CAB Insider: Cutout Values Responsive to Conditions

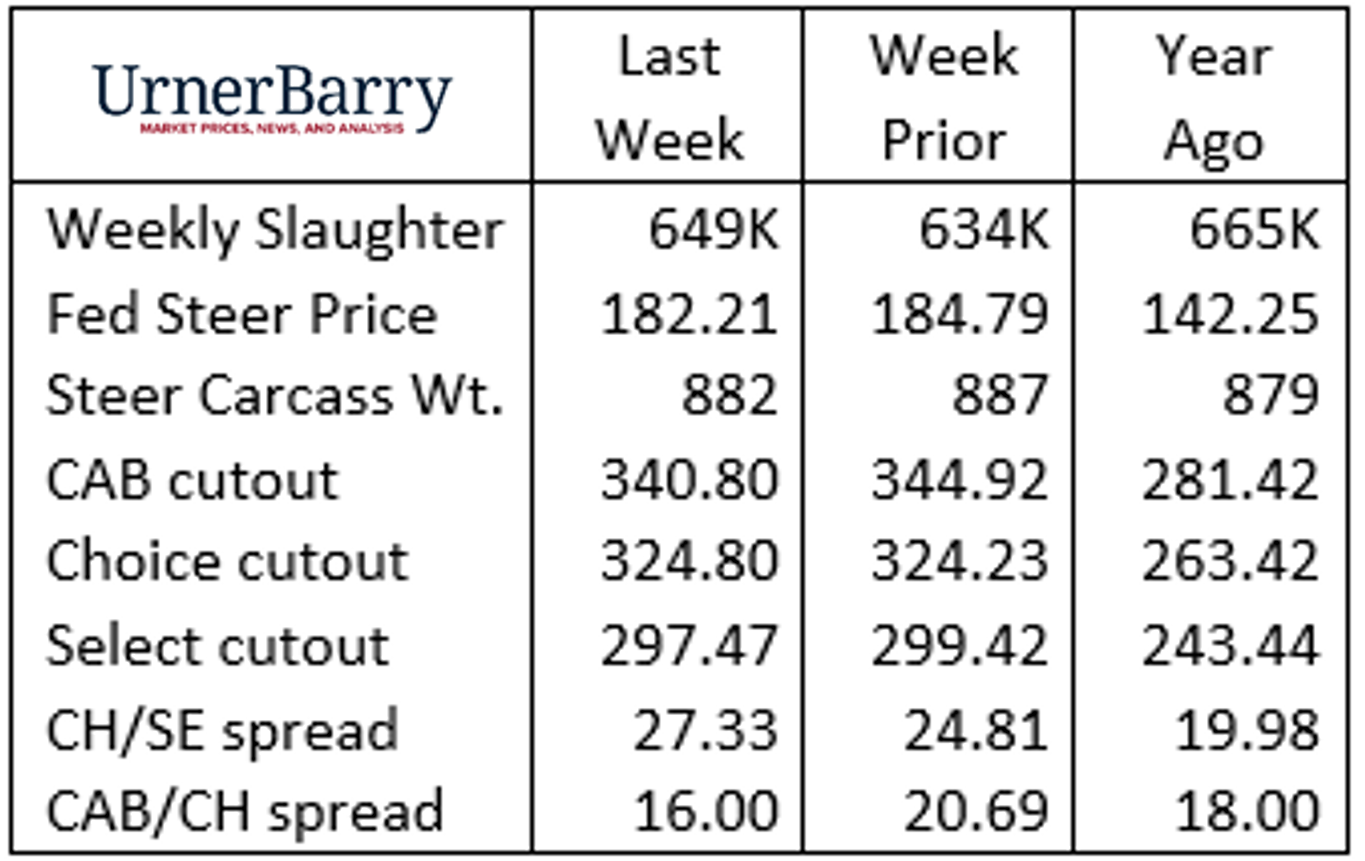

Two weeks ago fed steer prices reached a new record at $188.75/cwt. That was the culmination of a five week, high velocity climb taking the market $14.82/cwt. above the momentary setback the week of May 1.

That trajectory, fueled by strong demand and restricted head counts, was predestined to hit the seasonal ceiling. The only open questions were the precise timing of the rally’s end and at what price.

The question was answered as quickly as one can say “seasonal trend”, as spring holidays wrapped up with Father’s Day and cutout values eyed the expected downturn. In the ensuing two weeks fed cattle values retreated by $6.54/cwt. to last week’s $182.21/cwt. average.

The expectation for lower trending cutout values preceded the onset of the downturn, as the Choice cutout continued to rise until June 20, the week following the fed cattle market reversal.

One shouldn’t overlook the importance of the weekly slaughter volume size plays in cutout values and cattle prices this season. Packers have seemingly done their diligence in slowing the slaughter pace in an effort to manage cattle cost. However, the cattle supply has dictated this scenario with fewer head available. Yet the smaller boxed beef volume has supported both a record cutout and fed cattle values for the period.

Last week’s increased slaughter volume was a welcome reprieve with a 649K federally inspected total, bookending a six-week period averaging just 622K per week. That’s 32,000 head per week fewer than that period a year ago, a 4.8% deficit. Packer margins are on the rise and slaughter volume should remain higher than the recent trend as a result.

Specific to fed cattle alone, the six-week average head count has run at 489K per week compared to 514K for the period in 2022, also a 4.8% reduction year on year.

Cutout Values Responsive to Conditions

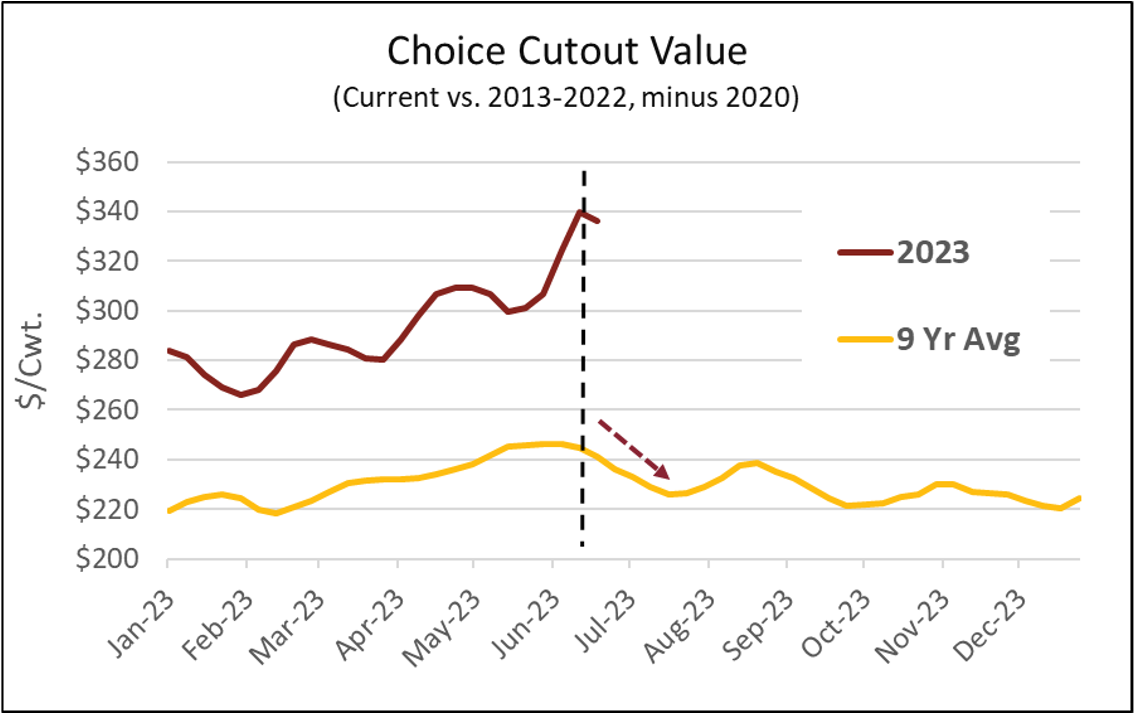

Few things are entirely predictable in the cattle and beef markets but the summer seasonal price decline in fed cattle and cutout values are very common as we get closer to July.

The Choice cutout value chart depicts the alignment of the recent price downturn and averages from 2013 through 2022, excluding the 2020 pandemic year. The seasonal expectation is for a lower trend into summer until upticks in late July give way to a more notable demand bump ahead of Labor Day. Everything is on pace, and we’d anticipate fed cattle prices to follow suit. Of course, any number of factors can impact a seasonal trend.

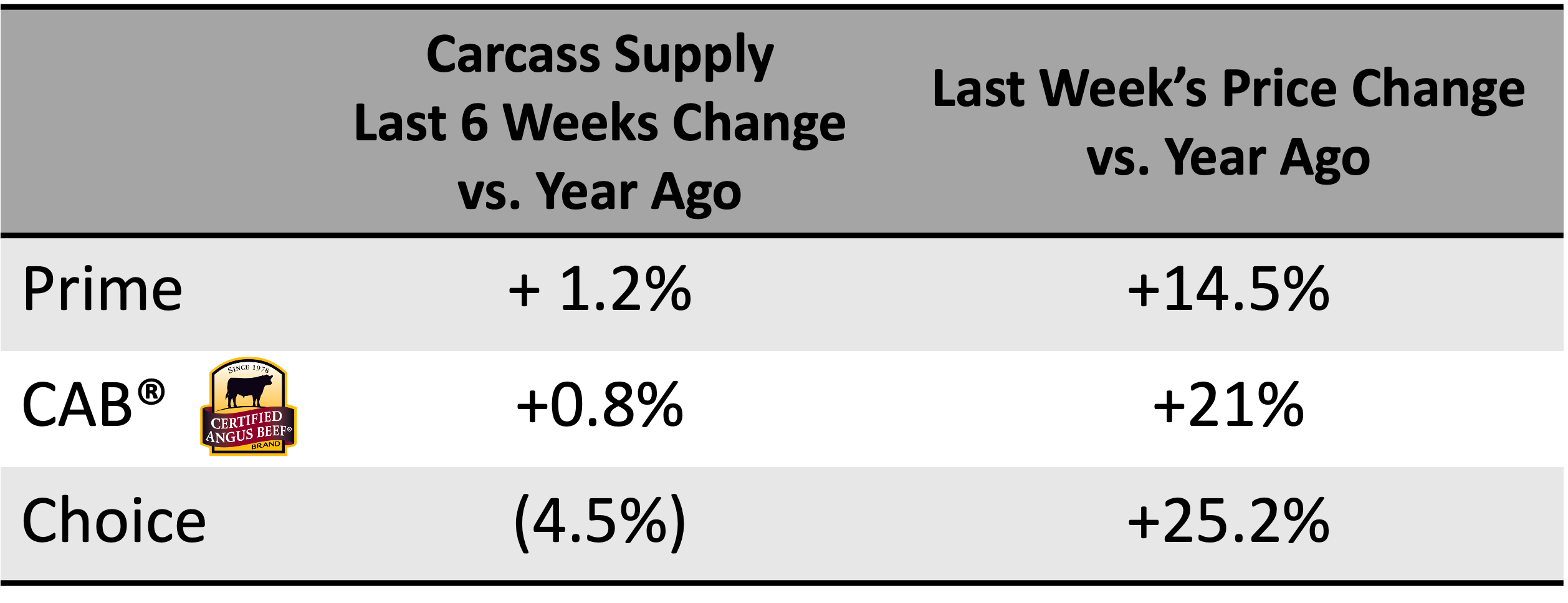

Shifts in carcass quality trends are more interesting lately even as cutout values cool just a bit. The outlook for a sharp decline in Prime carcass counts we projected in late May has not been fully realized. There has been a dip in total quality, but so far it has materialized in the Choice grade instead. The Texas packers’ average Choice grade has corrected from an erratic spike to 69% in May, dropping to 61% last week, 3.5 points below a year ago. Kansas Choice and Prime grades are holding even with last year while the Nebraska Prime grade has pulled out of a four-month deficit below the 2022 trend line, now 1.5 percentage points higher than a year ago.

The summary position for Prime is a national average of 8.8% versus 8.0% a year ago. With smaller slaughter head counts and carcass weights accounted for, the past six weeks are estimated at 1.2% more Prime carcass tonnage than a year ago. As well, the Prime cutout premium above Choice has diminished to $19.55/cwt., less than half of its position the same week in 2022. The current $346.76/cwt. wholesale Prime cutout value is 14.5% higher, year over year. The uptick in estimated product volume is very slight while the increased cutout price is significant. The resulting demand evaluation is quite strong for Prime.

At the same time, the last six weeks estimated Choice production is down 4.5%, year over year. The Choice cutout at $327.21/cwt. in the latest full-week data, up 25.2% compared to a year ago. So, the larger Choice price percentage increase is supported by a larger recent supply dip for Choice product than that seen for Prime.

CAB carcass supplies in the last six weeks are slightly higher than a year ago, up just 0.8%, or 1,000 head per week. The CAB cutout is up 21% in last week’s data compared to a year ago, indicating robust demand growth in the face of steady supply. The CAB cutout premium over Choice is $16/cwt., versus $18/cwt. a year ago.