New Texas A&M Analysis on Revised Cattle Price Discovery and Transparency Act Still Shows Huge Burden on Southern Plains

A new report from Texas A&M should come in handy for a hearing by the Senate Ag Committee on April 26. The panel will hold a hearing on a revised Senate bill that proposes to establish a regional mandatory minimum threshold for the percentage of cattle purchased under negotiated grid or negotiated pricing terms, to establish five to seven contiguous regions encompassing the continental United States for fed cattle reporting purposes, to establish a contract library, and to expand and change certain reporting requirements and data collection for cattle pricing and slaughter.

Sen. John Boozman (R-Ark.), Ranking member on the Senate Ag Committee, asked Texas A&M’s Agricultural and Food Policy Center (AFPC) to examine the impact of S 4030 on the various segments of the beef and cattle supply chain. Link to report.

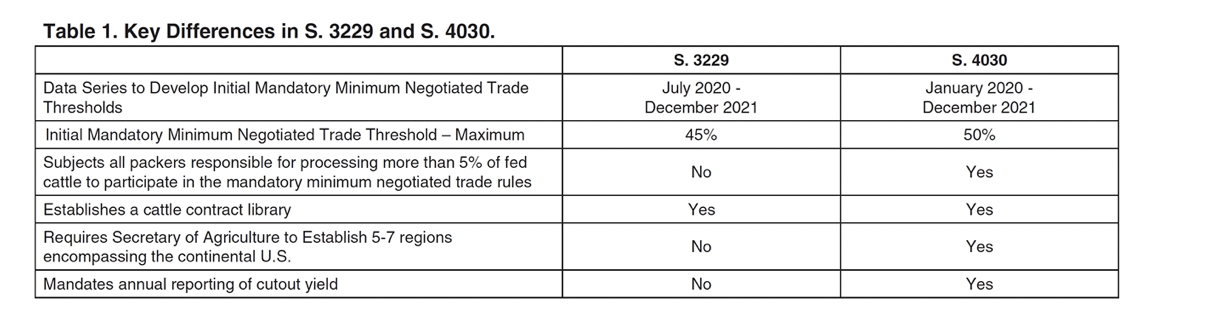

Background. On April 7, 2022, Sens. Deb Fischer (R-Neb.), Chuck Grassley (R-Iowa), Jon Tester (D-Mont.), and Ron Wyden (D-Ore.) announced a compromise cattle market proposal that was subsequently introduced as S 4030, the Cattle Price Discovery and Transparency Act of 2022. This latest bill modifies an earlier version that was introduced in November 2021 as S 3229. The table below highlights the key differences between the two bills.

The revised bill requires the Secretary of Agriculture (the Secretary) to establish minimum thresholds below which negotiated trade volumes cannot fall, allowing for public input and the review and modification of those thresholds. Section 259 establishes bounds within which the Secretary must establish minimum negotiated volume thresholds. The bounds dictate that:

• No regional minimum can be less than the average percentage of negotiated purchases and negotiated grid purchases made in a region between January 1, 2020, and January 1, 2022, and

• No regional mandatory minimum can exceed 50% of total weekly or total monthly trade.

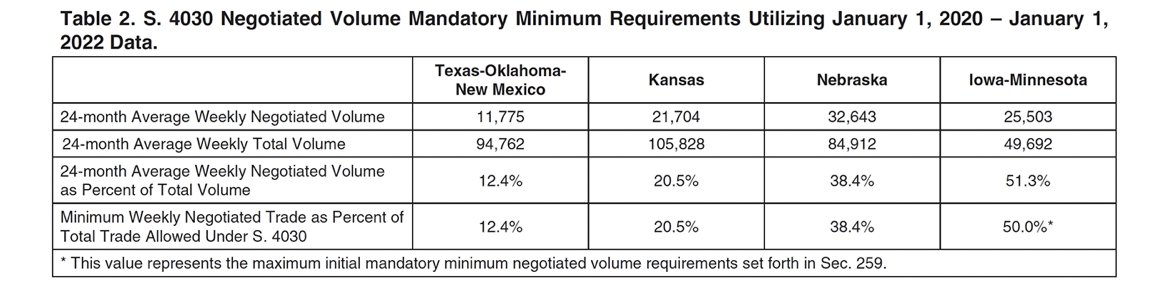

The analysis report notes: “In practice, had the bill been enacted on Jan. 1, 2022, the minimum bounds of required negotiated trade are presented in Table 2 (see below). This analysis excludes Colorado from the typical 5-area cattle region due to lack of consistent data.

Importantly, the revised legislative proposals calls for the Secretary to establish five to seven “covered regions” that encompass the entire continental U.S. and that reflect similar fed cattle purchasing practices. Because the publicly available data on fed cattle purchases outside of the current five-area region is largely presented in aggregate, the report’s authors say they “cannot reliably estimate the impacts of S 4030 outside of the five-area region. Consequently, in this analysis, we again analyze the expected change in negotiated volumes as a result of the mandate in four of USDA’s five major reporting regions which include Texas-Oklahoma-New Mexico, Kansas, Nebraska, and Iowa-Minnesota.

The report cautions its analysis “should only be viewed as potential impacts on the included states, with the understanding that results could vary widely depending on the Secretary’s designation of different regions.”

Conclusion. The report estimates that an additional 2.3 million head of cattle will be required to be marketed via negotiated sales because of S 4030. “While that is considerably less than required under previous versions of the bill (i.e., S 3229), it is still a significant burden that falls largely on the Southern Plains. Further, between the considerable discretion provided to the Secretary in S 4030 and the uncertainty surrounding many of the key provisions, we are limited in what we can conclude. While we’ve restricted our work to using the regional framework that’s currently in place with data that is currently available — and while we have purposely excluded overall cost estimates as a result —it’s relatively easy to conceive of scenarios where the total cost associated with S 4030 could end up exceeding that of its predecessor (S 3229)."

Bottom line:

(1) 2.3 million additional head would need to be marketed through negotiated framework under S 4030 (compared to the model with no sort of intervention). That’s less than S 3229 but still huge burden on Southern Plains.

(2) The bill is so open-ended that the analysts couldn’t (or chose not to) attempt a cost estimate. It could easily cost way more than their earlier version.

(3) The Secretary could choose to set the minimum at 50% (consistent with some proposals. In that case, Texas-New Mexico-Oklahoma goes from an additional 1.7 million to over 12 million head.