Speer: Don’t Blame Trade – Blame Protectionism

Don’t Look Ethel: Do you remember Ray Stevens’ song, “The Streak”? “Don’t look Ethel.” That’s what went through my head as I clicked on one of R-CALF’s shorts in my YouTube feed (“…it was too late, I’d already been mooned”). The video was part of the group’s weekly address, “Free trade distorts domestic cattle prices.”

Story: R-CALF explains, “…fed cattle prices have been trending downward for several months, losing nearly $15 per cwt since early November.” And then provides this explanation for the selloff: “…during the month of November, about 42,000 imported cattle were slaughtered, which compares to 28,000 slaughtered during the same time last year…”

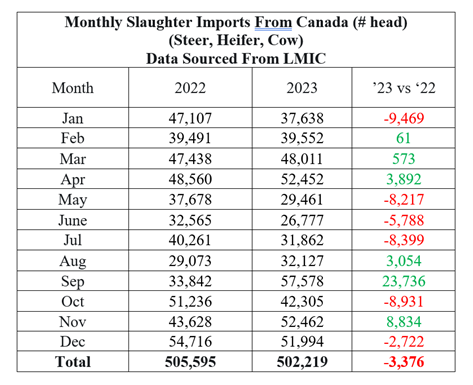

November: What about that claim? Cattle imported for immediate slaughter sourced from Canada are reported by USDA via this report. Here’s what’s important:

- Reporting lumps fed steer and heifer imports with slaughter cows. It’s difficult, therefore, to immediately parse out what’s what in terms of fed cattle versus cows.

- Meanwhile, November’s slaughter imports totaled ~52,500 head (not 42,000) – only 8,800 head (not 28,000) more than last year. (see table below)

October: To further bolster their trade / market distortion narrative, R-CALF sneaks in feeder cattle to the discussion citing a recent CME report: “…live cattle imports in October were up 76% compared to October last year, and for the first 10 months of this year, those imports were up more than 24% compared to the same period last year.”

For now, never mind feeder cattle (more on this below). Let’s stay focused on the fed market:

- Slaughter imports from Canada were actually down in October (8,900 head) versus 2022. (see table)

- Through October, the imported slaughter total lagged 2022 by ~9500 head (407,250 versus 397,760 in ’22 and ’23, respectively).

Carcass Weights / Exports: The ranch group avoids other drivers in the market. For example, November’s average steer / heifer carcass weight averaged 900 lb – 5 lb heavier versus year-ago weights. That means that for every 179 head slaughter in ‘23, the business now has the equivalent of one additional animal compared to 2022. Considering the beef industry slaughtered 2.066 M head of steers and heifers in November, the extra 5 lbs is equivalent to adding ~11,500 head compared to 2022 (more than November’s marginal import contribution).

Now let’s flip to the other side of trade. LMIC projects 4th-quarter exports to be down 136M lb compared to 2022. Given a 900 lb carcass, that’s the equivalent of adding 151,111 head to total slaughter mix – or roughly 50,000 head per month. That’s nearly equal to November’s total slaughter imports (which includes cows).

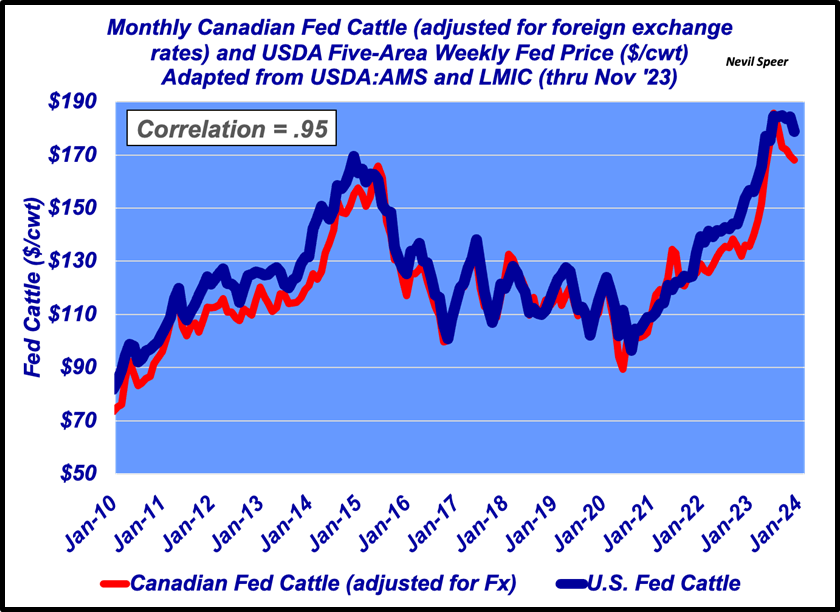

Fx: But then there’s this: “…imported cattle arrive in the U.S. duty free, so there is no adjustment to their value to address disparities between foreign and domestic production standards and related costs or differences in currency valuations.”

One, production disparities should be tariffed between the U.S. and Canada? What does that even mean? Clearly, there’s an inference to be made; I’m confident our Canadian trade partners wouldn’t appreciate the slight.

Two, “no adjustment [for] differences in currency valuations”? I’ve previously demonstrated (as it pertains to COOL) that Canadian cattle prices run in lock step with U.S. prices (see one and two and graph below).

Mad About Trade: Given R-CALF’s headline, “free trade distorts”, I’m waiting for the next press release highlighting the detrimental effects of importing the ranch-favorite Power Stroke engine. Yeah, that’s not happening.

That’s because the ranch group is seemingly content overlooking the benefits of trade being a two-way street. All the while, undermining the principles surrounding economic freedom (see Cowlandia).

For instance, the ranch group never tells us about the backhauls. USDA explains it this way, “Canadian feed lots continue to maintain efficiency by purchasing U.S. feeder cattle rather than returning with empty trucks when delivering cattle to the United States”; the U.S. exports 300,000+ head of feeder cattle to Canada (encroaching nearly 2X volume of feeder cattle imports arriving from Canada).

Given that reality, it’s not trade that distorts markets, but rather protectionism.