Speer: Beef Quality Driving the Business

Grid Marketing: The concept of supply elasticity generally reflects responsiveness of the supply chain to changes in price (demand) for its product. That’s essentially been the focus of my two previous columns on grid marketing (see 1. Bettin’ On and 2. Profiting From). That is, the potential to capture added revenue (via individual carcass pricing) has driven cattle feeders to increasingly market cattle via the grid (versus selling them live).

That has established some important changes in the business. Most notably, the bulk of that added revenue is tied to premiums at the top end of the quality grade mix (upper 2/3 Choice and Prime) – in response to consumer demand.

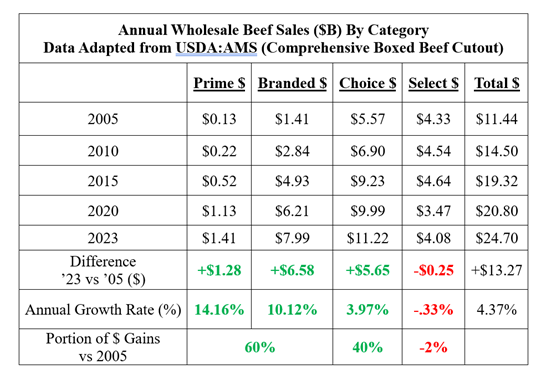

Quality Grade Mix: Given that premise, let’s put some context around the wholesale beef market during the past 15-to-20 years. For the sake of this discussion, let’s set aside sales that fall into the “ungraded” category (while sizeable – roughly $13B in ’23 alone - it’s a catch-all grouping that includes no-roll product, grind and trim). We’ll focus on what really drives differences in the market: Prime, Branded, Choice, and Select, respectively. The table below details the respective sales mix across the categories since 2005.

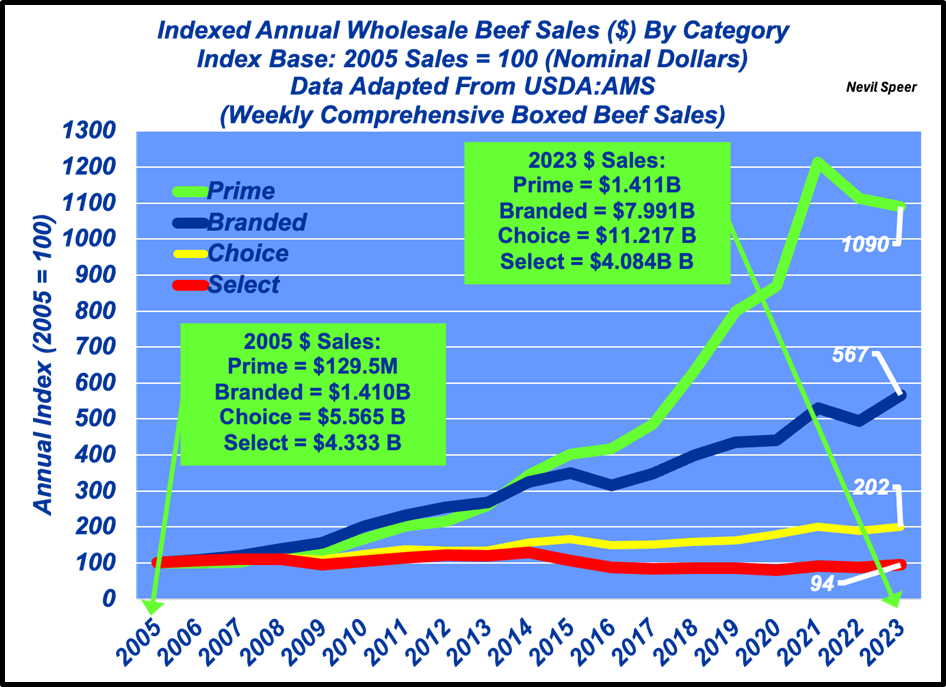

Difference Over Time: The most notable change over time is the sharp growth in market share of Prime and Branded product versus Select. That is, the top end of the quality grade mix has been growing steadily in terms of total dollars, while Select’s market share has progressively eroded. (see graph) Consumers are sending a clear message – marbling really matters!

Prime and Branded sales account for 60% of the new dollars coming into the business since 2005. Even more impressive, sales for the Prime and Branded categories own annual growth rates exceeding 14% and 10%, respectively, during that time.

Seemingly, there’s a self-reinforcing dynamic occurring to which beef producers are responding. More marbling means more dollars – that subsequently generates more product in the marketplace (supply elasticity). However, that extra supply hasn’t dampened the premiums for the product. Rather, it seems the more consumers get, the more they want.

I explained it in a previous column this way: “…more production of higher quality, more desirable products establishes better consumer demand. And in turn, better consumer demand creates the need for even more high-quality beef. One good thing leads to another.”

Marbling Is The Anchor: Even in the midst of tighter supply, higher prices aren’t a given. That is, if demand is waning, tighter supplies don’t necessarily translate to pricing power. The beef industry learned that lesson between 1980 and 1998 - the beef industry was essentially forced to increasingly discount its product to clear decreasing volume over time (see OFF Boondoggle).

That’s sure not the case today! As noted several weeks ago, the beef industry now has pricing power – consumers are clamoring for the industry’s product – even at a time when they’re particularly sensitive about higher prices (see Beef Forging Ahead).

That brings us back to the beginning. It all starts with the cattle – and ensuring the price signals match what’s underneath the hide. That’s best done via the grid. And in all of that, the anchor, the linchpin, the cornerstone – however you want to think of it – is marbling. It’s the difference maker when it comes to consumer satisfaction, subsequent spending and the total dollars available to the industry.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.