Speer: Feedlot Talking Point Goes To Court

People’s Court: Political talking points are often misleading. They’re meant to stir emotion rather than present facts. And the beef industry has its share of political doozies, but there’s one that’s particularly disingenuous. What if were to be defended in court? It’d play out something like this.

Defense: The defense would begin by making their case for the talking point. The attorney would then call to the stand a lobbying executive for some expert opinion related to the snippet.

- Att’y: Your organization claims most feedlots have been eliminated from the industry since 1996. Could you please tell the court about this situation?

- Witness: Yes, that’s correct. America’s cattle business is in crisis. For example, during the past 26 years, while NAFTA has been in place, 75 percent of all U.S. feedlot operations have disappeared, meaning there are nearly 85,000 fewer buyers to purchase the 25-26 million cattle that are raised each year by the 729,000 widely dispersed independent U.S. cattle farmers and ranchers.

- Att’y: Your Honor, the data speaks for itself. No further questions.

Cross Examination: Then comes time for cross examination from the Plaintiff’s attorney.

- Att’y: You’ve presented some shocking data. I’d like to ask you some questions about all of this. Let’s begin with some clarification of the facts. Your own material reads: “loss of 86,016 feedlots (77%) during the past 26 years.” However, the presenter notes included in the same handout state, “85,000 fewer buyers” and declare that’s “75% of all feedlot operations”. Those statements don’t line up. Can you clarify for the court which set we’re to believe? Additionally, isn’t the total loss actually 89,016 (from 115,109 in 1996 to 26,093 in 2022) - NOT 86,016?

- Witness: Um….

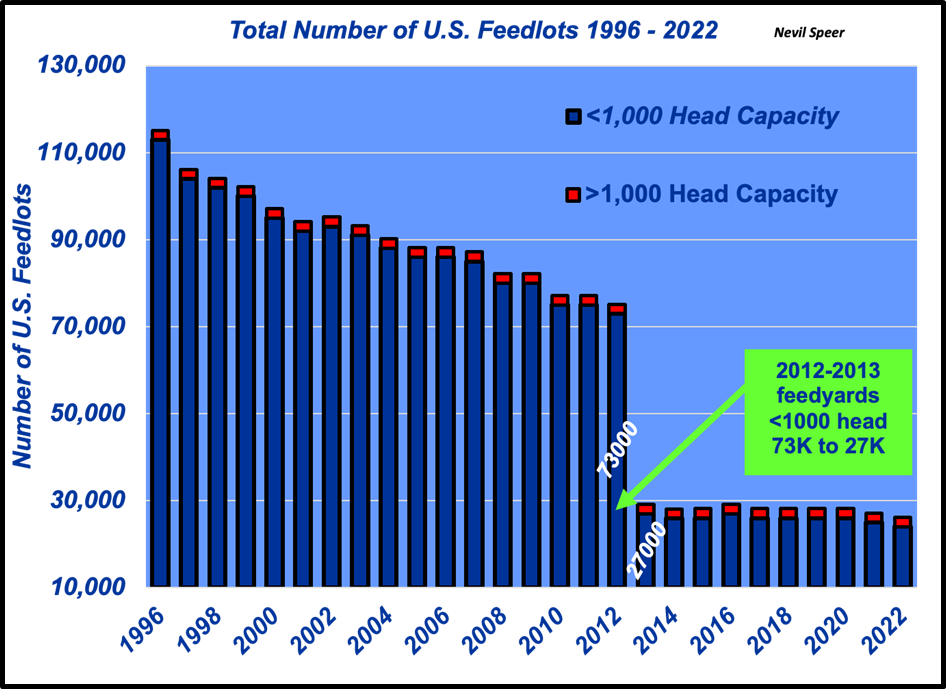

- Att’y: Your Honor, I’m submitting into the record Exhibit A: total USDA feedyard count since 1996. Note the marked decline in the number of feedyards between 2012 and 2013. That’s largely due to disappearance of 46,000 smaller feedyards (<1000 head capacity) - representing well over half of the total decline since 1996. Can you provide for the court some causative reason for the mass exodus in 2012?

- Witness: Um…

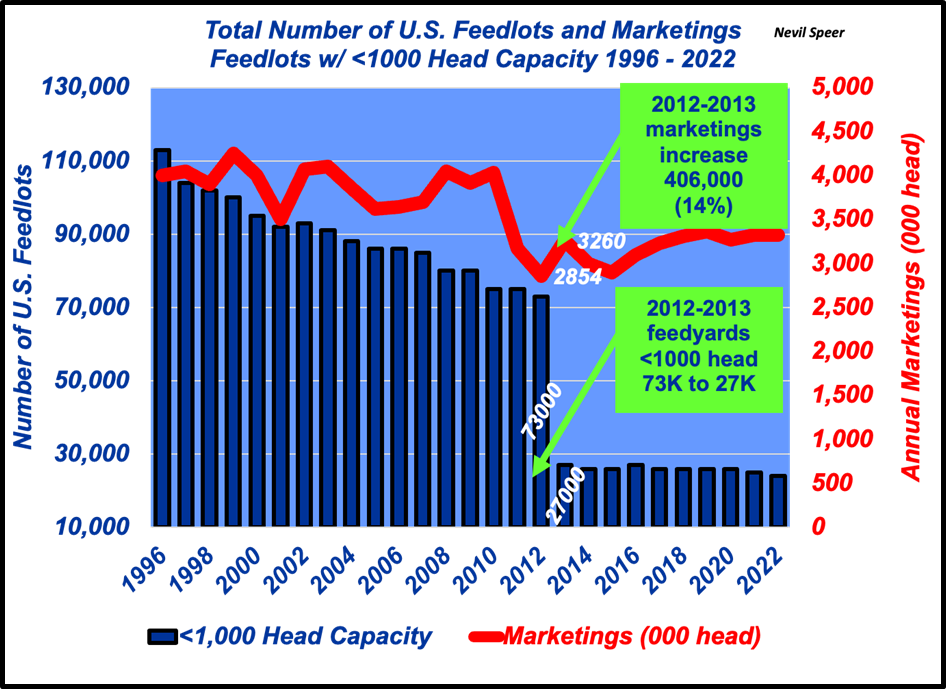

- Att’y: I’d also like to submit Exhibit B; it details feedlot count and feedlot marketings specifically for feedyards possessing less-than-1000-head capacity. While the number of feedlots between 2012 and 2013 declined dramatically, the total number of marketings increased during the same year. I’d like to ask the witness whether he can provide any clarification for the discrepancy.

- Witness: Um….

- Att’y: Let’s follow up on that. Is it possible USDA changed their respective methodology going into 2013? Were you ever curious and diligent enough to contact USDA about the anomaly?

- Witness: Um…

- Att’y: In fact, USDA DID change their process beginning with 2013; the feedlot count no longer included operations with less than 10 (ten) head. The change occurred to align with Census of Agriculture methodology. In other words, these feedlot operations haven’t “disappeared” (your words) – they’re just no longer being counted.

- Witness: Um….

- Att’y: Let’s set aside the less-than-10 group and focus on the commercial side of the sector. Is it also possible that some (or many) of the operations are no longer feeding cattle “for slaughter market” (as defined by USDA). Instead they’ve instead shifted to feeding cattle as “backgrounded only for later sale as feeders or later placement in another feedlot” (as defined by USDA)? That is, they, too, haven’t really “disappeared” – they’ve just shifted gears. That’s a real trend in the business, correct?

- Witness: Um…

- Att’y: And is it also possible there’s actually more operations with less-than-10 head as a result of the renewed emphasis on freezer beef and custom slaughter? But we have no real way of knowing, do we?

- Witness: Um…

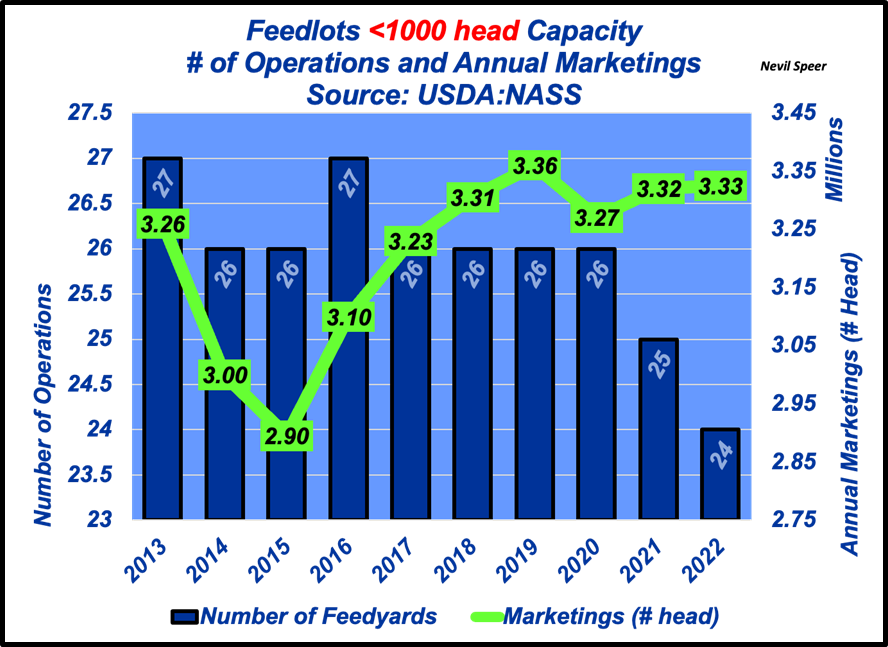

- Att’y: Finally, your honor I’d like to introduce Exhibit C. The data provides an overview of smaller feedyards and their respective marketings since the USDA methodology revision. You’ll note that marketings have remarkably strong since that time. No more questions.

Better Busines: The judge declares he’ll take the testimony into consideration and promises a swift ruling. But prior to dismissing the courtroom he notes his immediate bias. Turns out he’s also a parttime cattle producer. He specifically mentions producer optimism and resilience highlighted in Drovers State of the Industry survey. The judge also voices his frustration with distortion of USDA methodology to spin impending doom for the industry. And just before he gets up to leave, he mentions that he’s especially excited about the future and opportunities available across the business.