Why Ag Economists Think Net Farm Income Could Fall to Lowest Level in 3 Years

USFR-FJR January Ag Economists' Monthly Monitor

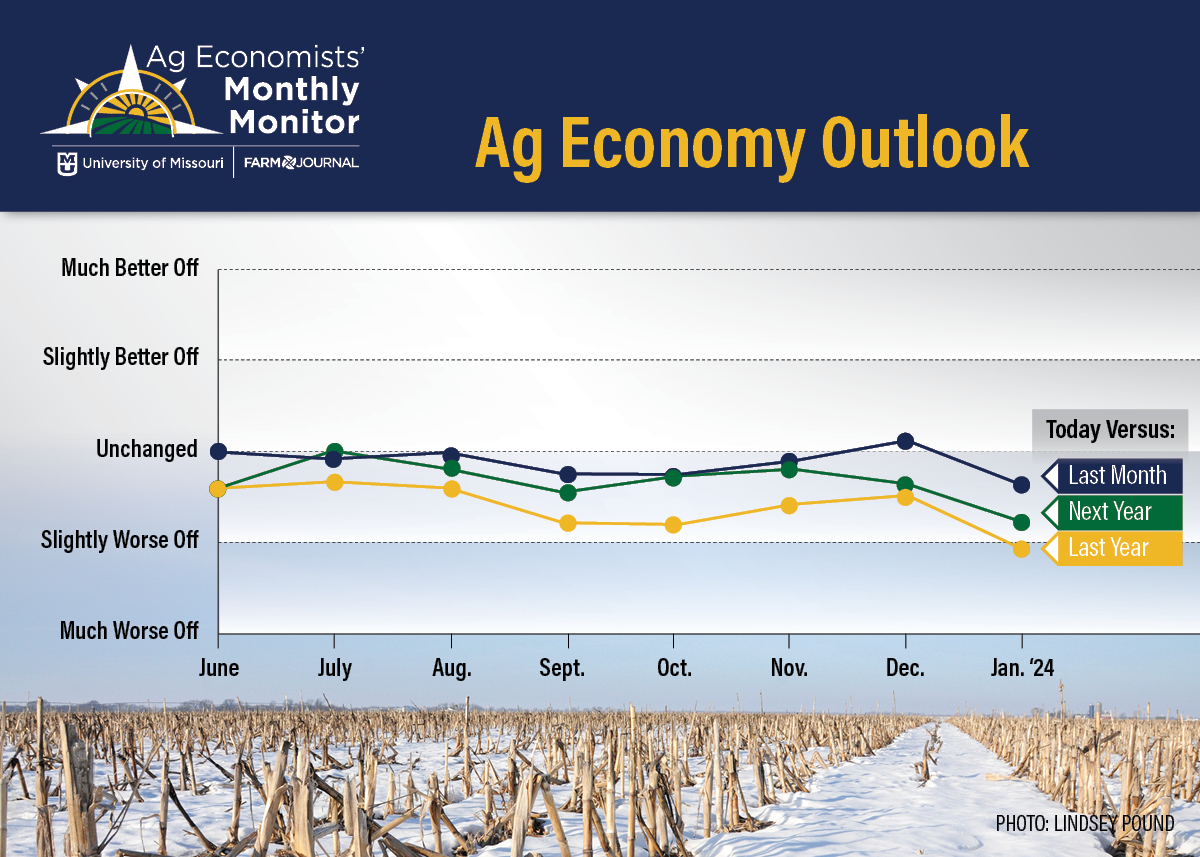

Agricultural economists’ views on the ag economy took a dive in the first Ag Economists’ Monthly Monitor of 2024. Lower commodity prices, along with the outlook for higher costs, continue to weigh on the agriculture industry. However, ag economists think relatively strong balance sheets and working capital could provide a cushion for 2024 with no major concerns about immediate farm solvency issues.

"We certainly saw the results in the January numbers suggesting a downturn, probably the largest downturn since we've started the survey,” says Scott Brown, an agricultural economist with the University of Missouri who also helps author the Ag Economists’ Monthly Monitor.

Brown says from December to the latest survey in January, projections for corn prices fell 25 cents, just one sign that economists are growing more pessimistic at the start of the year.

“I don't want to make a trend out of just one survey, but if we continue down the path that we started with the January estimates, perhaps we're telling 2024 to be a less positive story than we would have just a few months ago,” Brown says.

The January survey asked economists to pinpoint the two most important factors driving agriculture's economic health today, and in the next 12 months. Economists said:

- Declining commodity prices and complicated production costs, including stubbornly high interest rates juxtaposing reduced expenses in certain inputs.

- Commodity production and demand traveling in opposite directions.

- Macroeconomic factors domestically and abroad, as well as geopolitical factors.

In contrast, economists say the most negative aspect regarding the outlook of U.S. agriculture includes:

- Competition and expanded production in the global market paint an interesting export picture.

- Political stagnation, which could impact biofuel and trade policy.

- Compressing margins due to lower prices and higher expenses (including interest rates).

When asked what they view as the most positive aspect of the outlook for U.S. agriculture, economists looked beyond just yields and potential demand:

- Agricultural product demand growth has potential in the right environment.

- Resiliency and innovation of the U.S. farmer; includes financial resiliency and ability to weather tight margin environment.

- Strong crop yields, despite weather challenges.

- Double-edged sword of lowered grain prices making feed prices more affordable for livestock industries.

Forecast for Falling Net Farm Income

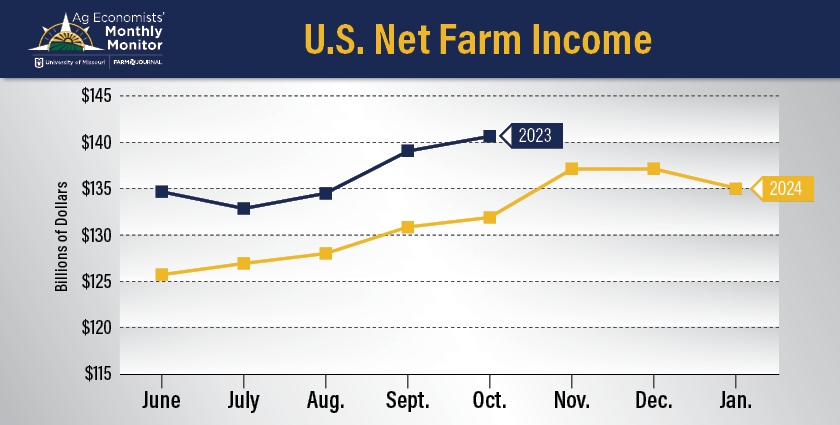

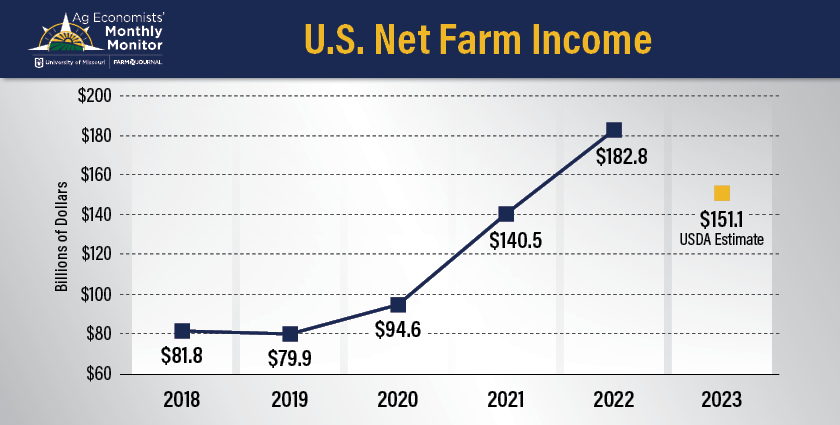

Ag economists’ forecast for prices of all crops and livestock shifted lower compared to the December survey, signaling net farm income could also fall more than originally anticipated. The January survey found economists views on net farm income also took a turn, with the survey average falling to $135 billion for 2024.

“Let's just remember that back in 2020, we would have talked about net farm income and about $95 billion. So, this is still much higher than where we would have been in that kind of 2016 through 2020 period,” says Scott Brown.

However, not all ag economists are forecasting net farm income to fall as low as what the survey revealed. While the average net farm income estimate came in around $135 billion for 2024, the range was of answers from economists was $100 billion to $150 billion.

“What surprised me, I think, is the nature of the pessimism amongst people, relative to expectations. To me, I think net farm income will be down, but maybe not near as low as current expectations are suggesting in that $120 to $130 billion range,” says Ben Brown, assistant extension economist with the University of Missouri.

Ben Brown is one of nearly 70 economists surveyed each month for the Ag Economists’ Monthly Monitor. He, along with a handful of other economists in the most recent survey, think hog and dairy could see a more profitable year in 2024, thanks to lower feed prices.

“We're going to see lower revenues on the crop side, but we're going to see record profits, potentially, on the on the cattle side,” says Ben Brown. “We're also going to see your recovery in pork and poultry profitability as well, at least in my expectations over the next couple of years.”

Bullish Beef

Economists were asked to rank each commodity by financial strength—10 being the strongest, 1 being the weakest. Scott Brown says it’s no surprise cattle continues to top that list.

“When you look at where we're at on prices, we've lost in the last couple of months a little bit of cattle price strength, but I think it's starting to turn back around, and just how tight we are on the supply side,” says Scott Brown.

Soybeans ranked second in the January survey, followed by sorghum, corn and wheat. Ag economist Bill Lapp says declining commodity prices for crops continues to be the headline.

“I think the January 12 reports gave us maybe some cold truth that we weren't ready for,” says Bill Lapp, president and founder of Advanced Economic Solutions. “We had record corn yields, even in the face of a lot of areas having far from optimal weather. So, that was maybe a bit of a surprise that we probably weren't completely shocked by, that led to increases in ending stocks, although modest, it did put a damper on the market going into the remainder of the winter.”

The Reality of Growing Supplies

As USDA prepares for its ag outlook forum next month, USDA will provide the first glimpse of supply and demand projections for 2024/2025. Lapp thinks the theme of growing stocks will continue, and serve as a wet blanket on crop prices.

“When you pencil it all out, it looks like even with a decrease in corn acreage, we're going to have another year of building stocks in corn,” Lapp says. “We expect at least some increase in soybean acreage. And that will lead to some building of soybean stocks as well, and last time we saw this was the 2012 through 2015 period where we were we push prices sharply lower.”

Lapp points out there are things that make the current market unique, including higher production costs, interest rates and the value of farmland. Another factor is the current strength of the U.S. dollar.

“The cost of production for U.S. producers has gone up significantly,” Lapp says. “And we can talk about the different aspects of that, but one would be seed costs, fertilizer costs - although they reverse themselves now - interest costs and land rent costs have increased significantly to the point where we are nowhere near where we were in 2008 in terms of cost of production for corn or soybeans. We've increased those dramatically.”

Relief in Feed Prices for Livestock Producers

If grain prices fall, ag economists point out it’s a double-edged sword—one that could drive down profit margins for row crop farmers, but help ease the pain of high feed prices for livestock producers.

“On the dairy side, I think cheese prices have continued to struggle. And I think that's kept class three prices lower than maybe some would have thought by now,” says Scott Brown.

The rankings of commodities by economists showed another dreary outlook for the pork industry. However, Lapp thinks hog producers could see some relief this year.

“The report didn't offer much hope for commodity financial strength for hogs. It was at the bottom of the barrel, but I think that could that's one area that could surprise us,” Lapp says. “Right now, the hogs are under great duress, but I think that could turn around at some point because they have such a sharp decrease in beef supplies and their feed costs are coming down as well.”

Some hog producers just saw the worst year on record, with profit margins in the red. Dairy producers saw much of the same. So Ben Brown thinks the only direction may be to go up from here.

“I do think we'll see some profitability returned to those sectors over the next two years. But again, it's kind of based on relative positioning. There's not a whole lot more we can haul and not a whole lot lower we can go in both those sectors,” says Ben Brown.

What to Watch into 2025

Economists were also asked how they expect their ranking of the financial strength of commodities to change by 2025. Economists who responded to the survey had mixed feedback on crop commodities, but several responses predict a weaker outlook for most crops.

However, economists note relatively strong balance sheets and working capital are helpful in this situation, with economists not concerned about immediate farm solvency issues.

Economists were generally positive on the livestock side, with the majority indicating cattle will have another strong year, but warned cattle prices will likely trend lower eventually. Economists also noted hogs, dairy and poultry could see a positive turnaround, thanks to lower feed costs and lower supplies of market-ready livestock with improve profitability.