Packer Capacity

The global COVID-19 pandemic provided historic windfall profits for beef packers, but at its peak, the packing industry was a bottleneck that drove many cattle producers toward financial ruin. Harvest-ready cattle backed up in feedlots as packers were banking obscene profits. That scenario spurred producers to explore building their own packing plants, bypassing the bottlenecks and keeping the profits for themselves.

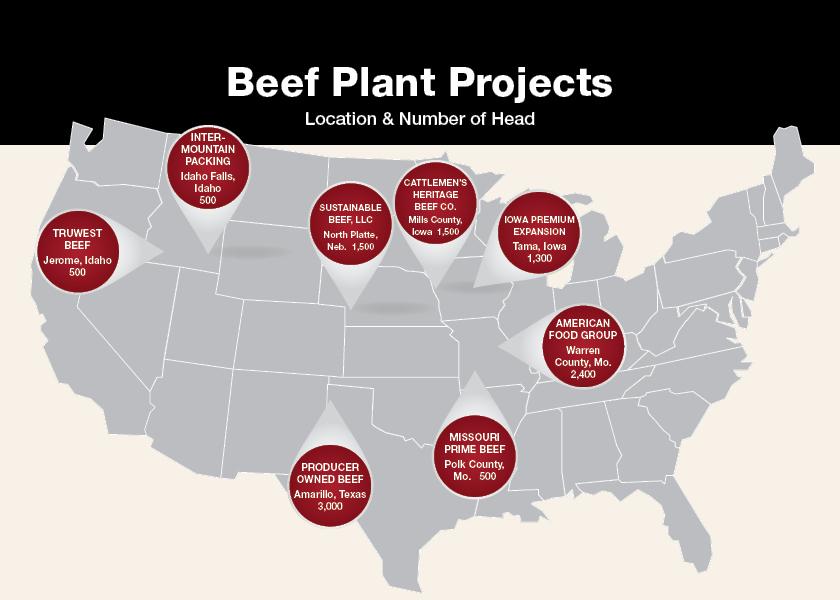

Fast-forward three years and progress toward increased packing capacity has begun. At least eight projects that have the potential to add 11,700 head to daily harvest capacity are in various stages of completion. The three smallest of those projects, all with a daily harvest of 500 head, are operating now.

BEEF PLANT PROJECTS

TruWest Beef | Jerome, Idaho | 500

InterMountain Packing | Idaho Falls, Idaho | 500

True West Beef, a division of AgriBeef, and Intermountain Packing, both began operations last year.

Sustainable Beef, LLC | North Platte, Neb. | 1,500

Sustainable Beef LLC, broke ground on its $325 million project in October of last year and expects to open in early 2025. A timeline of the project underscores the complexity of such a venture. Sustainable Beef CEO David Briggs told Nebraska Public Media earlier this year that Nebraska ranchers and cattle feeders began organizing in 2020. From that point it took 18 months, 18 public hearings and seven different public agencies for the project to gain government approval.

Producer Owned Beef | Amarillo, Texas | 3,000

In Amarillo, dirt work has begun at an 1,108-acre site east of the city by a group of Texas ranchers and cattle feeders. Producer Owned Beef is touted as a $670 million state-of-the art beef processing facility to “rebalance the scales for producers.” The cattle producer owners will receive a percentage of wholesale beef prices for the cattle they supply and a share of the profits from the plant.

American Food Group | Warren County, Mo. | 2,400

American Foods Group (AFG) broke ground in September 2022 on an $800 million facility, roughly 50 miles from downtown St. Louis. The facility will have daily capacity of 2,400 head and will be capable of processing cows and fed cattle. AFG is currently the nation’s largest cow packer, processing about 21% of U.S. beef and dairy cows with daily capacity of 5,550 head at four locations.

AFG has come under recent scrutiny from local residents voicing concerns to the Missouri Department of Natural Resources about the meatpacker’s plan for processing wastewater from the slaughterhouse. The comments are part of a public record being compiled by regulators as they assess the environmental impact of the project.

Missouri Prime Beef | Polk County, Mo. | 500

Missouri Prime Beef began operating in 2021 and was recently acquired by STX Beef Co., (formerly Sam Kane Packing) Corpus Christi, Texas.

Cattlemen’s Heritage Beef Co. | Mills County, Iowa | 1,500

Cattlemen’s Heritage Beef Company is a planned $520 million project on 132 acres. Ag Secretary Tom Vilsack visited in June to deliver a $25 million grant from USDA as part of an initiative to boost competition in the meatpacking industry.

Iowa Premium | Tama, Iowa | 1,300

Construction on the 1,300 head per day expansion of Iowa Premium is on hold indefinitely. A source familiar with the operation told Drovers rising construction costs and the declining availability of cattle prompted parent company National Beef to pause the project.

POTENTIAL HEADWINDS

Each of the eight new ventures is unique in its own way, though all aim to produce high-quality beef in a sustainable manner. They also aim to be more efficient and more environmentally friendly. Yet none can escape the glaring realities that all beef packers will face the next few years.

Chief among those challenges is the shrinking cattle herd in the U.S. and how well startup packers can compete. That fact becomes even more pronounced as cowherd production efficiency improves, says John Nalivka, president, Sterling Marketing, Inc., Vale, Ore.

“Production efficiency is a key issue driving structural change,” he says. “The U.S. cattle herd peaked at 132 million in 1975 and produced 24 billion pounds of beef. Our herd is now one-third smaller, and we will produce 27 billion pounds, or 15% more than 1975.”

Efficiency gains are even more pronounced in the current cycle. At the beginning of 2023 the herd size was roughly the same as in 2015, which was the smallest cattle inventory since the early 1950s, yet beef production this year will exceed 2015 by three billion pounds.

“We will see a slower herd buildup than in previous cycles,” Nalivka says. “Since the peak inventory of 132 million head in 1975 and subsequent liquidation down to 110 million, every buildup has peaked at a lower number than the previous peak. This time will be no different.”

As a whole, the beef industry does not need additional packing capacity. That’s not an argument against any of the new ventures, Nalivka says, but a reality that must be factored into their business plans.

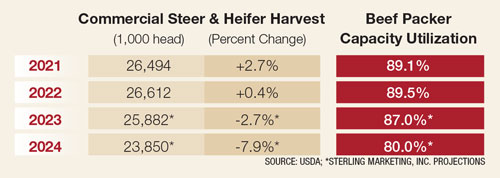

Sterling Marketing has calculated packer capacity utilization weekly and annually since 1988, and the current data provides a caution flag for the startups.

“Beef packer capacity utilization will be about 87% this year, and I project it will be about 80% next year, without any additional capacity added,” Nalivka says. “The drop at cow plants will be even greater.”

The precipitous drop comes from a projected 7.9% decline in steer and heifer slaughter in 2024, which, if realized, would be one million head fewer than 2023, according to Sterling estimates. Couple that with the fact beef packers need capacity utilization to run from 90% to 94% to capture efficiencies of size and maintain profitability.

“This cycle will produce further structural adjustments in packer capacity,” Nalivka suggests. “The successful packers — either the current ones or the new ones — will develop their margins on value-added further processed product, coordinating that with their slaughter capacity.”

Or, as he calls the strategy, “The right cattle for the right market.”