Market Highlights: Little Movement for Cattle Futures

By: Andrew P. Griffith, University of Tennessee

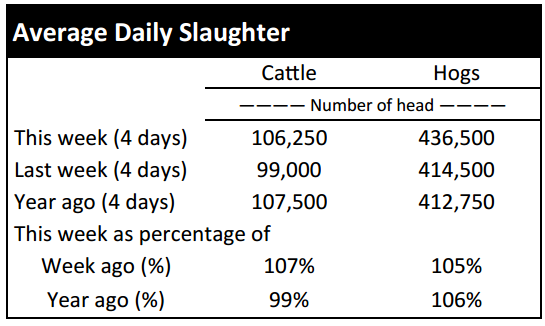

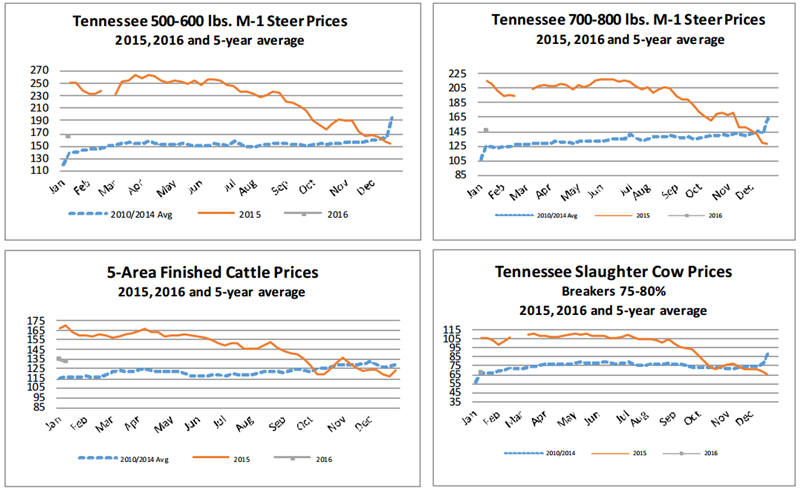

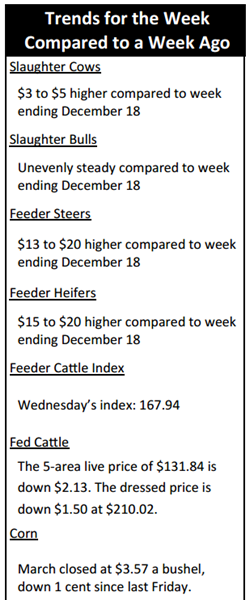

FED CATTLE: Fed cattle traded steady to $2 lower compared to a week ago. Live cattle trade was mainly $130 to $133 while dressed trade primarily ranged from $209 to $212. The 5-area weighted average prices thru Thursday were $131.84 live, down $2.13 from last week and $210.02 dressed, down $1.50 from a week ago. A year ago prices were $169.88 live and $270.62 dressed.

Finished cattle prices softened this week which may have cattle feeders asking why they are not receiving some of the price improvement in wholesale beef prices. One thing is for sure, cattle feeders are better off with the prices they received this week than the prices being received in the middle of December.

Feedlot managers continued instituting higher ask prices this week as live cattle futures stagnated the majority of the week. However, this strategy may have been their undoing as futures closed down the limit on Thursday and were softer on Friday. It may be difficult the next few weeks for feedlot managers to push for higher prices as beef cutout prices could falter.

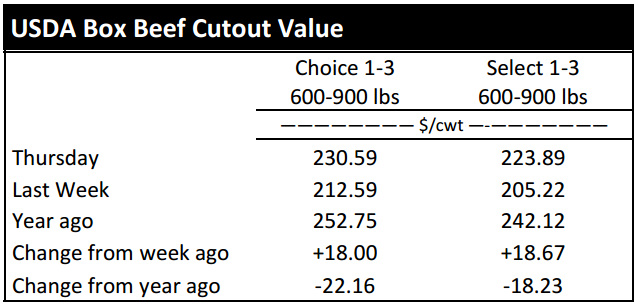

BEEF CUTOUT: At midday Friday, the Choice cutout was $231.23 up $0.64 from Thursday and up $20.40 from last Thursday. The Select cutout was $224.59 up $0.70 from Thursday and up $21.46 from last Thursday. The Choice Select spread was $6.64 compared to $7.70 a week ago. The Choice cutout price has increased nearly $37 in three weeks while the Select cutout has increased nearly $38 over the same time period.

Wholesale beef prices have not seemed to be hindered by negative information from international markets. It also did not hurt the market to find out beef exports finally picked up in November while imports declined significantly. Both of these aspects are supporting wholesale beef prices.

The drivers of the price increase are primarily the end meats. The chuck and round primal values are up 34.0 and 33.3 percent respectively over the past three weeks while brisket and flank prices are 40.3 and 27.6 percent higher than three weeks ago respectively. The short plate (14.7%) and loin (12.9%) have both experienced modest gains as well.

Alternatively, the rib primal price has declined 7.0 percent and seems to be the only drag on the market. It seems unusual for beef prices to make an early January price run of this magnitude especially considering international markets and the uncertainty of consumers and beef purchasing.

OUTLOOK: Tennessee weekly auction markets were back in business this week after a two week layoff for Christmas and the New Year holiday. Both calf and feeder cattle prices were much stronger than the week ending December 18th. In fact, steer prices were $13 to $20 higher while heifer prices were $15 to $20 higher. In most instances, calves and feeder cattle were worth $100 more per head than the last trading week of 2015. This move was largely expected as feeder cattle futures finished 2015 with a strong positive price movement.

Since the turn of the calendar, feeder cattle futures have been mainly trading sideways except for Thursday when the market moved the limit lower.

Many analysts would say the limit lower move on Thursday was due to weakness in the Chinese economy and the decline of the Chinese stock market. However, feeder cattle futures traded on both sides of even on Friday which means many traders are not yet willing to say that feeder cattle are overpriced or that demand for beef is slacking at current price levels.

The Chinese government did support the stock market on Friday to boost confidence among consumers and traders. The move seems to have worked considering U.S. stock market indices turned around from Thursday’s losses to starting Friday with higher marks. Global situations may not matter to everyone, but they do matter to commodity markets and those trading commodities which then impacts the beef industry.

The expectation from a fundamentals standpoint would have feeder cattle trading steady the next several weeks while calf prices will find additional support in March. There is no guarantee in relation to what prices will do, but producers are encouraged to lay off risk if it is deemed necessary.

Slaughter cow prices also made a small price improvement with gains of $3 to $5. Slaughter cow prices are expected to be supported through the winter and early spring especially due to the expectation of reduced imports of lean beef from Australia.

ASK ANDREW, TN THINK TANK: Female prices from some local heifer sales have been rather strong the past couple of months relative to the magnitude of calf prices with cow-calf pairs bringing $3,000 and bred heifers fetching close to $2,800. These price levels appear to be high relative to current calf and feeder cattle prices, but it does not mean a producer will not or cannot profit from the animal. Producers paying these prices are investing in some high quality cattle, but it is important for those producers to evaluate how to maximize the value of the animal. The answer could be to have the cow in the herd for ten years or to sell her at four years when she still has a lot of productive life left and can recover a higher salvage value.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle –February $132.83 -0.70; April $133.75 -0.55; June $124.03 -0.75; Feeder cattle - January $159.23 -4.60; March $156.60 -4.35; April $156.83 -4.00; May $156.45 -3.75; March corn closed at $3.57 up $0.04 from Thursday.