Speer: Why Those Day-old Calves are So Valuable

Review: Last week’s column covered the topic of beef-on-dairy (BXD) calves. The discussion approached the cost of day-old calves. But not from a dairy perspective, rather from the perspective of a commercial beef operation. That is, what does it cost cow/calf producers to produce a day-old calf? The parallel to the dairy day-old market is remarkable.

DMC: Let’s now turn to the broader significance of those BXD calves to the dairy – primarily from the standpoint of dairy margin insurance. What’s the day-old BXD calf mean within the context of the Dairy Margin Coverage (DMC) program? It’s initially somewhat counter-intuitive. However, given the current profitability challenges in the dairy sector, the value of those calves becomes increasingly important.

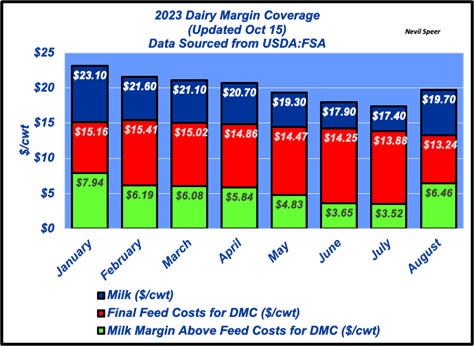

For those not familiar with the program, DMC fills the gap when milk margin (income less feed costs) as calculated by USDA falls below the selected coverage level. For instance, if USDA’s margin number is $7/cwt in a given month, and the coverage level is $8/cwt, the dairy would receive a $1/cwt payout (see graph below). Payout is also based on the dairy’s historical production record and corresponding coverage selection (5% to 95%).

Premiums: The DMC program provides two levels of basic coverage: Tier 1 (catastrophic coverage for production history of 5M lb annually or less), and Tier 2 (covering production over 5M lb). The respective premiums differ within each Tier and margin level. Like any insurance, more coverage equals higher premiums.

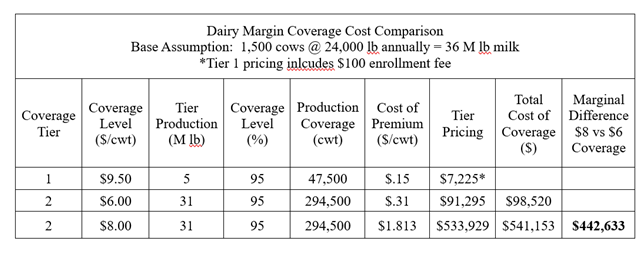

With that background, let’s work through an example. The base case being a 1500 cow dairy averaging 24,000 lb of milk per cow. That totals to 36M lb annually – or 3M lb monthly. We’ll work through two separate cases of margin protection ($6 and $8). For more on details on calculations see Dr. Andrew Griffith’s (Univ of Tennessee) Dairy Margin Coverage calculator.

Tier 1

- The program’s foundation is Tier 1 coverage for the first 5M lb of production. Assume the dairy selects the maximum margin option ($9.50/cwt) and production quantity (95%). The premium calculation would be as follows:

5M lb or 50,000 cwt @ 95% @ $.150/cwt = $7,125 (+ $100 initial enrollment fee) = $7,225

Tier 2

- $8: Next we’ll calculate the Tier 2 coverage (for the remaining 31M lb of production). The dairy prices the $8 margin option and maintains maximum production coverage (95%). The premium cost would be as follows:

31M lb or 310,000 cwt @ 95% @ $1.813/cwt = $533,929

Tier 2 @ $8/cwt Total Premium: Tier 1 $7,225 + Tier 2 $533,929 = $541,154

As a side note, $8 might seem extreme; however, in 2023 that coverage level would have provided payoff every month thus far (through August). (see graph below)

- $6: To explore some other options, let’s calculate the Tier 2 coverage at the $6/cwt margin level instead of the $8/cwt option detailed above. The premium cost would be:

31M lb or 310,000 cwt @ 95% @ .31/cwt = $91,295

Tier 2 @ $6/cwt Total Premium: Tier 1 $7,225 + Tier 2 $91,295 = $98,520

Again, more coverage means more premium; the cost difference between $6 and $8 DMC is approximately $445,000. (see table below)

Day-Old Calves: Back to the day-old BXD calf. Assume also the 1500-cow dairy commits 1/3 of its best cows (n=500) to creating replacement heifers, the other 2/3 (n=1000) will be bred to beef sires. And we’ll assume a 95% success rate to sell as day-olds – thus, 950 calves over the course of a year. Finally, let’s put a value on those calves of $625. That ultimately nets the dairy $593,750 annually in day-old BXD calf sales (950 calves @ $625/calf).

Milk: Last, let’s convert those sales to a milk equivalent. Remember, we’re primarily interested in margin protection and the premium difference among the Tier 2 options. The coverage applies to 95% of 31M lb of milk or 294,500 cwt. To that end, the calf sales (~$595,000) equates to $2+/cwt across nearly 295,000 cwt of milk.

BXD calf sales effectively represent a $2/cwt margin buffer independent of market conditions. The dairy is now able to opt for the $6/cwt DMC (versus the more expensive $8 option). Alternatively, the calf revenue also enables the dairy to purchase the higher level of coverage if so desired independent of milk revenue. In other words, calf sales facilitate an important source of working capital and provide the dairy options that wouldn’t be available otherwise.

Beef AND Dairy: Real dollars are incentivizing the dairy to get it right on the beef side. Calf sales not only represent a complementary source of revenue but double-up as a meaningful source of market risk mitigation. All this underscores the reality that dairy cows are now on double duty. The business is beef and dairy, both.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.