Speer: Blocking and Tackling

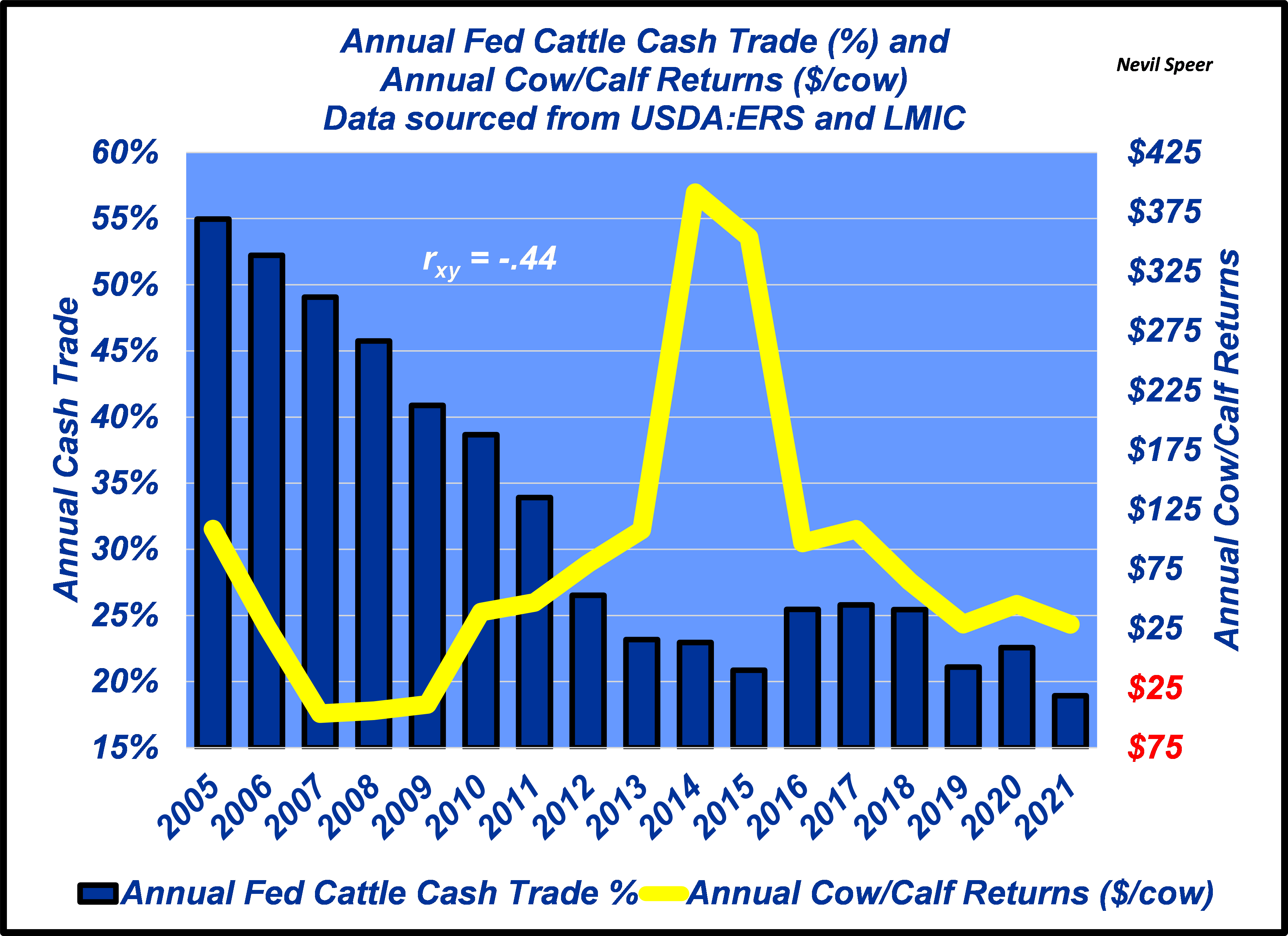

“Fix”: This is the third column in a series focusing on cow/calf profitability. The basis for the series stems from commentary about the topic rallying producers to, “…fix your industry’s broken market”. A subsequent press release further proclaims, “We must fix this with legislation.” The press release cites USDA ARMS cow/calf returns as the foundation for such an appeal; returns are down sharply from the ‘14/’15 peak because of declining cash trade in the fed market.

Bad Logic: Before we go deeper into the topic of profitability let’s review the first two columns:

- One: Any claim of dwindling cash trade negatively impacting cow/calf producers is unfounded. In fact, returns were peaking in ’14 and ’15 while cash trade percentages were plummeting. (see first graph)

- Two: As noted, the 2008 ARMS survey is the foundation for the commentary. However, the same survey led to USDA explaining: “…operators of beef cow-calf farms have a diverse set of goals for the cattle enterprise.” Meanwhile, USDA NAHMS survey indicates most producers do NOT consider the operation to be a primary source of income.

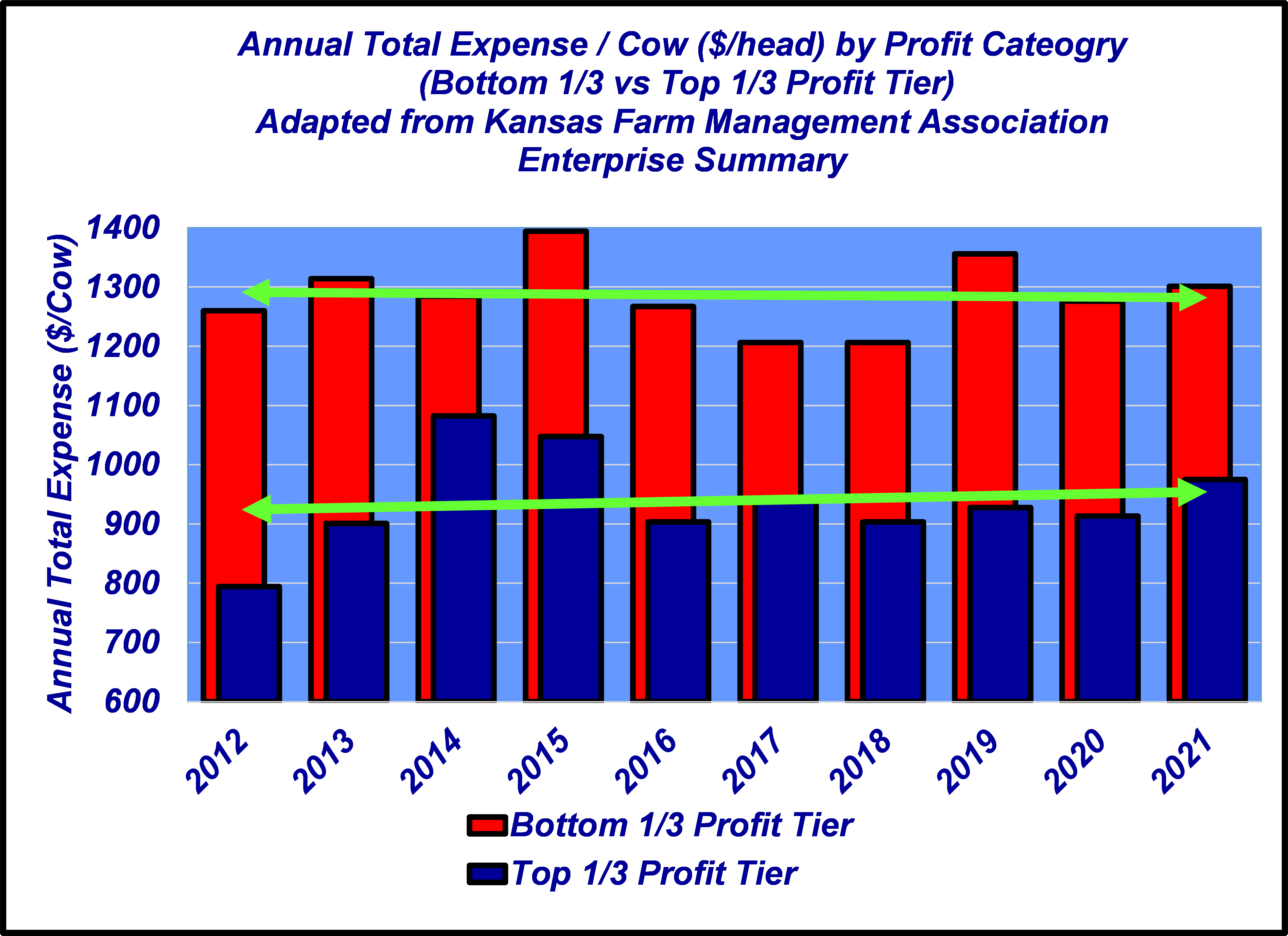

Revenue vs Costs: Receiving a sale check is psychologically rewarding. Therefore, the revenue side of the business receives lots of attention. Conversely, cost management is much less obvious. Thus, costs often get overlooked.

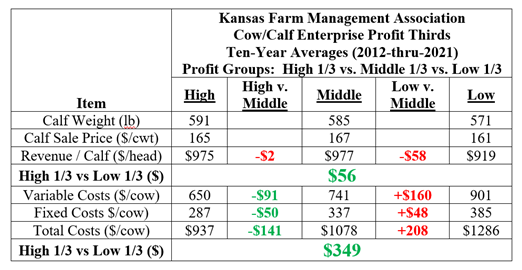

The Kansas Farm Management Association (KFMA) describes the contrast best: “…while both production (weight) and price do impact profit, they are much less important in explaining differences between producers than costs.” And the differences are huge. The table below outlines ten-year averages from KFMA for calf revenue and cow costs.

The revenue difference between the high-1/3 versus the low-1/3 profit group is $56/head. High-profit producers wean slightly heavier calves (+20 lb) and receive only marginally better prices ($4/cwt). But the difference on the cost side is six-to-one versus revenue! High-profit producers consistently possess nearly a $350/cow cost advantage versus the low-profit group (see second graph).

Risk Management: Typically, the phrase risk management focuses on market risk and implementing measures (i.e. futures, options, LRP) to protect against downside moves. Those are important tools for managing the business.

However, it’s also important to recognize there are additional layers available to buffer the business against external risk. (Because as Scott Sagan, Stanford University reminds us: “Things that have never happened before happen all the time.”). Those shock absorbers include:

1. managing long-term debt interest rates,

2. paying down debt,

3. increasing reserve of working capital, and

4. managing costs.

Low-cost / high-profit producers prove much more resilient during times of market stress.

Blocking and Tackling: The level of cash trade makes no difference to the fed market (see 55 – 0). In turn, there’s no connection between cash trade and feeder cattle. And ultimately, that means the level of negotiated cash trade doesn’t influence cow/calf profitability (The Better Investment).

That’s not to say producers don’t benefit from more revenue. But they don’t need a legislative “fix” (Pan Beats Knife); that’s just a wild-goose chase that potentially conjures up even more complications for the industry (Chessboard of Producers).

The foundation of long-run profitability, and capacity to counteract business risk, is largely determined by correcting shortfalls on the cost side. That seems simplistic and mundane. But it all boils down to the fundamentals - blocking and tackling. Discipline and consistency towards that end compounds over time and makes all the difference!

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.