Drought's Lasting Impact

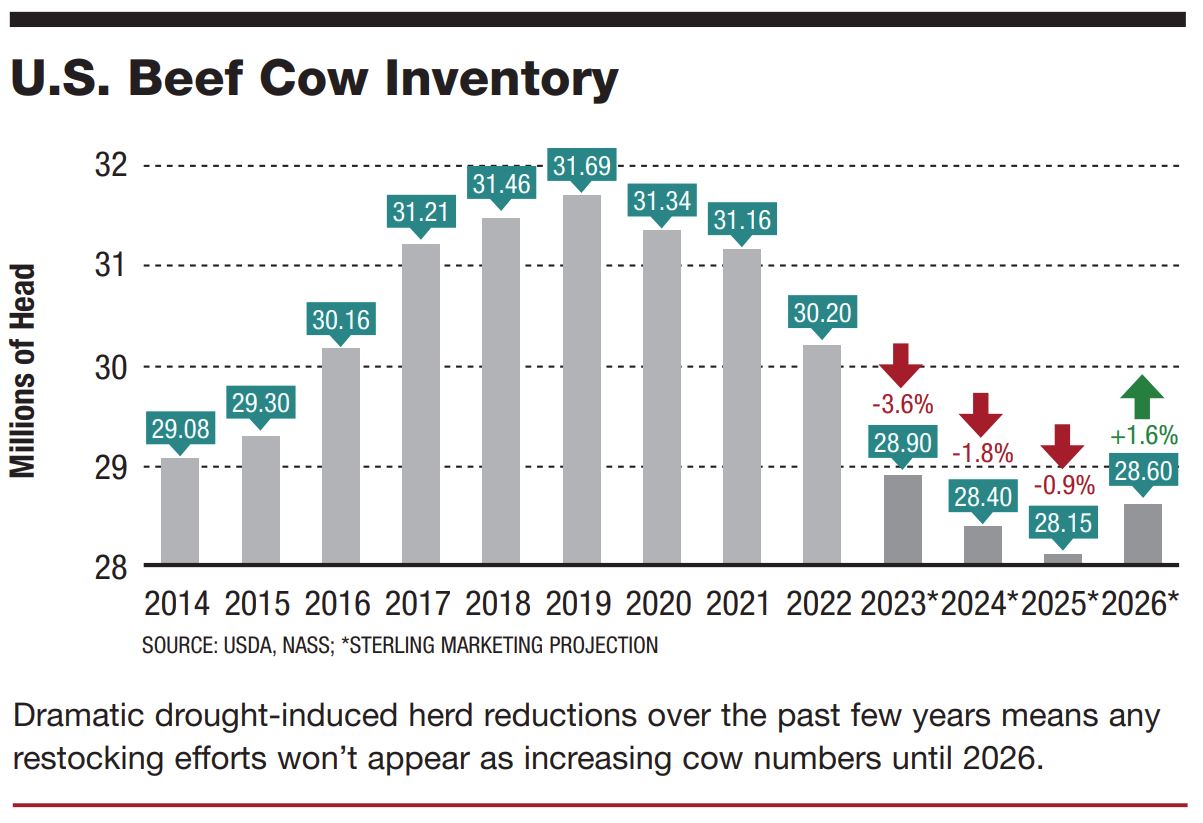

Keenly aware marketing leverage had swung in their favor as the calendar turned to 2023, cattle producers anticipated the opportunity to heal financially. Reminiscent of the previous price boom in 2014, widespread drought fueled cow culling at historic levels and tightened feeder cattle supplies to 60-year lows.

This year’s market, however, is not, as Yogi Berra once said, “déjà vu all over again.” While many similarities exist — smaller supplies, higher prices and robust ranch profitability — today’s beef industry faces many differences, some with long-term implications for the industry as a whole.

“Quite a bit of difference,” says Chris Swift, Swift Trading Co., Brentwood, Tenn., regarding the markets a decade apart. In Swift’s opinion at least two major factors exist between the 2013/14 market and the one unfolding this year.

“The biggest difference is the economy and the direction (the federal government) is taking with money printing,” Swift says. “Starting in 2008, the U.S. began a massive stimulus program that printed money and lowered interest rates. I believe in that time frame some producers held back cows that should have been sent to slaughter because the prospect of another calf was so valuable.”

In 2023, however, Swift says economic policy is now trying to take money out of the system. He believes efforts by the federal government to manage inflation will impact the beef industry. As Swift describes it, the battle against inflation (too much money for the amount of goods and services) comes at a time when cattle inventories are at cycle lows.

“We haven’t ended the liquidation phase, yet.” Swift says. “But as the industry tries to expand, I believe we will be expanding into a shrinking money supply.”

Higher interest rates will hinder producer efforts to restock their herds, he believes, even as prices encourage expansion. Swift also projects stakeholders up and down the chain will make adjustments to cope with higher beef prices. One adjustment to smaller cattle supplies is for feedlots to grow cattle to heavier weights, a trend already occurring in some instances.

A second response to the tightening supply of cattle could be a reduction in feedlot capacity.

“We’re seeing a lot of pen space open up,” Swift says. “Cattle feeders continue to bid against one another for inventory and keep occupancy rates profitable. We may see some of the corporate yards buying smaller yards and mothball them, shut them down, reduce the bunk space.”

COUNTING HEIFERS

While current prices clearly signal herd expansion is warranted, the industry remains crippled as the drought is far from over and showing signs of expansion into the Corn Belt. Meteorologists at NOAA’s Climate Prediction Center believe the U.S. precipitation outlook is improved as El Niño conditions — the warming of surface waters in the eastern tropical Pacific Ocean — have emerged.

But the El Niño impact is likely negligible until late this year.

“In the past we assumed producers would respond with expansion,” says Scott Brown, University of Missouri livestock economist.

“That may happen, but drought has expansion stymied for now.”

As of May, cow slaughter was down about 11% from the previous year, not enough of a decrease to ensure the end of liquidation. In 2014, for instance, beef cow slaughter dropped over 18% from the previous year.

“I suspect that the ongoing drought is masking continued liquidation in some areas up to this point,” says Derrell Peel, Oklahoma State University livestock economist. “While signs are encouraging that the drought will continue to fade through the year, more beef cowherd liquidation is likely in 2023.”

USDA’s Jan. 1, cattle inventory put supplies of bred heifers at 5.16 million head, down 6% to the lowest inventory since 2011.

“The low bred heifer inventory combined with the relatively slow reduction in beef cow slaughter makes additional beef cow liquidation this year probably unavoidable,” Peel says. “In other words, if drought conditions continue to improve, 2024 will probably be the low point of the herd similarly to 2014, albeit at even lower beef cow inventories.”

Additionally, the inventory of heifers in feedlots remains high, though declining. Heifer slaughter through May was fractionally higher year-over-year on top of the large heifer slaughter last year.

“Heifer slaughter in 2022 was 30.6% of total cattle slaughter, the highest proportion since 2005,” Peel says. “Heifer slaughter is expected to decrease through the year but, like beef cow slaughter, at a relatively slow rate. Heifer retention likely will begin in earnest this fall and heifers to be bred in 2024.”

DEMAND REMAINS KEY

While producers fret over rain and forage supplies, retailers and food services worry about inflation. Beef has been a main attraction but rising prices and a widening spread between beef and both pork and chicken is concerning. For instance, Brown says consumer demand could become a significant concern if smaller beef supplies remain an issue for too long. While he sees less substitution by consumers for meats today than 20 years ago, he’s concerned continued price increases for beef will lead to more substitution.

“When prices for meats get far enough apart we will see restaurants adjusting their menus to feature lower priced products,” Brown says. “When they do, it’s often hard for them to switch back, and that could be problematic for beef.”

Regarding wholesale beef prices, Brown says they reached their highest June price level on record last month, excluding the 2020 COVID-19-influenced market.

“I don’t know where the top is, but we’re not done. It’s only going to get tighter,” he says.

USDA’s forecast for beef calls for a 2-billion-pound decline, which is “territory we’ve never seen in terms

of consecutive years with significant decline.” Brown says.

While much uncertainty remains over when and if expansion will begin, it appears likely that the overall industry will be smaller.