Speer: Data-driven Decision Making (Or Not…?)

I recently had opportunity to make a presentation for participants in the American Junior Simmental Association Steer Profitability Competition. The discussion focused on data-driven decision making. The importance of that process is best characterized by Edwards Deming – often described as the father of quality management: “Without data, you’re just another person with an opinion.”

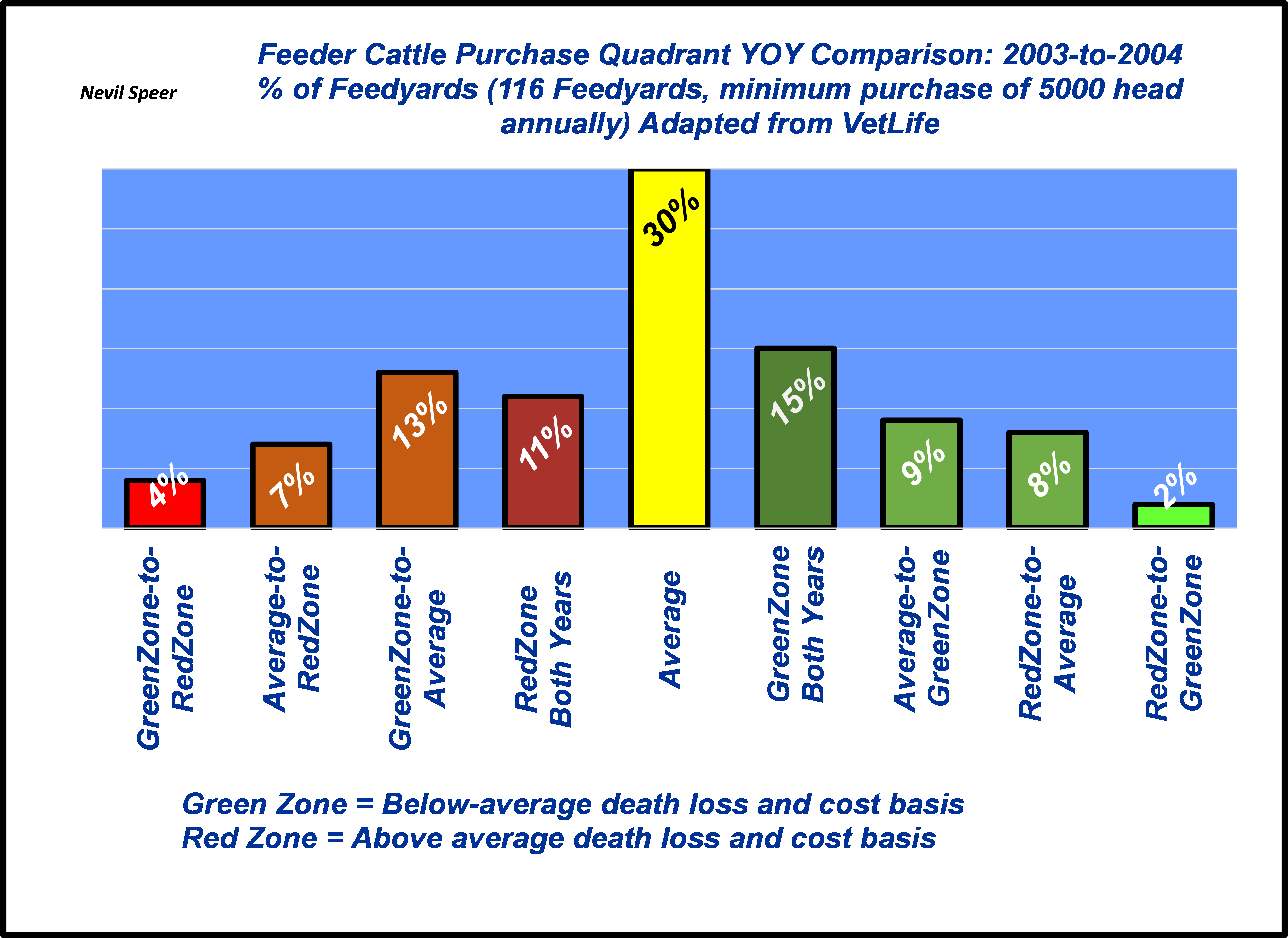

One of my favorite illustrations of this process stems from feeder cattle purchasing practices in the former VetLife Benchmark set. The example includes 116 feedyards purchasing a minimum of 5,000 head in both 2003 and 2004 (and while the data is from nearly two decades ago, the principles remain the same). The variables of interest being purchase price and death loss.

The feedyards are categorized according to their relative position among the group (the descriptors are mine):

- Green Zone: below average purchase cost AND below average death loss.

- Average: cattle purchased with either higher costs and better-than-average death loss, or below-average cost but higher death loss.

- Red Zone: cattle are purchased on wrong side of both profitability drivers: above-average cost and above-average death loss.

Purchasing results were shared with producers at the end of 2003 – and then again in 2004.

The objective is to utilize the benchmarking perspective to improve or solidify internal processes to be more successful in the subsequent year. The results are highlighted in the attached graph. In a breakeven, commodity business with a normal distribution of winners and losers it’s inherently expected most (30%) feedyards remain in the middle both years. But what about the remainder of operations on either side of average; where did they end up in 2004 compared to 2003?

First, the positive outcomes:

- 15% were in the green zone in both ’03 and ’04; these feedyards possessed systematic practices that enabled them to establish an advantage in both years.

- Nearly one-in-five (19%) utilized the results of 2003 to improve in 2004 - including 2% of the feedyards making the jump from the red zone to the green zone – the data coupled with strategic changes internally enabled these feedyards to dramatically transform their performance.

However, on the other side of the ledger were feedyards, that despite being presented with data, failed to make effective changes:

- 24% of operations went backwards the second year – including 4% going from green to red (apparently those operations weren’t doing anything special and just got lucky the first year).

- 11% were in the red zone in ’03 and remained there the following year; these operations were seemingly haphazardly purchasing cattle and proved either unable or unwilling to implement any sort of practice to improve that process regardless of the data.

With that in mind, there are really two parts to this discussion: 1) obtaining and seeing the evidence / data, and 2) demonstrating the commitment to act upon that information. To that end, Dr. Jagadish Sheth notes in his book, The Self-Destructive Habits of Good Companies that, “Good companies fail when they are unable or, more curiously, unwilling to change when their external environment changes significantly.” Utilizing data and information is critical to implementing successful decision-making - and it’s more important than ever given escalating input costs and capital requirements to remain in business.