Speer: Don’t Try This At Home

Paired System: Futures markets come in pairs. For every short, there must be a long – and vice-versa - else a contract doesn’t come into existence.

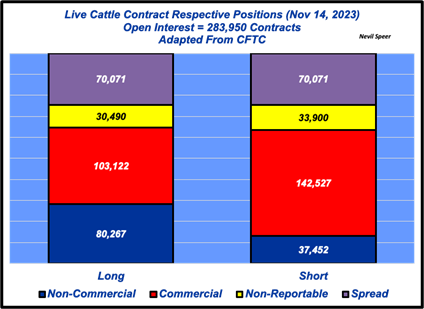

However, some industry talkers don’t grasp that fundamental premise. For example, my previous column highlighted an industry vlogger griping about not enough longs in the market but also grumbled on the other side; LRPs and corporate feedyards represent too many shorts. But with futures markets, there’s no such thing as “not enough” or “too many” – because for every buyer there must be a seller. It’s always perfectly balanced. (see first graph)

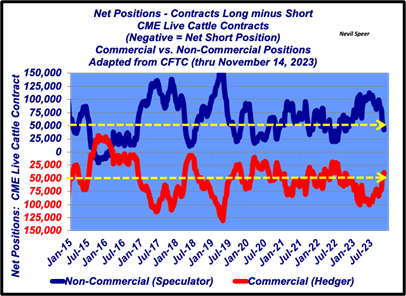

Hedgers vs. Speculators: That’s brings us to the role of hedgers versus speculators in the market. They’re distinctly different. Let’s stay focused on live cattle.

The speculator mostly (not always) takes the long (buy) side of the market with the expectation price in the future will exceed current futures price. The hedger mostly (not always) takes the short (sell) side of the market to avoid risk; the producer / hedger is buying insurance from, and subsequently transferring market risk to, the speculator.

To facilitate all that the short hedger must be willing to sell a futures contract at some level below the expected future price (otherwise there’d be no incentive for the speculator to assume the long position – the discount being what the hedger pays the speculator for assuming risk). (see second graph)

You Can’t Be Both: All that provides some background to the broader point. The same talking head confuses the speculator / hedger distinction:

I told you in a recent visit if you’re borrowing money and feeding cattle or raising cattle [i.e. you’re short the market] you can’t take the long side. Your lender will not allow you to take the long side. So, who’s going to take the long side? Well, it’s going to be your speculators or your managed money…but we don’t have any longs right now to take the long side to hold this thing up.

The vlogger would like short hedgers to go long the market. That’s wrong-headed. Any attempt to go long (while holding inventory) is a speculative position and inherently counter to a hedging position. That’s why bankers don’t want you using their money to become a speculator (not to mention the IRS also views speculative gains/losses differently versus those associated with hedging).

Case Study What Not To Do: I don’t recall the exact details; however, the scenario played out something like this. A group of producers send cattle to a feedyard in a retained ownership program. Year one the cattle are hedged; the market goes up during the feeding period; the owners are disappointed they missed the rally. Year two, recency bias kicks in: instead of hedging, the owners go long a futures position; the market goes down; the owners lose money. The should-be hedgers decided to become speculators. Now they’re in need of a double cure; they missed the hedge AND the trading account balance is negative.

Don’t Try This At Home: In contrast, Joe Vaclavik, Standard Grain, recently provided some sound wisdom in his daily show (“Grain Markets And Other Stuff”). Speaking to producers he emphasized the importance of understanding the hedging / speculating difference:

Guys, there will never be a trade recommendation here. There’s never been a trade recommendation here. In fact, here’s a recommendation: 99% of you guys have no business trading [emphasis mine] futures or options – that goes for myself as well. Those who should be trading futures and options include those with unlimited resources as it relates to money OR need to hedge physical production…Don’t speculate in the futures markets guys.

Unfortunately, not everyone wants to heed that advice - a fool and his money are soon parted (but they sure can talk big). There’s good reason the CFTC requires a disclosure statement that reads something like, “The risk of loss in trading commodity futures and options can be substantial…” Stated more simply, unless you really understand all the intricacies, don’t try this at home.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.