How to Lock in Calf Prices

Find out about creating a price floor by locking in calf prices and using Livestock Risk Protection as a risk management strategy.

By: Shannon Sand, SDSU Extension

For years, cattle producers used the commodities market as a way to hedge and create a price floor for their cattle. For example, suppose a cow-calf producer has 100 head of calves they plan on feeding, knows their breakeven price is $215/cwt, and knows the calves will weigh between 500-600 lbs. when marketed. Using the commodities market, that producer can purchase a hedge to create a price floor for their cattle. This used to be the only option available to producers. However, a hedge necessitates the purchase of at least one contract, which requires the sale or delivery of 50,000 lbs. Hedging in the commodity market is a good option for producers who know they will be able to deliver at least 50,000 lbs. to market. However, it might not be helpful to smaller producers or those who are uncomfortable with the possible fluctuations in the commodity market.

For those uncomfortable with market fluctuations, smaller producers, or producers looking to diversify their risk management strategy, Livestock Risk Protection (or LRP) may be a good option. LRP is a form of insurance used to insure anywhere from 1-2,000 head of cattle. One advantage of LRP over traditional commodity hedging is there are more categories available, thus allowing producers to pick something more specific for them. For example, a cow-calf producer in South Dakota is not necessarily going to purchase the same kind of coverage that a producer in Texas who owns feeder cattle might. Any producer can find their state’s current LRP prices from the Risk Management Agency (or RMA), a branch of USDA. LRP can be purchased through insurance agents, as well as many banks.

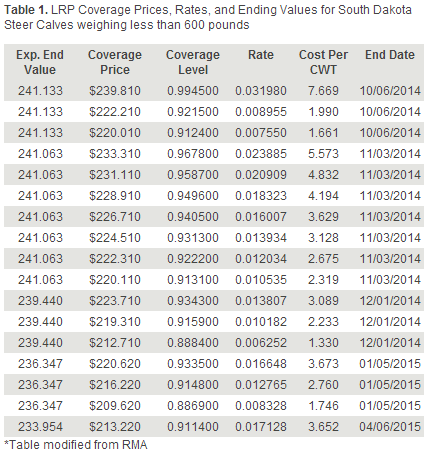

Looking at Table 1, producers can decide what level of coverage they want for their cattle. Table 1 shows the state (South Dakota) variables for the LRP program. The table also shows the commodity and the type (in this case, it is feeder cattle-- specifically steers under 600 lbs.). The table also displays the crop year, the expected ending value, the coverage price, coverage level, rate, and cost per hundred weight, as well as the end date of the policy.

To look up the LRP rates for your state and livestock, visit the RMA Livestock Reports website.

Continuing with our earlier example of calves weighing between 500-600 lbs. (average weight of 550 lbs.) when they go to market and assuming the producer markets them on December 1 of 2014, the producer knows $215/cwt. (LRP premiums are calculated into the breakeven price) is the breakeven price. Therefore, the producer has several ways to choose their coverage level (see Table 1). In this case the producer needs a coverage level of 91.6% which means if the price dropped below $239.44/ cwt. at market, they would be entitled to a payment of $219.10/ cwt. For the producer to obtain this level of coverage would cost $2.23/ cwt. or $13.38 per head (if the estimated average weight is 550 lbs. round up to 600 lbs.).

For example, if the producer takes, calves averaging 625 lbs. to market and they bring $210/cwt., the producer will receive a payout of an additional $9.10/cwt. on 100 head at 600 lbs./per head (or an additional $5,460). This additional income allows the producer to have a price of $218.736/cwti. While this does meet the producer’s minimum required breakeven, it demonstrates the importance for producers to be as accurate as possible when estimating calves’ market weight. LRP is an insurance tool which helps create a price floor for producers and can provide additional options for those producers interested in limiting their risk. For many producers LRP can be an excellent tool to manage risk. It is a very affordable option, allows producers to pick their desired level of coverage, and creates a price floor, increasing the producer’s ability to meet their breakeven requirements.

More Information

For additional information about Livestock Risk Protection (LRP) insurance, view the following iGrow publications: