Speer: LRP Sense and Nonsense

LRP: The topic has driven more communication than any other I’ve ever written about (even COOL!). That’s led to three columns prior to this one (see one and two and three). So, why yet another one?

Because there remains a lot of noise around the issue. That was best described by one of my readers last week: “[most of the critics] don’t even understand the facts, let alone the myths.” That’s not really that surprising. After all, every combination and permutation of explanations exists out there theory regarding LRP and the subsequent influence on markets (cash, futures, and options).

Bashing: For example, one commentator recently said this about LRP:

There's been some negative things come out here in the last several months about LRPs…There's been a few things that's happened with them that may have caused the feeder board to fall under more pressure than usual but that's just because a lot of the big dogs.

And then there’s this sort of statement regarding LRP and some large backgrounders: “I can’t prove this, but I know it’s true…and I’m pretty damn sure that there’s several outfits that are abusing the system…”.

May have caused the feeder board to fall…? You can’t prove it, but know it’s true? None of that is constructive; it’s just gas on the fire (for people to talk about at the coffee shop).

Gobbledygook: But then there’s the gobbledygook. For example, these comments on one of my LinkedIn posts went like this (we’ll take it in parts):

The subsidies created and [sic] arbitrage opportunity for underwriters to lay off risk in the futures market by buying put options or a put option spread and still harvest a portion of the subsidy/premium, thus increasing downward market pressure with substantial volume.

A couple of items to note inside all that verbiage:

- Underwriters aren’t arbitraging (i.e. harvesting) the subsidy – they’re policy sellers. Producers are policy buyers and thus incentivized by, and recipients of, the RMA subsidy; hence the subsidy harvest (See LRP Options Action).

- Volume – it’s always too much or too little (see Bashing The Speculator)

More Confusion: But it continued from there:

Additionally, cattle feeders used feeder lrp’s as less expensive put options and short puts at lower strike prices to synthesize a put spread as a backstop to long futures positions intended to hedge the next turn of cattle. Although initially it may have caused feeders futures to overshoot higher, once the market began a downside correction, feeders had insufficient capital to margin long futures and short puts because LRP’s don’t margin or pay until contract maturity. Hence, long hedgers not only had to liquidate long futures, but flipped net short in defense of short put options as the correction worsened.

Again, let’s sort some of this:

- A cattle feeder wouldn’t purchase a feeder cattle LRP policy –they’re buyers of feeder cattle – not sellers.

- An entity can’t hold LRP unless they own the cattle. Thus, one couldn’t use LRP (current owner / seller) as a “backstop” to a long (not-yet-owned / buyer) feeder cattle futures position. (Besides isn’t the hedge the “backstop” protecting the outfront purchase?).

- On one hand, LRP caused the market to go higher; on the other hand, LRP caused it to go lower? How does that work?

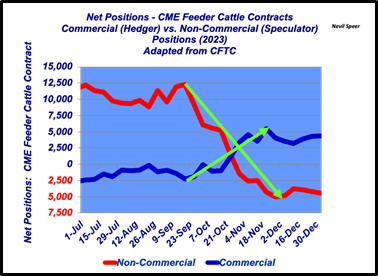

- Last, commercial traders (i.e. cattle feeders) have NOT “flipped net short”. It’s the other way around; they’ve gone from being net short to net long in recent months. (see first graph)

That’s Not It: The most significant part of the LinkedIn comment goes like this:

If the goal was downside price protection and market stability, the LRP feeder program achieved the exact opposite on both counts - and never mind the effects on feeder basis……

To be certain:

- LRP was NEVER intended to provide market stability; it’s risk protection (RP) amidst market instability.

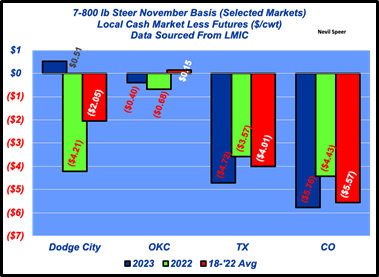

- During November’s selloff, basis remained largely in line with previous years (see second graph) – except Dodge City with basis benefitting the producer in 2023.

The LinkedIn comments illustrate the pervasive confusion regarding LRP. And it all sounds impressive – but none of it makes sense.

Sense: Meanwhile, a reader / risk manager recently shared this reminder with his customers: “Markets will do what they are going to do, and the higher prices go, the more steep the corrections.”

Now that makes sense! It’s a fundamental tenet of market behavior. (See The Most Important Thing) Applying that premise here: LRP didn’t drive the price break; rather, price breaks drive the necessity for LRP.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.