All Signs Point Higher

Record cattle prices set the stage for expansion

Most cattle producers are optimistic about the current cattle market. With record-high prices, anyone would be, especially since prices are expected to continue to climb.

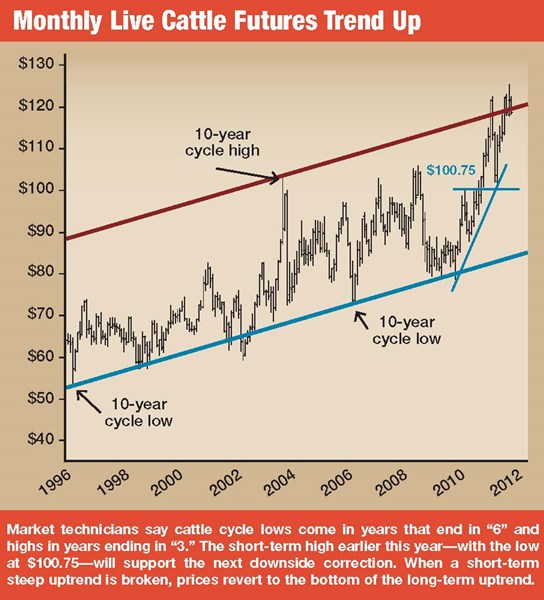

So how long will cattle prices maintain their upward momentum? The analysts at Pro Farmer expect the cycle to post its high in 2013.

"In the meantime, drought in the Plains, still-high feed costs and high cash prices give producers little to no encouragement to hold heifers back," explains Julianne Johnston, senior market analyst at Pro Farmer. "Simply put, it will take rain in the Plains to encourage heifer retention, which will propel the market into its 2013 cycle high."

For cow–calf and stocker operators, higher calf and feeder prices are good news. The challenge for stocker operators, however, is keeping break-evens in check given the higher prices for calves.

Jerry White, a 1,500-head stocker operator outside of Chickasha, Okla., expects next year to be another good year. He anticipates tighter margins due to higher calf prices, which in turn will increase break-even levels. But he believes feeder prices will keep up.

"This year was a good year in spite of the drought, due to higher feeder cattle prices," he says.

Once the drought hit, White harvested his corn for silage, giving him one more feed source. Fall moisture helped winter wheat pastures and provided good grazing conditions in mid-December.

Even though strong feeder prices are likely to continue in the months ahead, don’t be surprised by typical seasonal dips. David Anderson, Texas AgriLife Extension livestock economist, projects these target prices for 600-lb. steers in 2012: first quarter, $131 to $138 per cwt.; second quarter, $136 to $144 per cwt.; third quarter, $137 to $147 per cwt.; fourth quarter, $133 to $144 per cwt.

But the higher fed prices could cause consumers to balk at the meat case, especially if poultry and pork continue to be competitive. Ed Greiman, a cow–calf and feedlot producer in Garner, Iowa, says he’s a little worried that fed prices above $1.20 cwt. might slow down the beef movement.

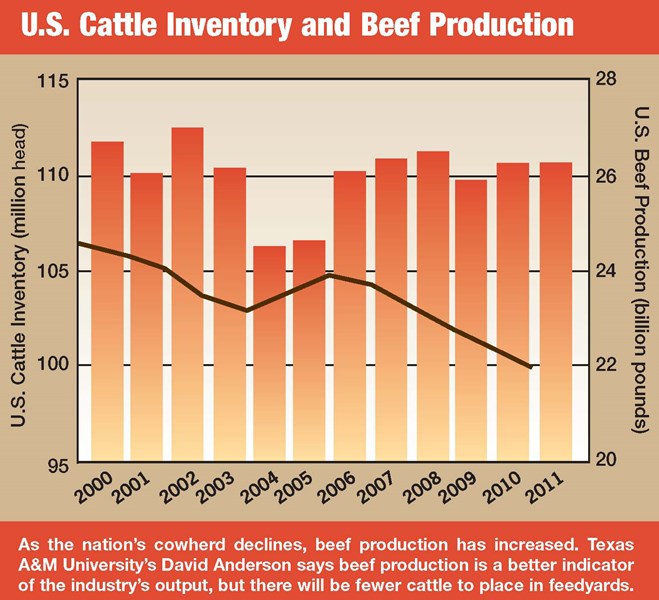

The driver is fewer cows. When the factory shrinks, so does production. Even though improved genetics means that it takes fewer animals to produce the same amount of beef, Anderson says, beef production in 2012 is predicted to be down 4%.

The extreme drought in the Southern Plains has halted expansion plans in the key parts of cow country. Texas lost approximately 600,000 head and Oklahoma lost about 250,000 head due to the drought, according to economists at Texas AgriLife Extension and Oklahoma State University. That’s a 12% decrease, the second largest percentage decline in history.

Derrell Peel, Oklahoma State University livestock economist, says that a continuing drought in 2012 means culling will begin much sooner than last year. For instance, the drought peaked in the summer, when hay supplies diminished. That’s when large numbers of cattle went to market or feedyards, he says. This spring, since hay is already in tight supply, culling might start earlier.

The other factor to watch is moisture timing. For example, winter wheat pastures in Oklahoma were all but written off a few months ago. Now, some farmers and ranchers tell Peel that this is the best wheat pasture for grazing they’ve seen in a long time, thanks to a few inches of rain this fall.

Oklahoma cow–calf producer and banker Zac Pogue says the lack of moisture continues to be a real concern, but he’s hoping winter rains and snow will help replenish grass before spring. "We culled harder than normal this year," he says. "But we didn’t have to do a major liquidation."

Pogue adds that he was able to buy hay and had a revival in his winter wheat pastures, which helped provide early winter grazing for his cattle.

As the cattle market goes, so goes the seedstock sector. Expect prices for quality bulls and replacement females to run considerably higher in the next couple of years, especially if grazing opportunities improve.

Donnell Brown, a fifth-generation seedstock producer and manager of R.A. Brown Ranch near Throckmorton, Texas, anticipates a good year for the seedstock side of the business since prices typically follow fed and feeder cattle prices. "My grandfather used a rule of thumb for pricing bulls," he says. "Basically, a good breeding-age bull on the average was worth five feeder calves or three fed steers. That has held pretty true throughout the years."

He adds that the difference in this age of value-based marketing is that good calves are worth considerably more than bottom-end calves. "I think that trend follows in the seedstock world, with a much wider than usual spread in the price of bulls relative to the value of the calves they produce," Brown says.

In areas that receive moisture and have adequate grazing during the spring and summer months, he anticipates, both bulls and females will be in high demand.

Tighter margins ahead. Some segments of the beef industry will struggle. For cattle feeders, the challenge of reduced numbers means fewer animals to fill pens and tighter margins, points out Randy Blach, executive vice president of CattleFax.

Interestingly, though, some are already finding innovative ways to use pen space, such as raising beef or dairy replacement heifers or even feeding cows until pastures recover.

The biggest hindrance for feedyards is rising input costs from more expensive feeder cattle and higher feed costs. While corn prices have declined somewhat, they are still expected to be strong in 2012. There will, however, be buying opportunities.

"USDA’s trend on its corn price projection has been decidedly lower in recent months," says Brian Grete, Pro Farmer senior market analyst. The December USDA supply and demand report projected an average cash price of $5.90 to $6.90 for 2011–12.

"We are near the middle to lower end of that range on our outlook. Ending stocks are still projected to be tight, which opens the door for a strong price recovery," Grete says.

"But with USDA continuing to cut its usage projections and given macro-economic headwinds, it’s going to be hard to generate sustained buying interest. If there is a strong price rally, it would likely come in late spring or summer, depending on how the growing season progresses," he adds.

But more than just feed prices have increased. "We’ve noticed that the capital needs to run the operation are higher," Greiman says. Fortunately for now, higher cattle prices are helping alleviate the increased expenses, but it does create a tighter squeeze to get capital for expansion.

The meat market. Higher cash cattle prices and buyer resistance had many packers in the red in late 2011. "One of the biggest unknown risks to the cattle market is exceptionally poor packer margins," Pro Farmer’s Johnston says. "Despite historic highs in the boxed beef market, beef packers are losing money on each animal processed because of high cash prices.

"If packers slow their kill rate to trim losses, it raises the risk of feedlots backing up, which causes weights to rise and leads to lasting pressure on the cash market," she says.

Still, "unless a global event happens that trims export demand suddenly, cash prices will remain above $100 per cwt. in 2012," she adds.

Many are banking on a growing export market. Beef prices between 2010 and 2011 rose 14%, helped by an increase in exports, and could average $5 per pound in 2012, Blach says.

Exports are expected to continue to rise as trade agreements go into place and export restrictions are lifted. The U.S. Meat Export Federation (USMEF) anticipates beef and beef variety meat exports to increase to 1.3 million metric tons, for a value of $5.57 billion. The export value of fed cattle slaughtered is expected to be about $218 per head, an increase of $15 per head compared with last year.

"Despite market access restrictions, high tariffs and other trade barriers, the investments we are making in foreign markets are paying tremendous dividends," says Philip Seng, USMEF president and CEO. "Beef producers are dealing with extremely high operating costs and other challenges, and the export markets are the best thing going in terms of profitability."

A few months ago, Wal-Mart announced plans to sell more Choice beef. As Choice beef supplies continue to dwindle, the Choice–Select spread will widen. This fall, it peaked at $19 per cwt.

For producers selling on quality grids, that could mean more premiums. Cow–calf producers with the right genetics might find this to be an opportunity to retain ownership and place cattle on feed.

The market signals are all there for producers to retain ownership of heifers. A little rain at the right time in the right places should get the cow numbers growing again.

Read more beef news.

Check cattle prices.