Differences Between High-, Medium-, and Low-Profit Cow-Calf Producers

Economic returns to cow-calf producers fluctuate considerably from year-to-year. These year-to-year swings can be extreme, as we saw between 2014 and 2015.

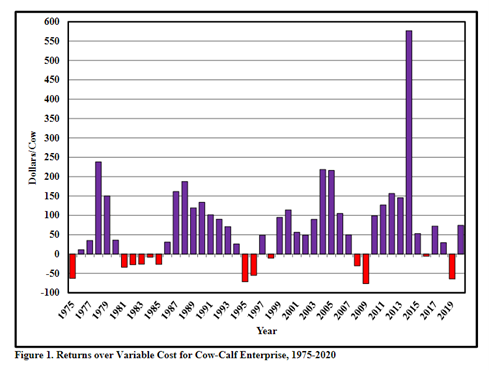

Figure 1 shows the returns over variable costs, on a per cow basis, for producers with cow-calf enterprises enrolled in the Kansas Farm Management Association (KFMA) between 1975 and 2020. Over the 46-year period, there were 132 producers, on average, participating in the enterprise analysis per year with a range from 64 to 258.

Over the entire time period, annual returns over variable costs averaged $71.02 per cow with a low of -$76.40 per cow in 2009 to a high of $576.95 in 2014. That is a difference of more than $653 per cow in a six-year span. Sorting the returns in figure 1 from the high (“good years”) to low (“bad years”) and dividing into thirds, the average returns for the time periods are $183.33, $61.11, and -$30.73, for the top-, middle-, and bottom-periods, respectively.

In other words, there is over a $214 difference in the average returns per cow in the “good” years compared to the “bad” years in nominal terms. This variability of returns over time is due to many factors, including the cattle cycle. Producers tend to reduce the size of their herd when cattle prices are lower, which in turn leads to smaller cattle supplies in the future. These smaller supplies lead to higher cattle prices, which then leads to expanding cattle herds resulting in larger supplies and lower prices (and the process starts over again).

As cattle producers know, especially in Kansas and the Southern Plains, cattle cycles are not perfectly predictable because factors other than price also influence producers’ decisions to expand or contract their herds (e.g., forage availability, input costs). For example, the declining returns in 2007 through 2009 were not the result of herd expansion but were due more to increasing input costs and weakening beef demand. The record high average return in 2014 was a result of a drought and strengthening beef demand. Given that some factors at the macro level (e.g., interest rates, consumer demand) are not controllable by producers, all producers are affected similarly. It stands to reason that variability of returns over time is inherent to the industry.

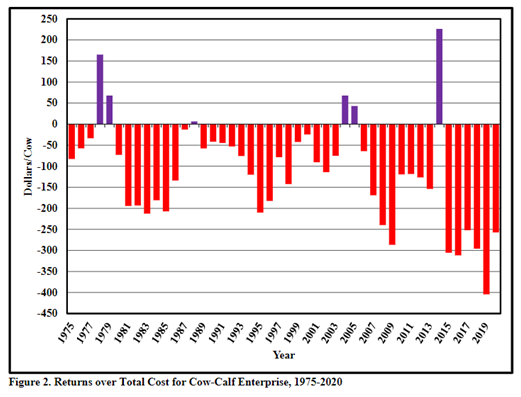

Figure 2 shows the returns over total costs rather than returns over variable costs (as seen above in figure 1). That is, fixed costs (i.e., depreciation, real estate taxes, unpaid operator labor and an interest charge on assets) have been added to the variable costs. Over the 46-year time frame, the average returns over total costs are -$114.41 per cow with a low of -$404.36 and a high of $226.35 (returns over total costs were only positive in 6 of the 46 years).

Given that average returns over total costs are only positive 13%of the time, one might ask why anybody is in the cow-calf business? However, it is important to recognize that the cost for unpaid labor and the interest charge on assets used in the operation reflect opportunity costs and these vary significantly between operations. Regardless of how we might measure returns (e.g., returns over variable costs vs. returns over total costs vs. returns to management vs. returns to labor and management), they are highly variable across time (as seen in figure 2).

Because the returns over total costs are highly variable across years, we sorted the 46-year returns over total costs into thirds, similar to returns over variable costs. This resulted in averages per cow of $13.96, -$108.62, and -$248.95 for the top-, middle-, and bottom-third of years, respectively. In other words, there is a large difference of $263 in the average returns over total costs per cow between the “good” years and the “bad” years.

Figures 1 and 2 show the variability in annual average returns across time, where the annual averages are calculated across a group of producers. Some of this variability across time is due to macro-economic factors that producers have limited ability to manage.

However, an important question for producers to ask is what do the returns for individual producers look like at a point in time? That is, how much variability is there in the returns across individual producers in good or bad years? The answer to this question is important from a management perspective because, while producers might not be able to influence overall market conditions, they do have opportunity to control profitability at the farm level relative to other producers.

While numerous factors beyond the producer’s control impact the absolute level of profitability, producers’ management abilities impact their relative profitability. In a competitive industry that is consolidating, such as production agriculture, relative profitability will dictate which producers will remain in business in the long run. Thus, it is important to recognize which characteristics determine relative farm profitability between producers. Specifically, it is important to be able to answer questions like: Does size of operation impact profitability? Do profitable farms sell heavier calves or receive higher prices? Do they have lower costs? If they have lower costs, in what areas are their costs lower? Answering these questions, and others related to why some producers are more (or less) profitable than average provides valuable information for decision makers.

To read the complete analysis visit this link.