Market Highlights: Has Cattle Futures Market Found its Bottom?

By: Andrew P. Griffith, University of Tennessee

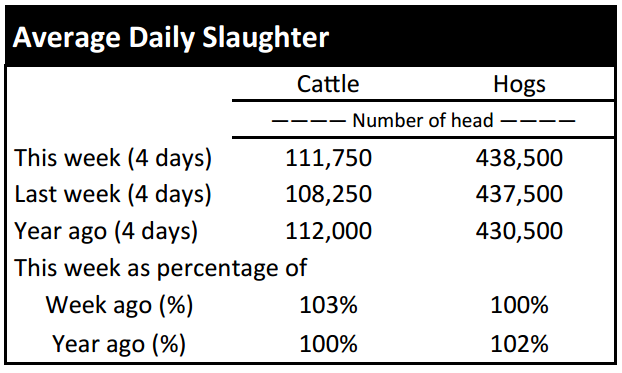

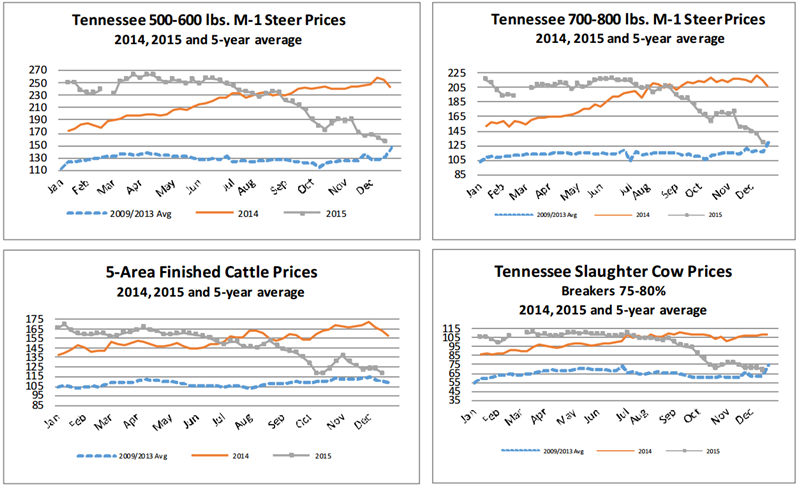

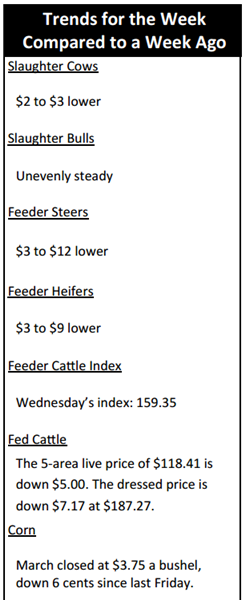

FED CATTLE: Fed cattle traded $5 to $6 lower on a live basis compared to a week ago. Live cattle trade was mainly $117 to $119 while dressed trade primarily ranged from $187 to $188. The 5-area weighted average prices thru Thursday were $118.41 live, down $5.00 from last week and $187.27 dressed, down $7.13 from a week ago. A year ago prices were $163.11 live and $256.55 dressed.

Feedlots continue to lose big money on cattle being currently marketed. The losses are due to the buy-sell margin which has been tormenting feeders for several months now. The futures market is showing signs of finding a bottom but nothing is guaranteed. Cattle feeders will continue to weather the storm that has resulted in losses exceeding $500 per head in hopes that cattle that are being placed at much lower prices in the near term result in profits in the spring and summer of 2016.

The one positive for cattle feeders is that feed prices are relatively low and will remain low for at least the next six or seven months. With prices dipping to current levels, the risk of significantly lower prices is very small.

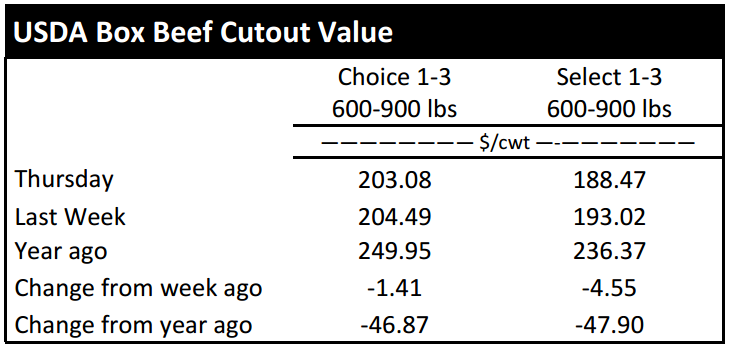

BEEF CUTOUT: At midday Friday, the Choice cutout was $203.37 down $0.03 from Thursday and down $0.32 from last Friday. The Select cutout was $188.45 down $0.02 from Thursday and down $4.17 from last Friday. The Choice Select spread was $14.60 compared to $10.75 a week ago.

The Choice cutout price was fairly flat relative to last week resulting is a steady price. The Select cutout was not as fortunate as some additional weakness was evident. The weakness in Select cuts is not surprising for the time of year as retailers and consumers are looking to secure Choice middle meats for holiday gatherings. The softer Select prices have resulted in a widening of the Choice Select spread.

Packers would rather see the Choice price strengthening to achieve the widening spread, but packers may just have to be satisfied with a steady price. Seasonal weakness is expected to dominate beef markets in January and February which will tighten margins for packers.

The Choice Select spread will begin to narrow after Christmas and it is likely most of the narrowing will be due to lower Choice prices as opposed to a strengthening Select market. The wholesale beef market will continue to face competition from relatively low pork and poultry prices, but its biggest competition is itself as retail prices remain elevated.

OUTLOOK: Since the Thanksgiving holiday, there have been eleven trading days for the futures market. Of those eleven trading days, January feeder cattle futures have closed lower eight days with a market that is more than $15 per hundredweight lower than the Friday following Thanksgiving. There was some hope on Thursday that prices were going to turn around as most feeder cattle contracts jumped more than $2, but the follow through was not evident on Friday.

Even though prices have continued to spiral into the deep abyss, both fundamental and technical analysis would suggest an imminent price improvement. This is good news for sellers, but not as good for those trying to secure inventory.

If cattle need to be purchased in the next several months then it may be beneficial for producers to use the futures market to purchase those cattle today, or the producer could purchase a call option to secure a price for those cattle. However, the options market does not appear an advantageous route due to the cost of options.

From a seller’s standpoint, there would not appear to be much to do at this point. The anticipation is that prices will begin improving and the cash price will likely see its largest gains after the first of the year.

There has been tremendous volatility in the cattle markets for more than a year, but volatility does not result in catastrophic losses. What does result in catastrophic losses is not reevaluating the marketing plan when prices are trending down. Moreover, those losses are increased when the marketing plan is nonexistent.

Similar to futures prices, cash prices for feeder cattle and calves continue to decline. The total value of steers has declined more than $550 per head compared to the record price. Such a decline can turn once profitable cattle herds into what may seem like a bottomless pit for losses. However, producers should still be able to be profitable at current price levels as cost of production has remained fairly stable the past couple of years. In order to achieve more profits, producers should take a look at cost of production to cut out waste.

ASK ANDREW, TN THINK TANK: Questions concerning the price of bred heifers continue to pour in. What determines the value of breeding stock? Several production characteristics such as the quality of the heifer, breed, breed of offspring, commercial or registered, and several other factors determine the value of one heifer relative to another heifer. However, that is not what drives the heifer market. Current and expected price of calves is what drive the market. Additionally, the same bred heifer may have two different values across producers. A producer with lower cost of production can afford to pay more for the heifer than someone with higher cost of production. Similarly, a producer intending to harvest embryos from a female would likely place a higher value on the animal than a producer with intentions of breeding the animal.

Please send questions and comments to agriff14@utk.edu or send a letter to Andrew P. Griffith, University of Tennessee, 314B Morgan Hall, 2621 Morgan Circle, Knoxville, TN 37996.

FRIDAY’S FUTURES MARKET CLOSING PRICES: Friday’s closing prices were as follows: Live/fed cattle – December $121.15 -0.40; February $125.95 -0.58; April $127.15 -0.50; Feeder cattle - January $151.50 -1.55; March $149.88 -0.98; April $150.70 -1.45; May $151.53 -1.65; December corn closed at $3.73 down $0.04 from Thursday.