CAB Insider: Looking Ahead to Marketing Spring Calves

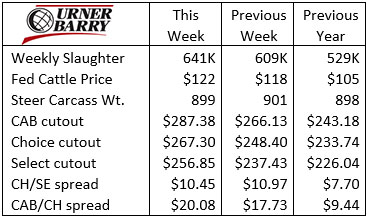

Cattle and beef markets have been a flurry of activity since the last CAB Insider with many positive market indicators sending fed cattle and cutout values rapidly higher.

Fed cattle values finally broke out of their seven-week stagnation in the $114/cwt. range with a two-week gain ending in last week’s $122/cwt. average. Eastern Nebraska and Iowa feedyards featured the top prices on the week, ranging from $123 to $125/cwt., evidence that the region is the most current as far as harvest-ready cattle.

The shift away from larger availability of yearlings to the new crop of spring 2020 calf-fed cattle is beginning. This is the early stage of this seasonal trend, with more to come as April progresses.

Latest USDA carcass quality grade information dates back to the week of March 22. The two-week dated trends show no indication of marbling trending lower in Nebraska packing plants. In fact, quite the opposite is true. The % Prime total in Nebraska reached 17.5% during that period. This is immensely higher than a year ago by 4 percentage points and 5 points higher than in 2019. The trend could turn lower with April data, but it’s a quality-rich carcass environment at last test, not indicative of an especially "green" set of fed cattle in the region.

The smaller 609K head federally inspected harvest two weeks ago likely has had some bearing on cutout prices making massive upward moves. The CAB cutout was up $21.25/cwt. in the weekly average data through last Thursday.

Equally important, retail demand is sharp and foodservice business continues to open up around the country. A lot of boxed beef orders have been pre-booked, making the thinly traded cash market all the more heated so far in April.

Middle meats are still the driver in the spring market and buyers are snatching up grilling items in preparation for warmer spring weather and the excitement that will be even higher this season as people are able to congregate.

Ribeyes are in short supply, sending wholesale prices to average $11.78/lb. for CAB product. Strip loins, short loins and tenderloins are all priced much higher with prices jumping daily, a couple of weeks ahead of schedule.

A study of historic middle meat pricing suggests a late-April price decline but that would be a serious departure from current market activity. The old saying that "the cure for high prices is high prices" may yet come to fruition. It’s an exciting market to sell into and a very difficult market for buyers caught short of needed product.

LOOKING AHEAD TO MARKETING SPRING CALVES

With baby calves running around many spring-calving operations there’s probably little thought to fall feeder calf markets for this majority of cow-calf producers. Still, recent bullish direction in cattle futures urges a degree of optimism looking ahead to marketing the new calf crop.

With this said, feedyard ration costs are the limiting factor in current breakeven calculations. The corn price rally that began last August has taken dry matter ration costs from the $200/ton range to upward of $300/ton range, with lots of variables depending on timing and circumstances in the future. Today’s information looking ahead as far as next fall suggests using a ration cost of $300 to $320/ton in calculations.

The April 2022 Live Cattle contract this Tuesday was quoted at $132/cwt., a price that hasn’t been reached since the $136/cwt. value seen in June 2017. This is not to suggest that we limit upside expectations, prices could move higher, but this a respectable price given what we’ve experienced in the past three years.

Marketing the spring 2021 calf crop when the calves are just weeks old is possibly a bit aggressive in an up-trending market, but let’s take a look at a breakeven projection as an exercise of awareness.

Using one of the more favorable examples, we’ll look at 650 lb. steers delivered in October with an expected finish date in April 2022. Further feedyard performance assumptions include 3.6 lb. average daily gain at 6-to-1 dry matter feed conversion.

If taken to a shrunk finished weight of 1,380 lb. with an average of 1.5% death loss, then the total cost of gain lands near $1.08/lb. The finishing date is at the end of April, so it’s fair to acknowledge that likely one-third of the pen will fall in the May market. If sold in the weekly cash market, the math suggests a breakeven purchase price of $156.38/cwt.

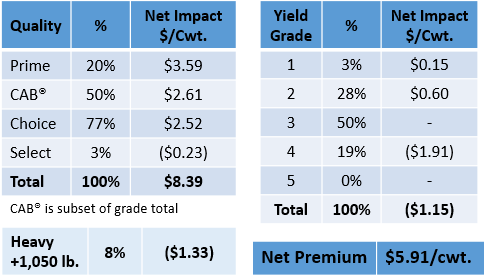

Grid marketers have a bit more figuring to do. A good, but not exceptional, set of Angus steers might achieve the carcass results seen in the table below. Given 203 days on feed and an average backfat thickness of 0.65 inches, the proposed yield grade outcomes and estimate of 8% of carcasses over 1,050 lb. (heavies) are logical.

Using this week’s USDA grid premiums and discounts report, the net adjustment to the carcass price is +$5.91/cwt. Converted to a live price the premium is $3.74/cwt. or $51.70/head.

Feedyard operators are privy to more details fitting their own circumstances but cow-calf operators may find the grid calculations helpful. That $51.70/head premium backed up to the weaned 650 lb. steer price is a $7.95/cwt. increase above the commodity market average.

The futures-implied 650 lb. steer price given the above assumptions suggests a $156.38/cwt. breakeven purchase price for the October delivery. Updating the math with the accompanying grid premiums and discounts implies a $164.33/cwt. purchase price after premiums.

Capturing the premium at weaning, after backgrounding or selling the finished steers requires planning and dedication to marketing. Results are widely variable.

SELECT CARCASSES SCARCE, QUALITY UP AGAIN

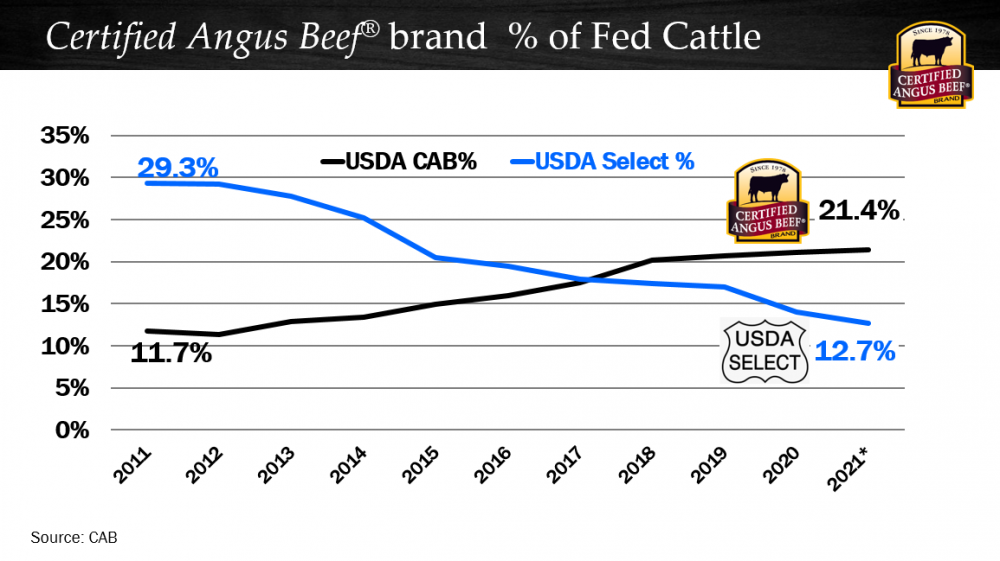

The continuing evolution in carcass marbling content is highlighted this spring as the Select quality grade fell to the lowest proportion of the carcass mix in modern history. In the last eight weeks, Select carcasses accounted for just 11.8% of total fed cattle. In the past year fed cattle outcomes have been largely impacted by extra days on feed, since many cattle could not be harvested due to the backlog. However, the shrinking Select category has been an entrenched evolution for more than a decade, as the cow-calf sector made breed and trait selections favoring carcass quality. Feedlot placement and finish weights as well as management are also favoring carcass quality, on average.

The 10 year trend in the chart is only a brief segment of a more dramatic historical decline, with Select dropping from 29% of fed cattle carcasses in 2011 to just over 12% so far in 2021. In contrast, the Certified Angus Beef ® brand has increased from 11.7% to 21.4% of all fed cattle carcasses in as much time.

The seasonal grading pattern predicts quality grades less rich in the near May/June timeframe. But current data shows Prime carcasses looking for elbow room as the Prime grade average hit 12.5% two weeks ago, pushing the Choice total down to 72%, with the resulting effect on Select touching record low territory. The larger proportion of quality carcasses is being met with seasonally higher quality price spreads, undaunted by the richest marbling mix the industry has ever achieved.