Speer: Let’s Make A Deal!

Suppose you’re a contestant on Let’s Make A Deal. Behind one of the doors is a car (the prize); behind the other two are goats. You choose door #1. Door #3 is opened and reveals one of the goats. Monty Hall then asks if you want to stick with your original choice door #1or switch to door #2. What should you do? The probability assigned to the decision-making process is commonly referred to as “The Monty Hall Problem”.

Let’s assign that model to the beef industry. However, the difference here being we know what’s behind each door. But even with that knowledge, will we choose correctly?

Behind door #1 is a commodity-oriented business. It’s defined by an adversarial, win-lose, zero-sum, short-term perspective. The orientation is inward-looking with little regard for the consumer. Participants possess a fixed-pie perspective and battle over how it gets sliced.

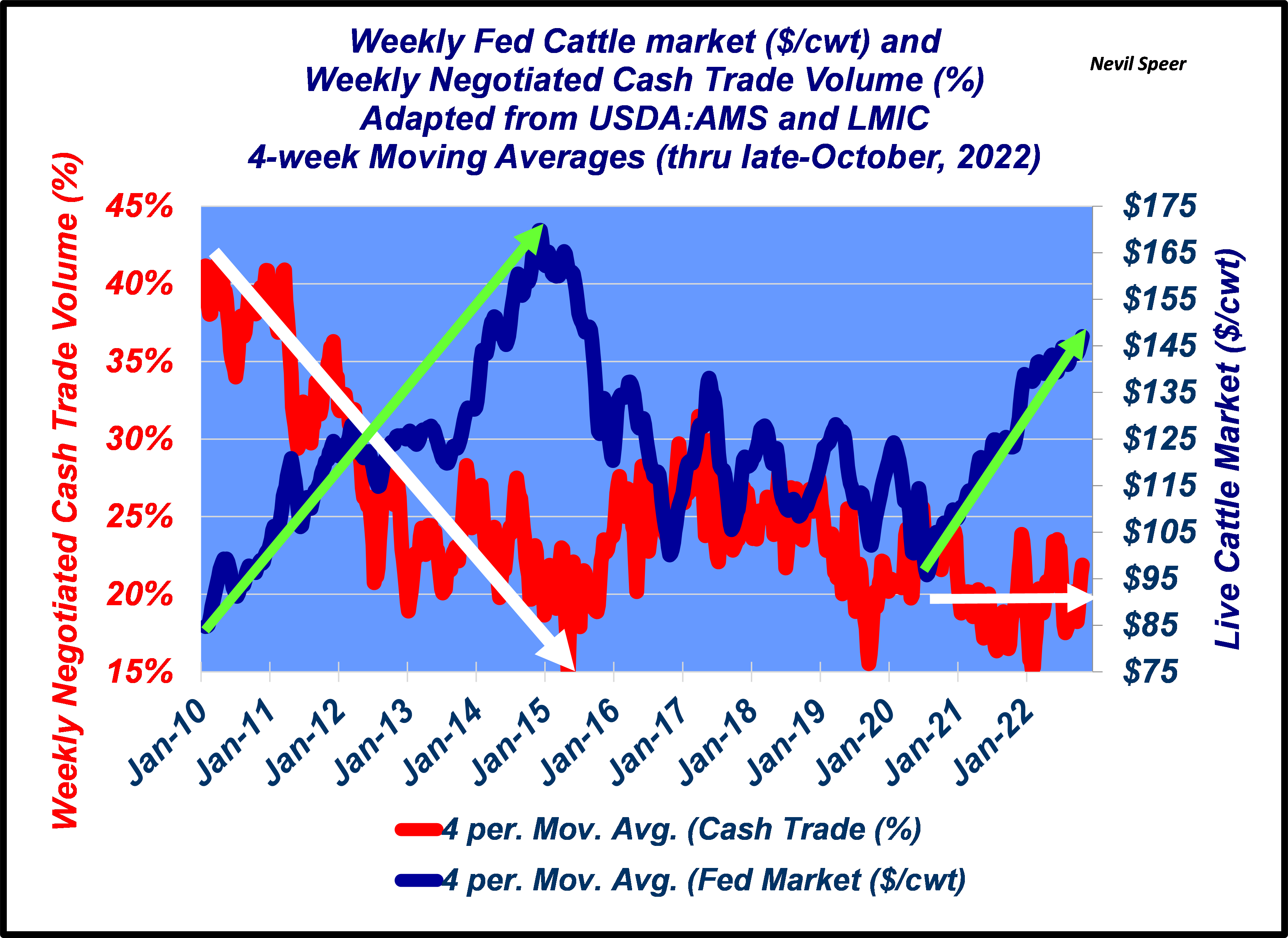

And that perspective drives proponents to believe that government regulation will make producers better off. The first graph below addresses that thinking. It outlines the time trend of negotiated cash trade and the fed market. Note that cash volume bottomed in 2015 while the fed market was surging. More significant, note the trend during the past several years. The percentage of cash trade has averaged 20% while the fed market has tacked on better than $55. (see 55-0)

And as noted in my previous column, the long-run correlation between cash volume and fed prices is NEGATIVE .45. That doesn’t imply less cash volume drives prices higher (i.e. causation). But it does negate any suggestion more “cash sales” means “your market’s normally gonna be higher.” Given the data, cash mandates aren’t going to benefit producers in any meaningful way.

Behind door #2 is a consumer-oriented business. It’s defined by a synergistic, win-win, positive-sum, long-run perspective. The orientation is outward-looking and emphasizes customer feedback to ensure it remains relevant in the marketplace. Participants concentrate effort towards growing the pie in order to get bigger slices over time.

Champions of the consumer orientation believe the path to prosperity occurs via the free enterprise. Connecting the dots between 1. cattle and 2. beef and 3. consumers is the best (and only) way to generate more revenue.

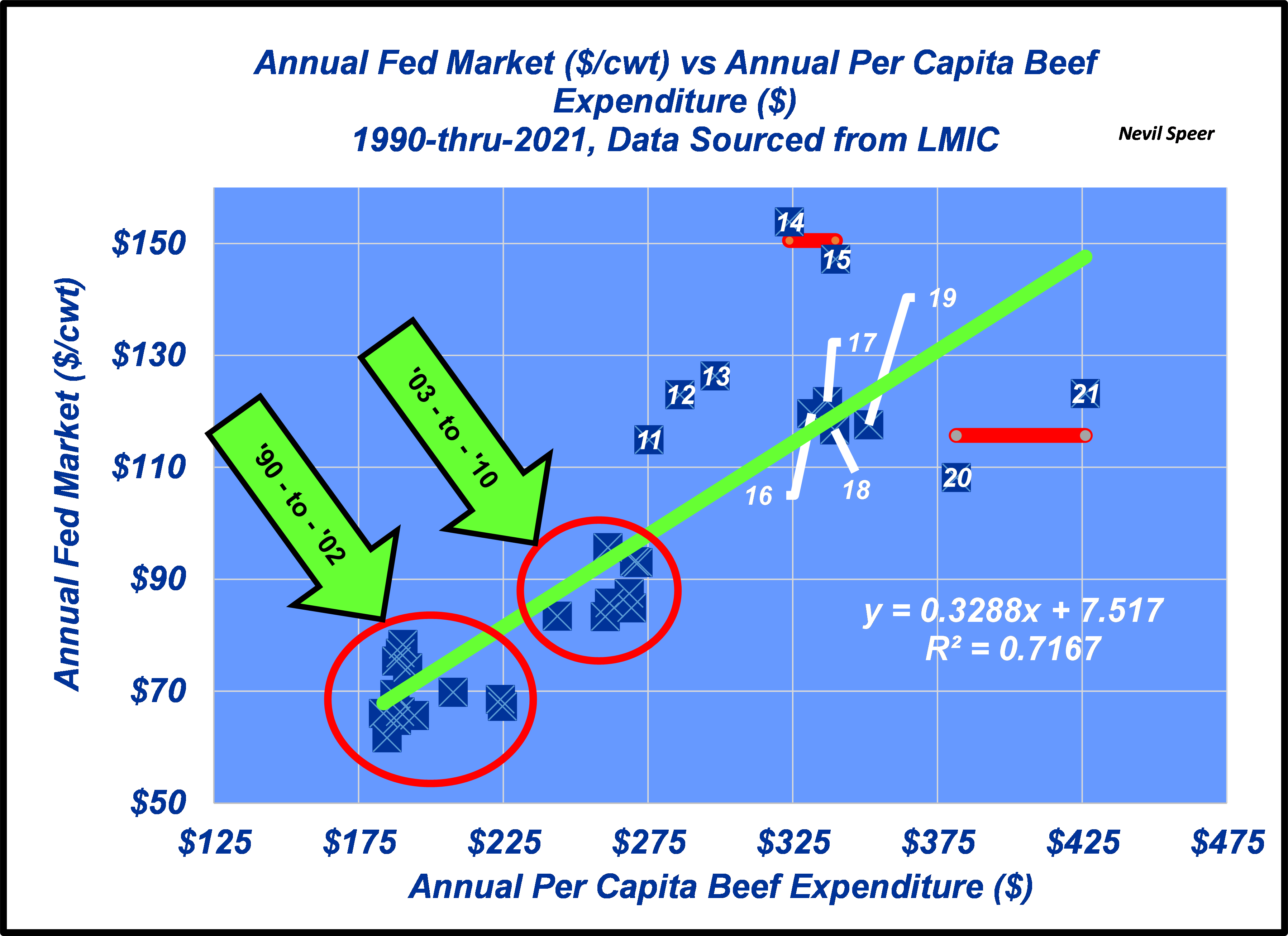

That’s best exemplified by the second graph below. The data represent the annual fed market averages versus spending between 1990-and-2021. More spending portends better prices. The correlation between the two is nearly POSITIVE .85! As such, nearly three-fourths of the annual variation in the fed market is due to differences in consumer spending – it’s the overwhelming driver of better prices over time (not cash volume)!

Those principles are further underscored by ongoing trends in the marketplace. That is, consumers are trading-up and pursuing of higher-quality beef products. That trend will only strengthen over time. And possesses real opportunities for producers. (see: Real Money for Real Value)

To that end, in response to one of my previous columns, one reader shared his company’s perspective: “Our belief is this economy has even more difficulties ahead but there will continue to be support in the premium beef category.” Meanwhile, another veteran analyst shared this important observation: “As we work towards all these new plants coming on-line that are all based on a premium product foundation it is going to be increasingly important for cow/calf producers to be aligned with an alliance.”

The contrast is stark. Behind one door is a commodity business, behind the other door is a consumer business. Goat or car, which one will you choose?

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.