not only came from the demand increase, but also due to some price inflation that was experienced in 2020, mostly as a result of supply chain disruptions in meat production. Average retail price per pound for beef products increased 10% from $4.85 in 2019 to $5.34 for 2020.3 While these supply chain disruptions impacted revenues in a positive manner at the retail level, the foodservice industry had the opposite impact.

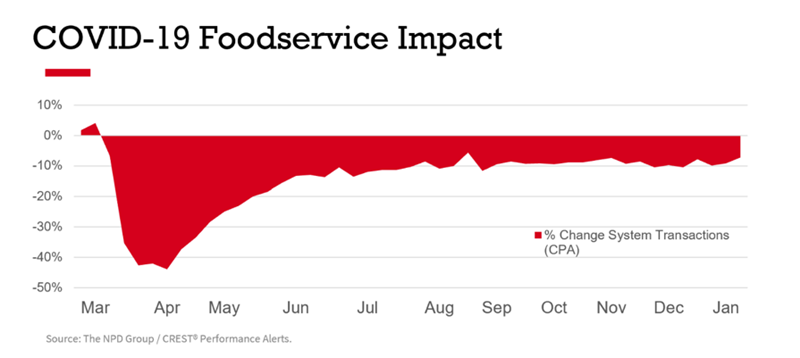

The foodservice industry has faced the largest disruption of operations in modern history the past year. Due to a combination of low consumer comfort and government-mandated restrictions on in-person dining, year over year transactions and sales in restaurants declined 11% in 2020.4 The full-service restaurant (FSR) foodservice segment, which are restaurants where customers are generally waited on, experienced the largest disruptions in activities. As a result, volume of various proteins was impacted greatly. Total foodservice volume for meat purchases totaled 27.7 billion pounds.5 Comparing last year totals to the prior year, volume sales dropped by 5.6 billion pounds.5 Examining the market for specific proteins, beef sold 1.3 billion fewer pounds, totaling 7.2 billion pounds for 2020.5 Compared to competing proteins, beef’s performance and COVID-19 impact was relatively comparable in terms of year over year decline rates. Beef volume sales declined by 16% in pounds; chicken volume was reduced by 13% to 12.3 billion pounds.5 Pork struggled significantly more than beef or chicken, as the former two proteins are a significant portion of the Quick-Service industry, which performed better than the Full-Service industry through the pandemic. Pounds of pork sold to distributors were reduced by 22% to 3.1 billion pounds.5 Not only did the amount of meat and beef demanded at the foodservice level shift during the pandemic, the way that consumers, distributors, and restaurants interacted with each other changed dramatically.

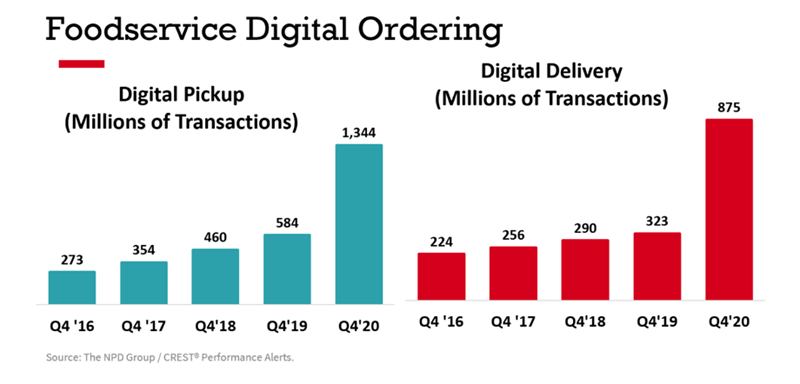

Throughout 2020, only 27% of consumers reported that they felt comfortable eating inside a restaurant, and only 43% of shoppers felt confident going inside a store.6 This sentiment shift precipitated a wide variety of changes and behavioral adoptions in these channels, including an uptick in the prevalence of e-commerce and online grocery shopping, increased levels of food delivery, and a shift away from indoor dining. Online grocery ordering, which has already been on a positive trend, had help this year speeding up adoption with total store growth hitting nearly 60% for ecommerce. According to IRI, meat was a big part of that growth, which increased over 100% year over year. In fact, from March through August, online meat sales exceeded 900 million dollars, nearly half of which featured beef, according to NielsenIQ. The primary experience consumers are choosing for online grocery shopping is click and collect through brick-and-mortar stores. As for the restaurants and the foodservice industry from 2019 to 2020, the amount of food ordered digitally increased 111%, and comprised roughly 13% of all food orders placed in the fourth quarter of last year.4 While this technology was growing in popularity since before 2016, the pandemic forced some businesses to adopt digital-ordering platforms quickly. Other structural impacts to the foodservice industry include the amount of people dining-in versus “to-go”, orders for delivery, and drive-thru. According to NPD, in the fourth quarter of 2020, carry out orders increased by 363 million transactions, while delivery and drive-thru transactions increased by 660 million and 927 million, respectively. These technologies and trends will likely remain a popular feature in the foodservice industry in the future.

Although the foodservice industry, beef’s usual majority volume market, has experienced a significant reduction in activity over the past year, per capita consumption of beef is forecasted to increase 0.4 pounds to 58.5 pounds per person.7 This shows that although the beef and protein industry experienced disruptions in normal business operations, consumers still demand high quality beef in their diets. Looking forward to the future retail and foodservice environments, as the U.S. population begins to get more comfortable and a greater number of people receive vaccinations, expect foodservice activity to slowly return closer to “normal” levels. Until then, expect consumers to continue to prepare a large percentage of their meals at home, looking for those convenient and versatile options that beef is helping satisfy during this turbulent time.

1. NielsenIQ, Answers on Demand, 2020 Beef Sales; NPD Category Sizing

2. NCBA, Beef Behaviors and COVID Report, April-September 2020

3. NielsenIQ, Answers on Demand, 2020 Protein Sales

4. NPD, YE Dec’20 CREST Topline

5. NPD Category Sizing

6. NCBA, State of the Consumer Report, Fall 2020

7. CattleFax, Per Capita Beef Consumption Forecast