Speer: Rebuilding the Cowherd: Past Is Prologue

Cow Math: One of my columns last September focused on 2022’s beef cow slaughter rate and subsequent starting inventory in 2023. The data indicated cowherd inventory would land somewhere around 29M cows to start the year. USDA pegged the number at 28.9M cows.

More Questions Than Answers: The selloff leaves the industry with lots of questions going forward. Most important, when might cow/calf operations begin the rebuilding process? Lots of variables will ultimately dictate the answer including weather, input prices, and interest rates.

This contraction may be prolonged versus prior cycles. Consequently, producers are also very focused on prices. Just how high will markets get? And for how long? There again, numerous factors drive the outcome – but however it plays out, producers are cautioned to not be complacent along the way. Things that never happen, happen all the time. And risk management – no matter the size of the operation – is more accessible than ever.

Business: Equally important, are questions of how the business might change in the coming years. As noted in a previous column, one of the major drivers will be the influence of BeefX (beef-on-dairy) cattle in the supply chain: “What used to be considered a highly discounted after-thought (straight dairy steers/heifers) is rapidly transforming into a meaningful source of production (BeefX steers). That prospect becomes even more important amidst tighter cattle supplies ahead.”

Turning our attention to the beef cow herd, if this time is anything like 2014, several key indicators provide some insight into what the rebuilding process will look like. Every sell-off enables producers to make key selection decisions – it’s ultimately an opportunity to change and/or make the herd better (both individually and collectively). That has huge influence on the supply chain going forward.

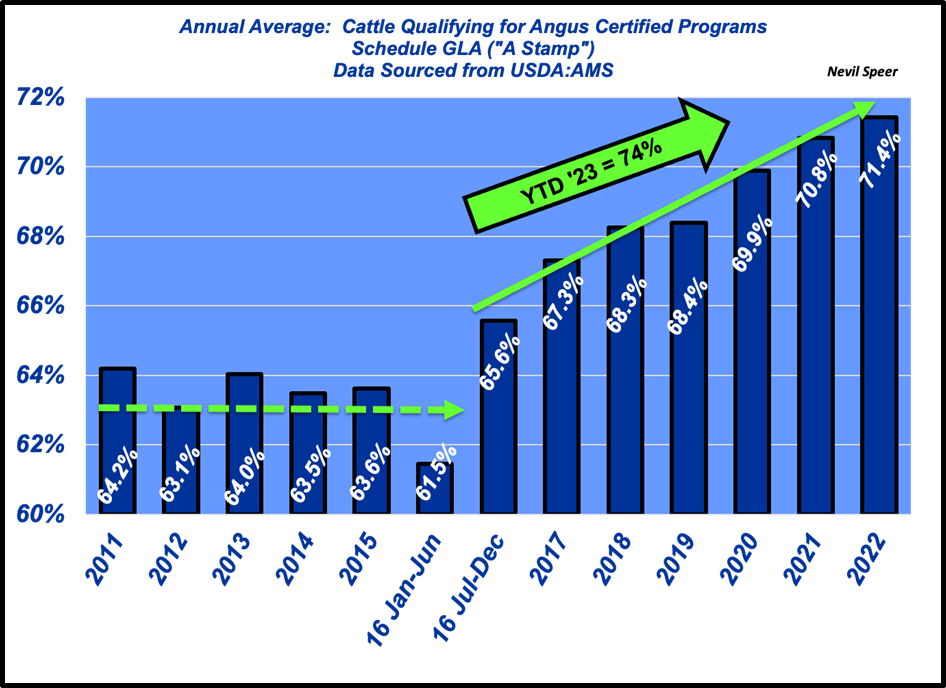

GLA: The first graph highlights annual average of USDA’s percentage of “cattle offered under Schedule GLA identified.” It represents cattle receiving an A-Stamp and, most notably, thus eligible for CAB.

The A-stamp rate averaged ~63% through 2015. But from there the trend turned markedly higher. The first calf crop coming out that sell-rebuild process started hitting the market in 2016. The percentage subsequently jumped to nearly 67% going into 2017 and his been rising ever since (even encroaching 75% in recent weeks).

It’s likely two things are occurring: One, part of the increase is greater presence of BeefX calves in the supply chain. And two, beef producers, in response to the market, are increasingly producing cattle eligible for value-added opportunities throughout the value chain.

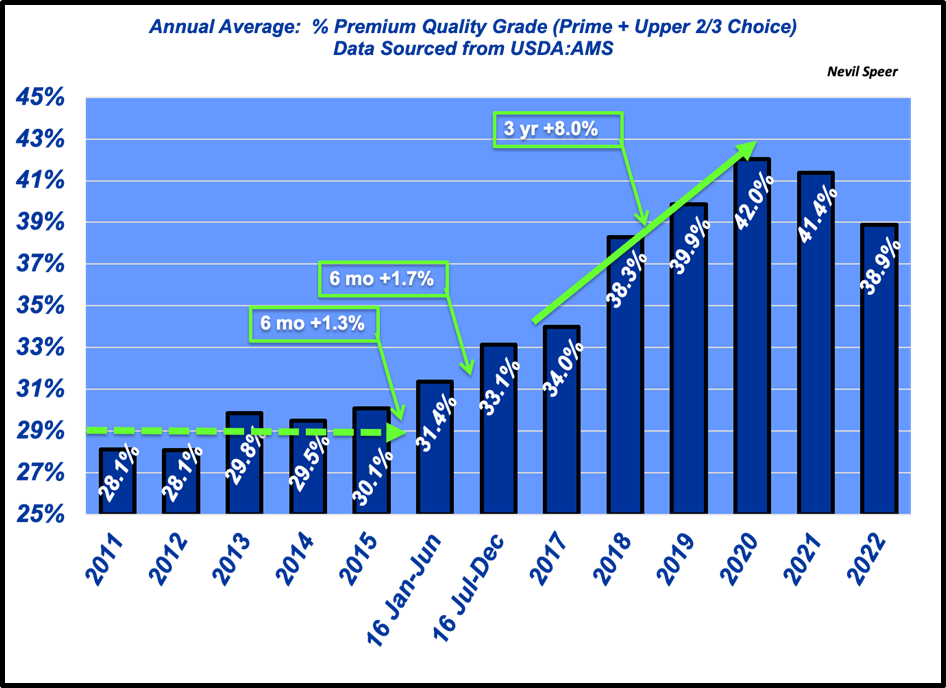

Marbling Is The Anchor: In conjunction with the GLA schedule, USDA also reports percentage of cattle that attain premium Choice (upper 2/3) quality grades. The second graph details the percentage of those cattle plus percentage grading Prime. The distinction is important – the likelihood of a favorable eating experience for Prime and Upper Choice ranks well ahead of a commodity Choice product.

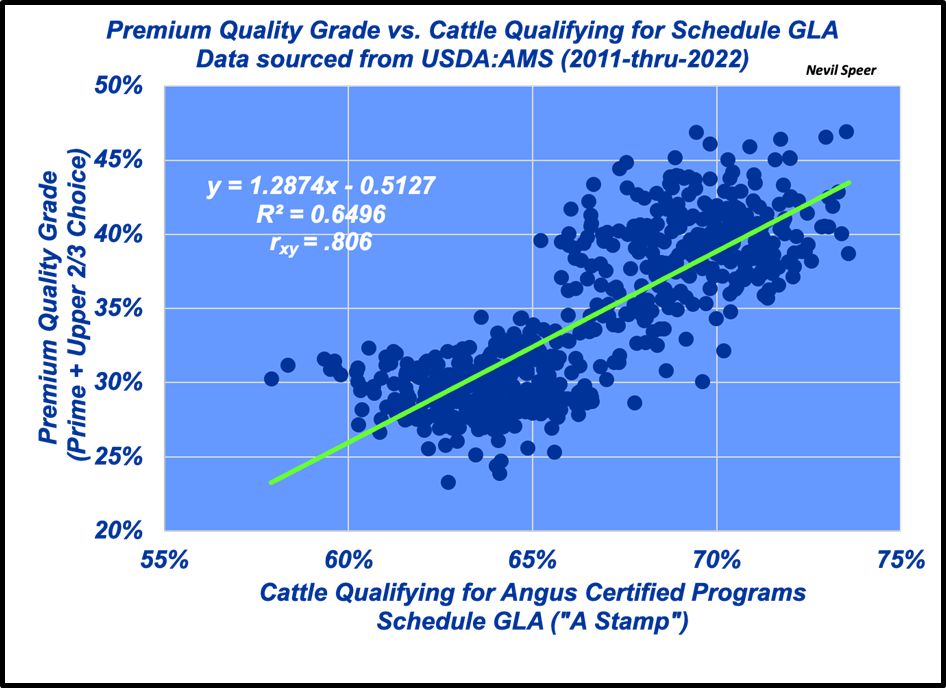

Note the national average hovered around 29% through 2015. However, during the next five years (’16-thru-’20) cattle possessing modest-or-better marbling increased roughly 2.5% per year and ultimately eclipsed 40% of the total slaughter mix in 2020. (Tying this together, for reference see also third graph.)

What’s Next?: As alluded above, lots of uncertainties are circling around the business. But given the data, it’s clear the last cycle launched the business towards achieving unprecedented levels of beef quality. None of that happened by chance; it’s occurred because of economics.

And based on recent consumer data from Midan Marketing, that trend is here to stay. Market signals are driving the supply chain to become even more channeled and intentional going forward in order to secure beef demand and facilitate value to consumers. As such, when it comes to the next rebuilding phase, the past is prologue.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.