Farmers Are Now Paying Above $5 For Off-Road Diesel, And It's More Than Just Russia to Blame

Gas prices keep crushing records in the U.S., but diesel prices are posting even more sticker shock as fears of a possible diesel shortage this year are also causing concerns. It’s not just retail diesel prices that are rapidly rising. There are now reports of farmers booking off-road diesel for farm use trending above the $5 mark, too.

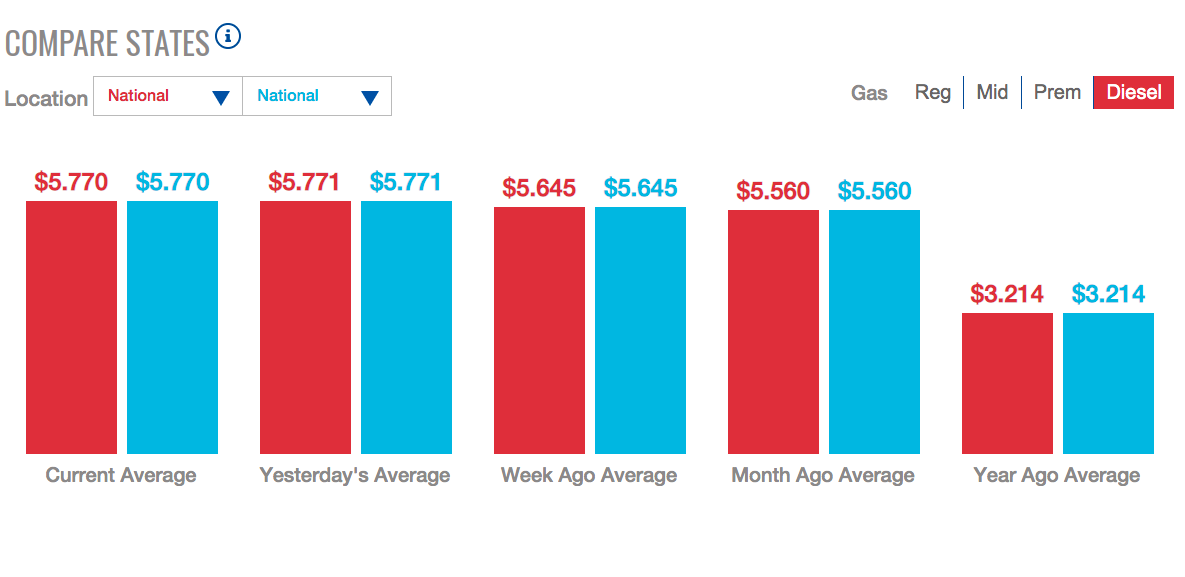

It’s an issue facing the trucking industry from coast to coast. AAA reports the national average diesel price is now $5.77 a gallon. A year ago, it was $3.21.

“It's almost like every five minutes, I see the little live indicator tick up on our GasBuddy data,” Patrick De Haan, head of petroleum analysis, GasBuddy, told U.S. Farm Report two weeks ago.

GasBuddy tracks both diesel and gas prices in real time. And while the pain at the pump is something drivers are seeing across the country, it’s also an issue plaguing agricultural producers across the U.S.

“We had some farm diesel delivered yesterday, and it cost us $4.85 or $4.89 a gallon delivered. Two years ago, we bought fuel for just over $1,” Craig Moss, a farmer in Hull, Iowa, told Farm Journal’s Michelle Rook.

The rapid rise in input prices is eating into outlooks this year, even with high livestock and grain prices.

“It's a challenging market, no doubt, buying $8 corn and $5.50 diesel; it’s a tremendous challenge for producers,” says David Newman, a pork producer in Myrtle, Mo.

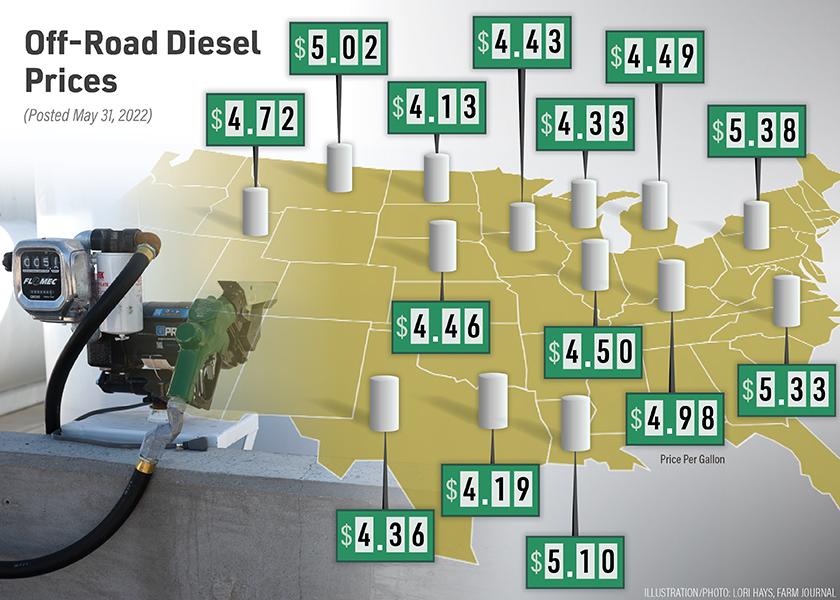

While prices at the pump for both gas and diesel climbed this week, it’s a similar story for off-road diesel prices. A survey of farmers on Twitter drew a wide range of responses regarding the prices they are currently seeing. Farmers reported off-road diesel at $4.13 in the northern Corn Belt, while off-road diesel is now above $5 for those further east and in western states like Montana.

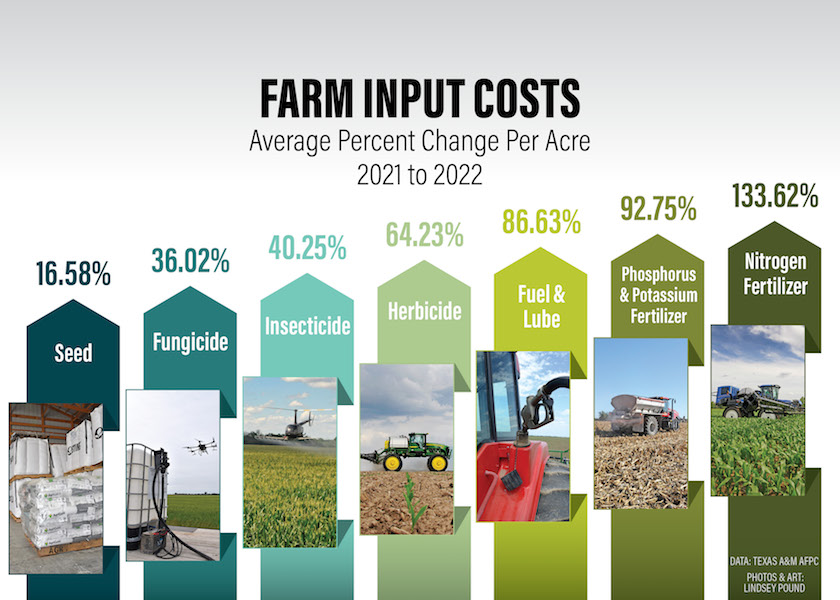

Research by Texas A&M Agricultural and Food Policy Center (AFPC) shows farmers are seeing nearly every input cost on their farm rise this year. Nitrogen prices produced the biggest increase, up more than 133% per acre year-over-year. Phosphorus and potassium fertilizer were up nearly 93% during that time. That was followed by fuel and lube, which jumped more than 86% compared to last year.

The latest baseline projections from the University of Missouri Food and Policy Research Institute (FAPRI) also shows the sharp rise in fuels costs today.

“A 57% increase may or may not capture what's happening right now throughout the whole calendar year of 2022, but it is capturing at least the part that we're seeing right now,” says Bob Maltsbarger, a senior research economist with FAPRI.

FAPRI’s baseline projection shows even if fuel prices retreat the second half of this year, higher overall production costs will continue to sway balance sheets. Maltsbarger points out diesel prices vary by not only geography, but also by farm, especially considering crops like corn typically require more fuel use.

“It will vary quite a bit on the dollars-per-acre impact, but if you have about an equal increase on a percentage change basis, you will see those dollars per acre be more expensive in this calendar year,” he says.

Why Are Diesel Prices So High?

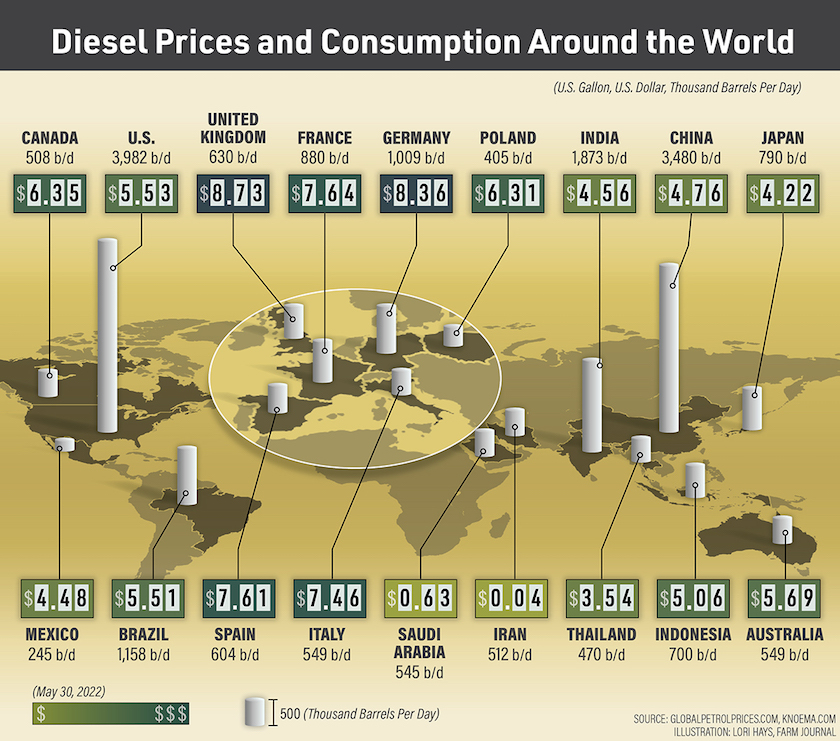

Why have diesel prices raced higher this year? It’s largely due to a shortage of refining capacity, not a shortage of oil, but the prices started to climb higher long before Russia invaded Ukraine.

“The nation is dealing with about a million barrels a day less of capacity than we had just three years ago. That's the equivalent of about 5%,” De Haan explains. “So, not only is oil a problem with sanctions on Russia’s oil, but turning that oil into something like gasoline and diesel is also now a choke point.”

“Refineries have less capacity; we have about 1.2 million barrels a day of less capacity because of shutdowns that occurred prior to the pandemic,” says Debnil Chowdhury, vice president, head of Americas Refining, S&P Global Commodity Insights. “Also during the pandemic, we've had some convergence to biofuels' facilities as well as a refinery that was hit by a hurricane and damaged to the point where it can't really be run anymore.”

S&P Global Commodities is also watching the situation. At a time when the U.S. is typically building inventory, the opposite is occurring, which is also heightening concerns about a possible shortage.

“This is the year we're running very low on inventory entering the summertime, and any type of impact on refining capacity is really going to increase the chance of the shortage,” says Chowdhury.

One Hurricane Away from a Diesel Shortage?

With supplies already tight, De Haan says the U.S. can’t afford to lose any refining capacity, which is a major risk considering NOAA is projecting an above-normal hurricane season.

“We're probably one Category 3 storm away [from a shortage], and that Category 3 storm would have to take aim for an area roughly from the Mississippi River to Houston,” says De Haan. “That's the really sensitive area. Not only could it affect refining, but it could affect offshore oil production.”

One of the reasons inventories are already tight is due to Hurricane Ida making a direct hit along the Gulf Coast. Refineries located near New Orleans went offline last fall, with some still not back online today. That major hurricane, and the devastation it caused, was one of the initial dominoes to fall for diesel prices.

“This all actually started before the war. It began in October of last year, when natural gas prices in Europe started to rise,” Chowdhury says. “The cost of natural gas increased substantially in Europe, and why that’s important to a Midwest farmer is because the cost of producing that diesel increased with it.”

Searching for Solutions

While the financial incentive is there today to pump more oil and increase refining capacity, one worker in the oil industry told U.S. Farm Report that the push to electric has investors concerned about the risk of such an investment. And considering it takes years for refining capacity to come online, that's also not a solution today.

There’s talk of the Biden administration tapping into diesel reserves to help ease supply concerns, but De Haan says not only will that move have a minimal impact, it’s also a question of timing.

“It's only a million barrels, so it's not a infinite amount of supply,” he says. “The worry is that if we release those barrels of diesel now from areas in the Northeast, we're also in the start of hurricane season. Now we do have some tropical activity. So when do you use the inventories? Do you use them now because of high prices? Or, do you wait for a bigger potential issue later this summer?”

In order to relieve the tight diesel supply situation, Chowdhury points out the other option is for the government to wave the Merchant Marine Act of 1920, otherwise known as the Jones Act.

“The U.S. refiner now has to decide do we send product to Europe? We can send it via pipeline easily, but because of the Jones Act, which is a regulation that mandates U.S. flagged vessels from port to port, it's not something that we could do now. And that's something that the government could look at waving if we do face a shortage,” says Chowdhury.

The Jones Act is a federal statute that was established more than 100 years ago. It requires all vessels carrying good between two U.S. points be American-built, owned, crewed and flagged. The policy was created to help sustain American jobs, and in turn, generate economic benefits each year. Proponents claim the Jones Act has secured critical movement of goods over the years.

How Long Could the Diesel Price Pain Last?

While the industry searches for possible solutions, those who follow and track refineries don’t see a dramatic drop in diesel prices anytime soon.

“These prices are not going to go back to the levels we had at the beginning of 2021. It's more likely that we'll see maybe, you know, a $5 to $10 decline in crude price, and that would equate to maybe 50¢ to 60¢ on the diesel price itself. We're not talking about a major relief,” Chowdhury says.

On the heels of diesel prices climbing higher again this week, anyone hoping for relief might have to look out beyond this year.

“It could take a couple of years. Keep in mind the longer we go down this road, and that demand eclipses supply, the more catching up we're going to have to do,” De Haan says.