Speer: Producers Have the Whip Hand

October: Several insights evolved out of USDA’s regular reports in October that were especially telling about where the business is headed for the next several years. The first being the agency’s weekly slaughter reports. The second was USDA’s cattle-on-feed survey – most notably, the quarterly assessment contained in the October print. Let’s dive in.

Beef Cow Slaughter: Each Thursday USDA releases actual slaughter numbers under federal inspection (the data being delayed two weeks). Significant to this discussion, the report includes breakout of weekly slaughter totals by class – including “Dairy Cows” and “Other Cows” (i.e. beef cows).

At the outset of the fall run the primary question that existed around cow slaughter was whether producers had pulled cows ahead - that is, high cull prices advanced the decision to cull earlier in the year versus waiting until fall. If that were the case, liquidation might begin to lag. The answer to that question, based on the first three weeks of October is definitive. “No.”

During that time, beef cow slaughter has totaled ~221,100 head – equivalent to ~73,700 head/week (Monday-thru-Saturday). If we extrapolate that pace out to the final full week of business (thru October 28) plus add Monday and Tuesday (Oct 30 and 31) business at 15,000 head/day, the month’s total will be ~325,000 head.

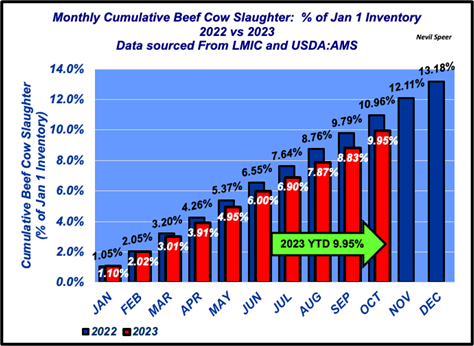

Context: That monthly total represents ~1.12% of the 2023 starting inventory. Moreover, it’s the third highest October pace since 2000 (behind only last year and 2011). Given that pattern, it appears there are plenty of trips to the sale barn that remain.

Most important, year-to-date slaughter totals 9.95% of the Jan 1 inventory (see first graph).

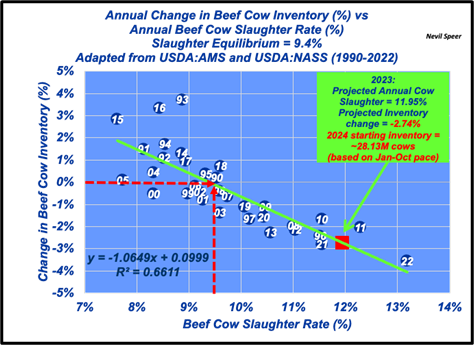

Assuming the pace doesn’t change dramatically, this year’s total liquidation will run roughly 11.95% of starting inventory (3.45 M head). Based on previous years’ data, that translates to the cowherd shrinking ~2.75% - putting next year’s starting number somewhere in the range of 28.1-to-28.2M head (see second graph).

Heifers on Feed: Switching gears, the October cattle-on-feed report was especially significant from several perspectives. Most notably, placements were up across every weight category versus 2022. That is, feeder cattle are getting pulled into feedlots on an advanced schedule. All of that indicates producers are responding to the incentive of better markets - and also likely feeling some drought pressure.

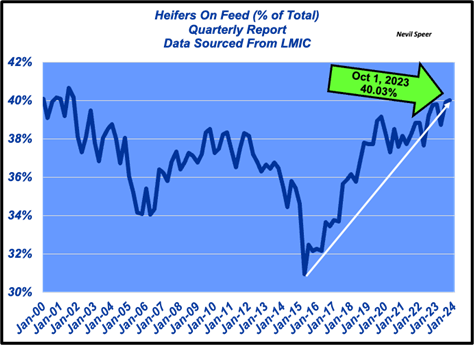

But the most significant read within the report was the quarterly heifer inventory assessment. Heifers surpassed 40% of total feedyard inventory. That hasn’t occurred since 2001. Clearly, producers aren’t in any hurry to start rebuilding the nation’s cowherd.

Whip Hand: What’s all that mean? It’s the one-two punch that’s especially telling. Continued sell-off of both cows and heifers means the cow/calf sector isn’t ready to turn the corner. Any thoughts to rebuilding the cowherd that might have existed earlier in the year, has effectively been put on hold for the time being.

That means continued tight numbers and subsequent higher prices are in the forecast. As a note of caution, that’s not intended to sound the all-clear; producers should still be on guard against external shocks – things that never happen, happen all the time. Nevertheless, for the foreseeable future, producers have the whip hand.