Is A Recession Imminent? Here Are The Red Flags Ag Economists Are Now Watching

Recession talk has been rampant for more than two years. While ag economists continue to be at odds when it comes to the likelihood of a recession in the United States, there are also concerns about economic woes around the globe. Some economists doubt the United States’ biggest importers will be able to avoid a recession over the next 18 months.

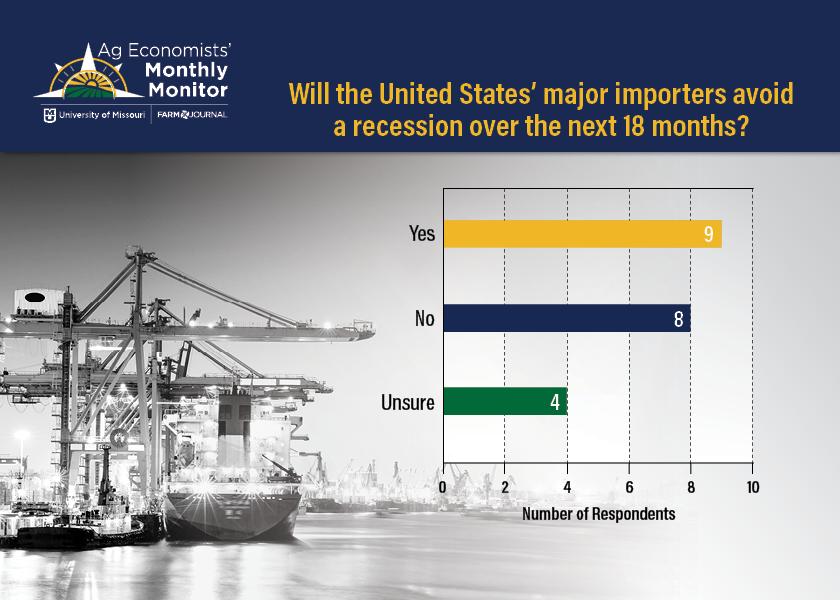

In the latest Ag Economists’ Monthly Monitor, a survey of nearly 60 ag economists from across the country, the economists were asked if the United States’ major importers will avoid a recession over the next 18 months. Of those who answered the question, nine said “yes,” but eight responded “no.” Four remained unsure.

The economists were then asked to explain the reasoning behind their response. The answers revealed a host of concerns, including labor shortages, risks in China and Europe as well as the strength of the U.S. dollar, as to why the economists think a recession might be imminent for those countries.

“The slowdown in global trade and the strength of the dollar are placing excessive pressure on importers,” said one economist in the anonymous survey.

“Of the countries the United States exports product to, China is the only one I have large concerns about. Europe has seen an economic slowdown, but I think they will avoid a recession over the next 18 months,” said another ag economist.

“It's hard to imagine that much of the world won't continue to be squeezed by too much private and government debt and rising interest rates, which ultimately ripples through all economies. The United States is the prettiest of the ugly horses,” was another response.

Out of all the responses, the biggest concern continues to be China. While economists say pork and beef exports might be the most at risk, a ripple effect around the globe is possible.

“The economic slowdown will result in some of our major importers entering a recession. It will remain slow recovery and growth longer term,” said one economist.

“China appears to have some economic problems. They have emerged as major importers of pork and beef, but they also remain a trading partner that contributes market uncertainty. On meats, traditional partners will be more important,” said another economist.

In the United States, economists have been largely impressed by the resiliency of American consumers, but many point to red flags that continue to flash caution signs moving forward. One is the fact credit card debt is climbing at a time when inflation continues to eat away at consumers’ spending power.

“The U.S. economy has proven to be more resilient than many expected with low unemployment and moderating inflation,” said one economist.

“It's touch and go in the United States,” was another response. “However, it's becoming increasingly difficult for companies to raise prices and pass through higher input prices. That'll likely mean margin compression, which translates to the need for layoffs. This won't necessarily be deep, thus avoiding a recession, but there's still some pain ahead for the economy.”

Economists point out every recession is different, and the signs vary. So, what are economists watching to know if a recession in the United States is imminent? The September Ag Economists’ Monthly Monitor revealed some of those signs.

When asked to list the top three general economist indicators to gauge the likelihood of a recession, economists in the anonymous survey said:

- “There is too much reliability in the inversion of the yield curve predicting a recession. Given the length of time the yield curve has been inverted, it is going to be difficult to not expect a recession. It is going to be exceptionally difficult and will take longer with more interest rate hikes for the Fed to achieve a 2% inflation rate than what the market is prepared for.”

- “I follow Fed monetary actions, interest rates and unemployment levels.”

- "I follow unemployment rate, hourly wage rate and consumer prices."

- “I don't think the Fed can get inflation down to the 2% mandate without a recession, if it holds to that mandate.”

- “Employment growth remains fairly strong, and the U.S. unemployment rate remains historically low. As long as there is not a sizable decline in demand for labor (which is what I believe), the U.S. should at worst have a shallow and relatively short recession.”

- “I tend to watch GDP and the Conference Board Leading Economic Index because that is a compilation of 10 leading indicator components. I watch on the inversion in the spread of long- and short-term treasuries yields, although that is also part of the LEI.“

- “I like to look at GDP, real incomes and savings rate. Consumer debt like credit card debt is an interesting data point. I don't do a lot of recession or general economic projections.”

Ag economists’ view on the overall ag economy is also starting to erode. The September Ag Economists’ Monthly Monitor shows lower commodity prices, concerns about demand and a negative outlook for China’s economy are all contributing to the changing views, even as the cattle herd and U.S. corn and soybean crops continue to shrink. But the most influential piece of the farm economy might be the price of corn.

Related Stories:

The One Factor That Could Make Or Break the Farm Economy Over the Next 12 Months