CAB Insider: Will Quality Premiums Continue Higher?

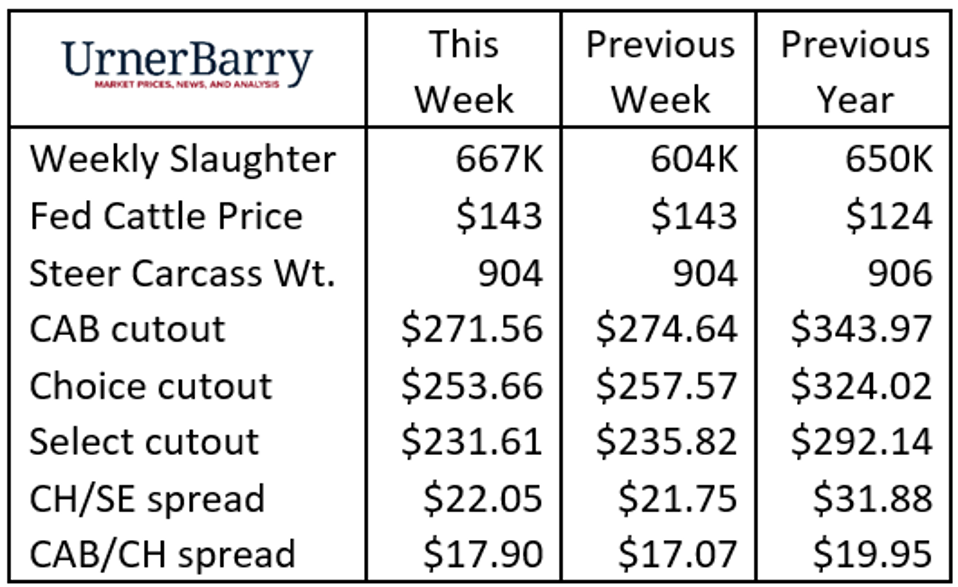

Federally inspected steer and heifer slaughter has picked up a brisk pace since the conclusion of Labor Day. In the past two weeks, the weekday head counts have averaged 5,300 head (5.3%) more per day than the same period a year ago. As well, a week ago Saturday featured a 77,000 head total in an effort by packers to replenish the supply chain during a holiday-shortened week.

Carcass weights have mirrored 2021 trends since May with last week’s steer weights unchanged on the week prior at 904 lb. The latest heifer weights are 84 lb. lighter than steers at 820 lb. each.

The fed cattle market has been steady for three weeks in a tight range around $143/cwt. Price variation from north to south in the cattle feeding belt has narrowed since July/August. The range in both regions can be boiled down to roughly a $5/cwt. range with most of the market consolidated once again. This occurred despite the failure of northern packers to see premium beef grading trends return to the lofty levels of the past two years.

Prices have fallen quickly over the past two weeks on the boxed beef side of the business. The Choice cutout is down $8/cwt. in that period with this week’s early quotes down to $252/cwt. The CAB cutout value, reported last Thursday, was down more than $4/cwt. in a two-week trend. The seasonal expectation is for continued lower prices into the early part of October in the spot market before fourth quarter demand begins to stare retailers in the face. Prudent protein buyers are making out-front purchases now given the opportunity to procure product at lower prices today for 21- up to 90-day delivery periods.

Breaking down the CAB carcass cutout in last week’s pricing report, the 0x1 strip loin jumps out with major price reductions in the past month. Strips set an all-time high wholesale price in August at $9.43/lb. but dipped to $7.65/lb. in last week’s report. Given the high-flying price point strip loins notched in July and August the price reduction was justified, bringing the quote within the 2019 and 2020 price range in the mid-September timeline.

CAB ground chuck and round items, on the other hand, worked slightly higher in price last week in reaction to both slightly smaller supplies of brand-qualified carcasses as well as consumers trading down to grinds in the beef offering.

Will Quality Premiums Continue Higher?

Late fall holiday demand heats up the cattle market, and that’s when high-quality carcasses get extra bragging rights.

Demand alone doesn’t spur prices higher, there must be a degree of supply constraint to get dollar values moving. That’s the part of the high-quality market equation that is generating some uneasiness as USDA quality grade trends disappoint. Our brand standards rely heavily on Premium Choice and Prime quality grade product, and 2020 data shows that over 80% of carcasses fail to meet our requirements due to insufficient marbling.

In the past 15 years, beef demand has improved dramatically, built on revolutionary carcass quality improvement. I mean "quality grade," specifically, and that has allowed our brand to use science-based specifications to successfully build a following. It’s easy to forget that today’s Premium Choice and Prime beef production volume is monumentally larger than it was in 2006 when just 14% of Angus-type carcasses met CAB specifications. That pales in comparison to our latest annual average of 36%. But even small drops from record-high production volumes create supply concerns among grocers and restaurant partners in today’s demand-driven environment.

This brings a focus on carcass quality premium trends in the rapidly approaching fourth quarter. While we expect seasonal quality grade improvement in October there’s no guarantee this develops sufficiently to meet market demand. The total USDA Choice category recently slipped to 71.3% of fed cattle carcasses, down 1 percentage point from a year ago. This is relatively minor compared to the USDA Prime and CAB brand declines versus the past two years. In early September, CAB carcass certification was 31.9% compared to 34.7% a year ago. That decreased the brand’s weekly carcass supply by 7.5% in the recent four-week period.

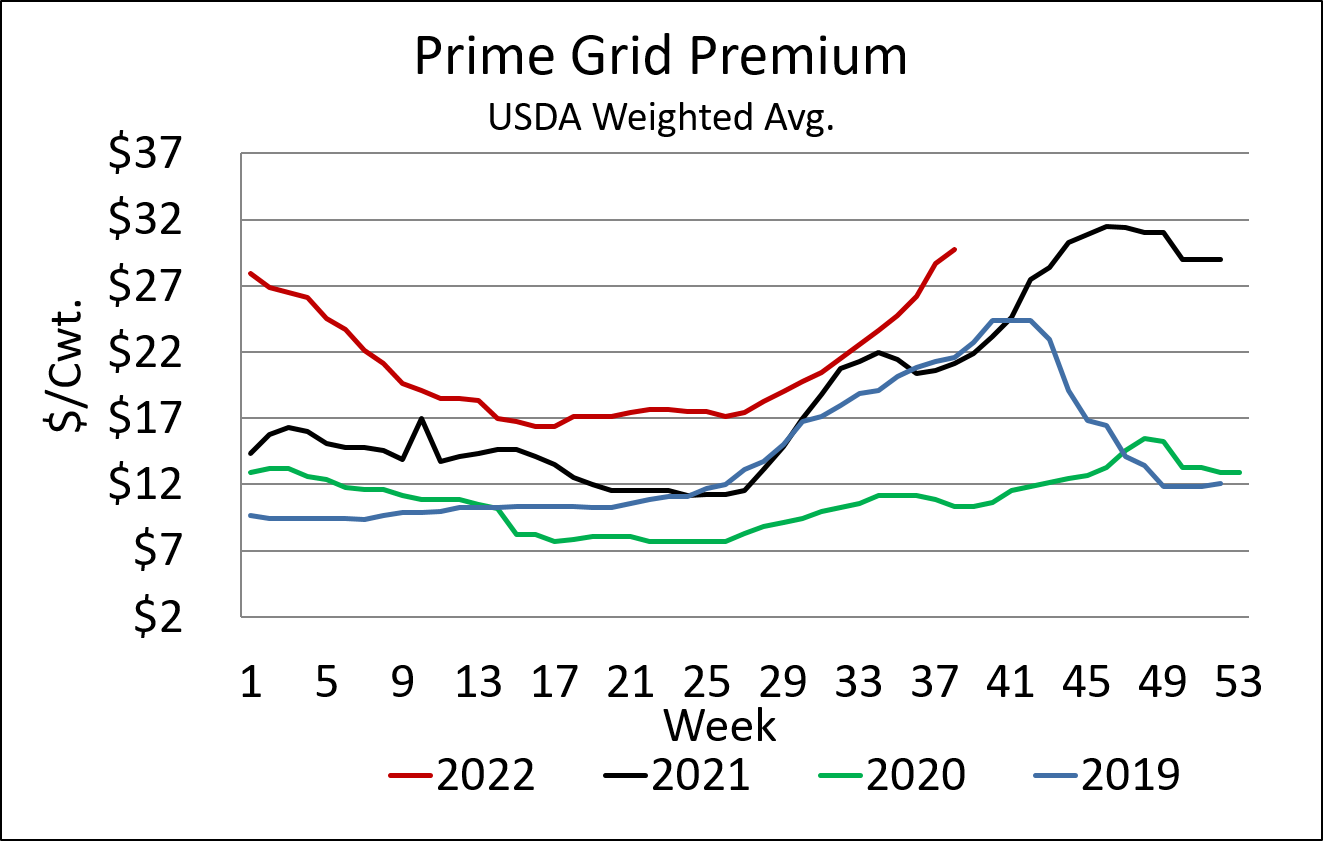

Both CAB and Prime (including CAB Prime) carcass production volumes remain the third largest on record in recent weeks. Yet, the Prime cutout and derivative Prime grid premiums suggest early fall supply/demand imbalance. The news for cattlemen is that the Prime grid premium, which typically peaks in the fourth quarter, is out of the gate early this year. The current $29/cwt. Prime carcass premium is $8/cwt. higher than a year ago and $19/cwt. higher than this time in 2021. There is plenty of runway ahead for further advancements in the Prime premium as demand for highly marbled middle meats heats up in the next two months.

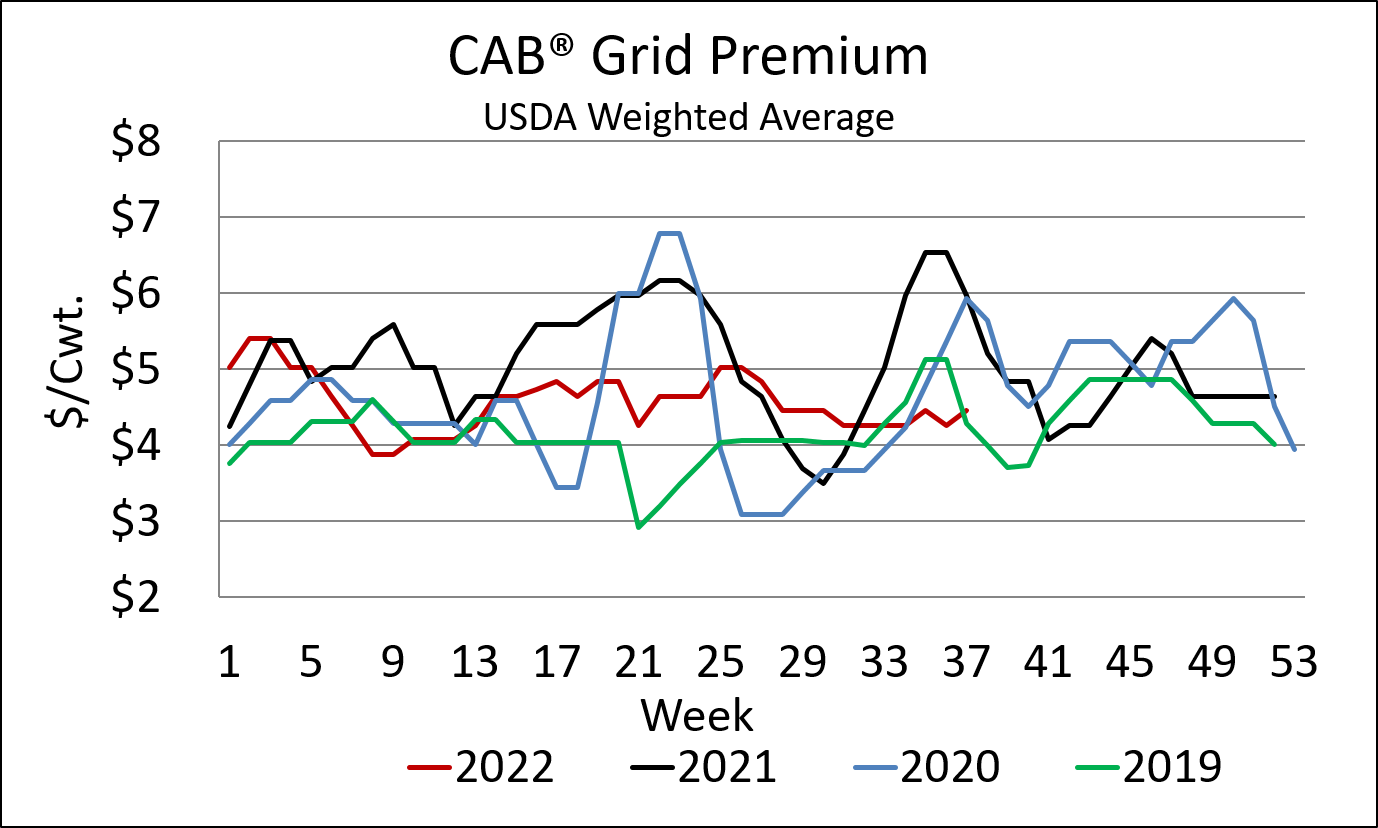

The latest CAB grid premiums have not yet adjusted higher in response to the supply void. This week’s $4.64/cwt. price is $0.57/cwt. cheaper than a year ago and a full $1/cwt. lower than this week two years ago. Granted, the CAB premium range typically sees annual highs of $12/cwt. on some grids, but this week’s high reported by packers was $8/cwt.

With a $23/cwt. Choice-Select spread the net premium to feedyards on each CAB carcass is averaging near $11.50/cwt. over the commodity fed cattle price on a carcass weight basis. That’s an even $100 per head at the recent 870 lb. average carcass weight. Not bad, but increased input costs have feeders potentially weighing input costs and efficiency improvements against quality premiums.